- United States

- /

- Banks

- /

- NasdaqGS:FIBK

First Interstate BancSystem (FIBK): Valuation Perspectives After Buyback Announcement and Leadership Changes

Reviewed by Simply Wall St

If you have been keeping an eye on First Interstate BancSystem (FIBK), this week’s developments might have caught your attention. The company unveiled a $150 million share buyback program and completed its redemption of 5.25% fixed-to-floating notes. At the same time, it has shaken up its senior leadership by adding two new directors and appointing a pair of co-chief banking officers. For investors, these decisions send strong signals about management’s confidence in the company’s position and their intentions to deploy capital in ways that could enhance shareholder value.

All this comes amid some interesting shifts in the stock. Despite flat momentum for much of this year, shares have climbed 11% over the past year and 22% in the past 3 months. This points to a recent pickup in investor optimism. These gains accompany a period of steady revenue growth and a sharp rise in annual net income, lending credibility to the idea that the business is finding its stride even as the market environment remains uncertain.

With new talent at the top and fresh capital allocation plans in motion, is First Interstate BancSystem shaping up to be a value opportunity, or are investors already factoring in all the future growth?

Most Popular Narrative: 60% Undervalued

First Interstate BancSystem is seen as significantly undervalued according to the most followed narrative. This perspective points to factors like rapid profit growth and a solid future outlook as key drivers for the valuation.

“Strong capital and liquidity levels, further enhanced by the Arizona and Kansas branch transaction, give the company multiple options for value creation. For example, share repurchases, organic investment, or future M&A increase flexibility to support shareholder returns and earnings growth through 2026 and beyond.”

Curious why the bulls think the real value here is so much higher than today’s price? There are bold assumptions about future growth and profit margins baked into this call, plus a future earnings multiple lower than many banking peers. Which key levers are driving this steep undervaluation? The answers might surprise you. Discover the full narrative to see what could be fueling this stock’s upside potential.

Result: Fair Value of $32.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining loan balances and rising asset quality pressures could challenge the optimistic outlook. These factors could potentially impact First Interstate’s earnings momentum.

Find out about the key risks to this First Interstate BancSystem narrative.Another View: What Do Valuation Ratios Suggest?

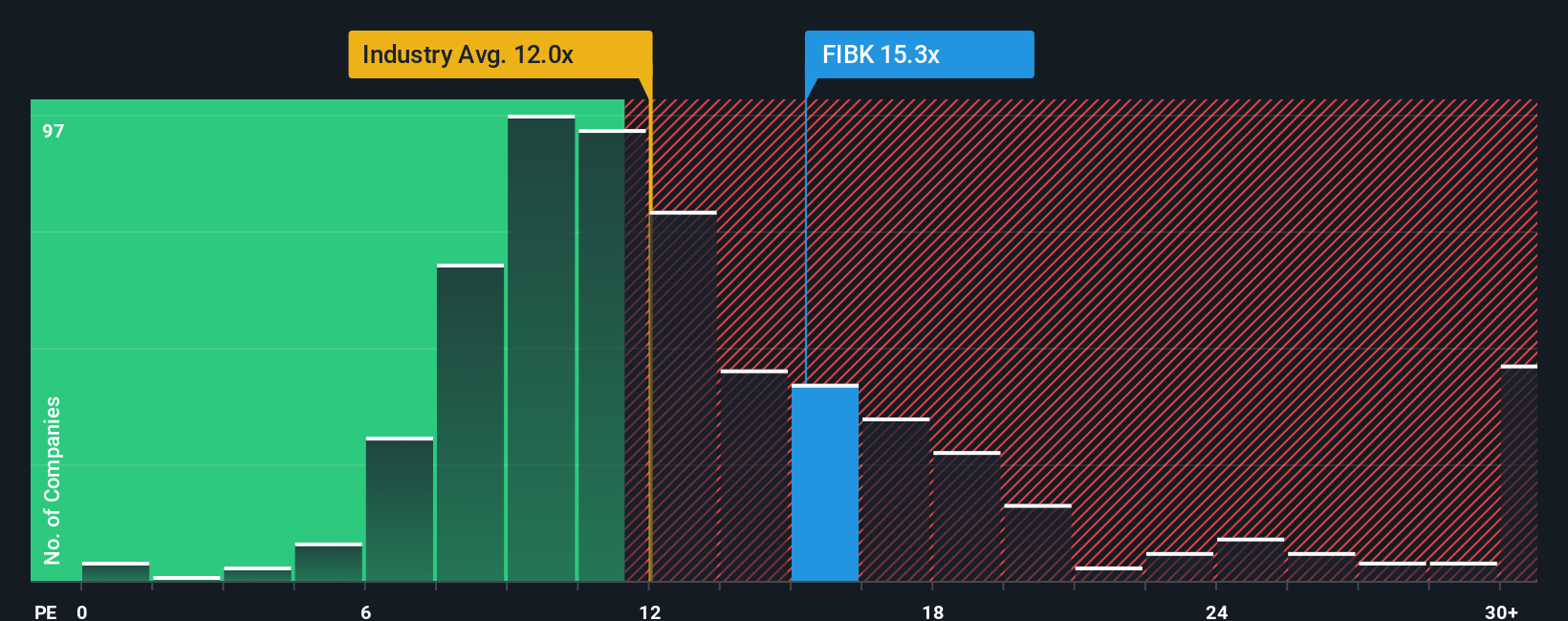

While the earlier perspective flagged First Interstate BancSystem as undervalued, standard valuation ratios compared to the industry tell a different story and suggest that shares may actually be more expensive than average. Could this point to missed risks, or are other factors more important?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding First Interstate BancSystem to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own First Interstate BancSystem Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can put together your own take on First Interstate BancSystem in just minutes. Do it your way.

A great starting point for your First Interstate BancSystem research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t let today’s momentum stop at First Interstate BancSystem. Expand your toolkit and uncover even more promising stocks using Simply Wall Street’s powerful screener tools. The next big winner might be just a click away, but only if you take action now.

- Spot opportunities in fast-growing startups boasting robust balance sheets by checking out penny stocks with strong financials.

- Tap into the future by finding companies transforming healthcare through artificial intelligence with healthcare AI stocks.

- Unlock value gems trading below their true worth with the tailored search power of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives