- United States

- /

- Banks

- /

- NasdaqGM:FGBI

First Guaranty Bancshares (NASDAQ:FGBI) Has Affirmed Its Dividend Of $0.16

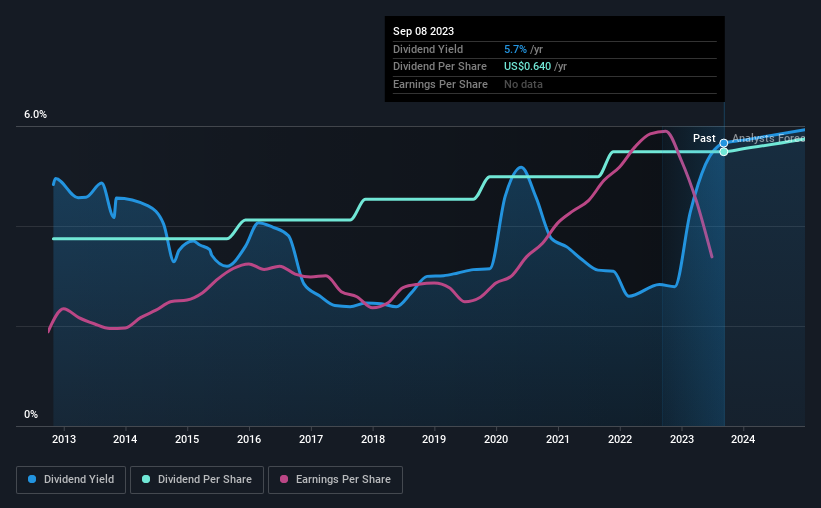

First Guaranty Bancshares, Inc. (NASDAQ:FGBI) will pay a dividend of $0.16 on the 29th of September. The dividend yield will be 5.7% based on this payment which is still above the industry average.

Check out our latest analysis for First Guaranty Bancshares

First Guaranty Bancshares' Dividend Forecasted To Be Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable.

Having distributed dividends for at least 10 years, First Guaranty Bancshares has a long history of paying out a part of its earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 41%, which means that First Guaranty Bancshares would be able to pay its last dividend without pressure on the balance sheet.

EPS is set to fall by 44.3% over the next 12 months. If recent patterns in the dividend continue, we could see the future payout ratio reaching 81% in the next 12 months, which is on the higher end of the range we would say is sustainable.

First Guaranty Bancshares Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2013, the annual payment back then was $0.437, compared to the most recent full-year payment of $0.64. This implies that the company grew its distributions at a yearly rate of about 3.9% over that duration. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Dividend Growth May Be Hard To Achieve

The company's investors will be pleased to have been receiving dividend income for some time. Earnings per share has been crawling upwards at 2.9% per year. First Guaranty Bancshares is struggling to find viable investments, so it is returning more to shareholders. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Our Thoughts On First Guaranty Bancshares' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While First Guaranty Bancshares is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 3 warning signs for First Guaranty Bancshares (1 shouldn't be ignored!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FGBI

First Guaranty Bancshares

Operates as the holding company for First Guaranty Bank that provides commercial banking services in Louisiana and Texas.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026