- United States

- /

- Banks

- /

- NasdaqGS:FFIN

First Financial Bankshares (FFIN): Rethinking Valuation After Sector Loan Loss Worries Ripple Across Regional Banks

Reviewed by Kshitija Bhandaru

First Financial Bankshares (FFIN) saw its stock react alongside other regional banks after disclosures from several peers highlighted significant loan losses and collateral issues. Investors are now considering the potential impact of sector-wide credit concerns and higher interest rates.

See our latest analysis for First Financial Bankshares.

First Financial Bankshares shares have slipped this year as worries about loan quality ripple through the regional banking sector, especially after recent news from industry peers. While the company posted a one-day share price gain of 0.61%, its total shareholder return over the past year is down 16.2%, which reflects fading investor momentum as sector risks continue to evolve.

If you’re wondering what else is changing across the market, it could be the perfect time to broaden your view and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and ongoing selloffs weighing on sentiment, the question now is whether First Financial Bankshares is undervalued due to sector headwinds or if the market has already priced in the risks and potential growth ahead.

Price-to-Earnings of 18.2x: Is it justified?

First Financial Bankshares trades at a price-to-earnings (P/E) ratio of 18.2x, which is notably higher than comparable U.S. banks and peers, based on its last closing price of $31.53. This elevated multiple suggests the market may be paying a premium for the company’s future earnings potential, but it also raises questions about whether such optimism is warranted given sector uncertainties.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings, and is a standard benchmark for valuing banks and financial institutions. For First Financial Bankshares, the current P/E is substantially above the U.S. banks industry average of 11.2x as well as the peer average of 16.7x. This indicates that investors either expect stronger growth, higher quality earnings, or are simply paying up for perceived lower risk.

However, compared to the estimated fair P/E ratio of 12.7x, the stock’s valuation appears steep. If the market were to recalibrate towards that fair ratio, it could signal a repricing ahead, unless First Financial Bankshares delivers outsized results to justify its current premium.

Explore the SWS fair ratio for First Financial Bankshares

Result: Price-to-Earnings of 18.2x (OVERVALUED)

However, ongoing concerns about declining loan quality and volatile market sentiment could challenge expectations for First Financial Bankshares’ future performance and valuation.

Find out about the key risks to this First Financial Bankshares narrative.

Another View: Is The SWS DCF Model More Optimistic?

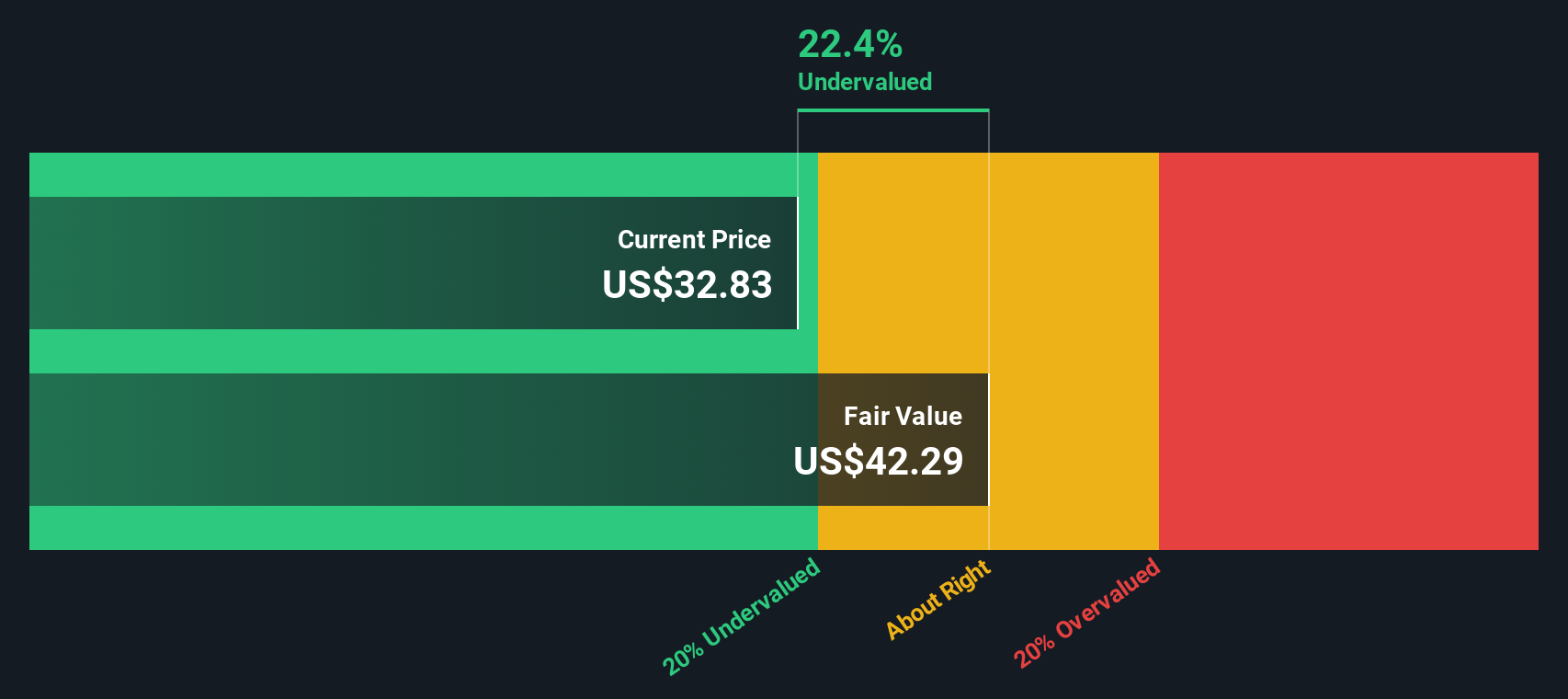

Shifting to the SWS DCF model offers a different perspective. Here, First Financial Bankshares appears undervalued, trading nearly 25% below its estimated fair value. This method suggests the market might be too cautious in its pricing. Does this discounted view counter the risks just highlighted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Financial Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Financial Bankshares Narrative

If you’re keen to dig into the numbers yourself or want to reach your own conclusions, you can easily build your own perspective in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding First Financial Bankshares.

Looking for more investment ideas?

If you want to stay ahead of the curve, use the Simply Wall Street Screener to find fresh opportunities others might be missing right now.

- Accelerate your search for strong income by checking out these 18 dividend stocks with yields > 3%. This tool is packed with stocks offering reliable yields exceeding 3%.

- Uncover the next wave of healthcare transformation by exploring these 33 healthcare AI stocks, which features companies at the forefront of medical AI breakthroughs.

- Catch undervalued gems early by browsing these 100+ undervalued stocks based on cash flows. Here, stocks are screened based on solid cash flow fundamentals for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives