- United States

- /

- Banks

- /

- NasdaqGS:FFIN

First Financial Bankshares (FFIN): Exploring Valuation After Recent Sideways Share Performance

Reviewed by Kshitija Bhandaru

First Financial Bankshares (FFIN) shares have moved sideways over the past week, following a steady pattern that mirrors its latest performance. Investors seem to be weighing the company’s recent one-year return in comparison to longer-term growth trends.

See our latest analysis for First Financial Bankshares.

Zooming out, First Financial Bankshares’ share price has edged lower over the year, while its 1-year total shareholder return is only modestly negative. The recent performance suggests investor enthusiasm is taking a breather after a run of steady growth. The current price reflects a cautious stance on near-term prospects.

If you’re weighing your next move, it could be the perfect opportunity to broaden your investing toolkit and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and consistent profits fueling the business, is the market overlooking hidden value here, or has it already factored in all the expected future growth for First Financial Bankshares?

Price-to-Earnings of 19.4x: Is it justified?

At a current price-to-earnings (P/E) ratio of 19.4x, First Financial Bankshares trades at a notable premium compared to both its peer average and broader industry benchmarks. The last close price of $33.5 reflects the market’s willingness to pay a higher multiple for the company’s earnings, despite modest stock performance this year.

The price-to-earnings ratio measures how much investors are paying for each dollar of the company’s earnings. For banks, it is a widely used metric because profitability and earnings quality are critical for long-term value. A higher P/E can suggest that investors expect stronger future earnings growth, stability, or a quality premium in management and financials.

However, First Financial Bankshares’ P/E of 19.4x is meaningfully above the US Banks industry average of 11.7x and also higher than the estimated fair P/E ratio of 12.7x. This signals that the market could be overvaluing the company relative to its direct competitors and what regression analysis suggests as fair value for the sector. If the market shifts towards the fair ratio or industry average, the stock could face valuation pressure.

Explore the SWS fair ratio for First Financial Bankshares

Result: Price-to-Earnings of 19.4x (OVERVALUED)

However, risks remain, including potential earnings pressure if growth slows or if the valuation premium contracts. Either scenario could challenge recent market optimism.

Find out about the key risks to this First Financial Bankshares narrative.

Another View: What Does the DCF Model Say?

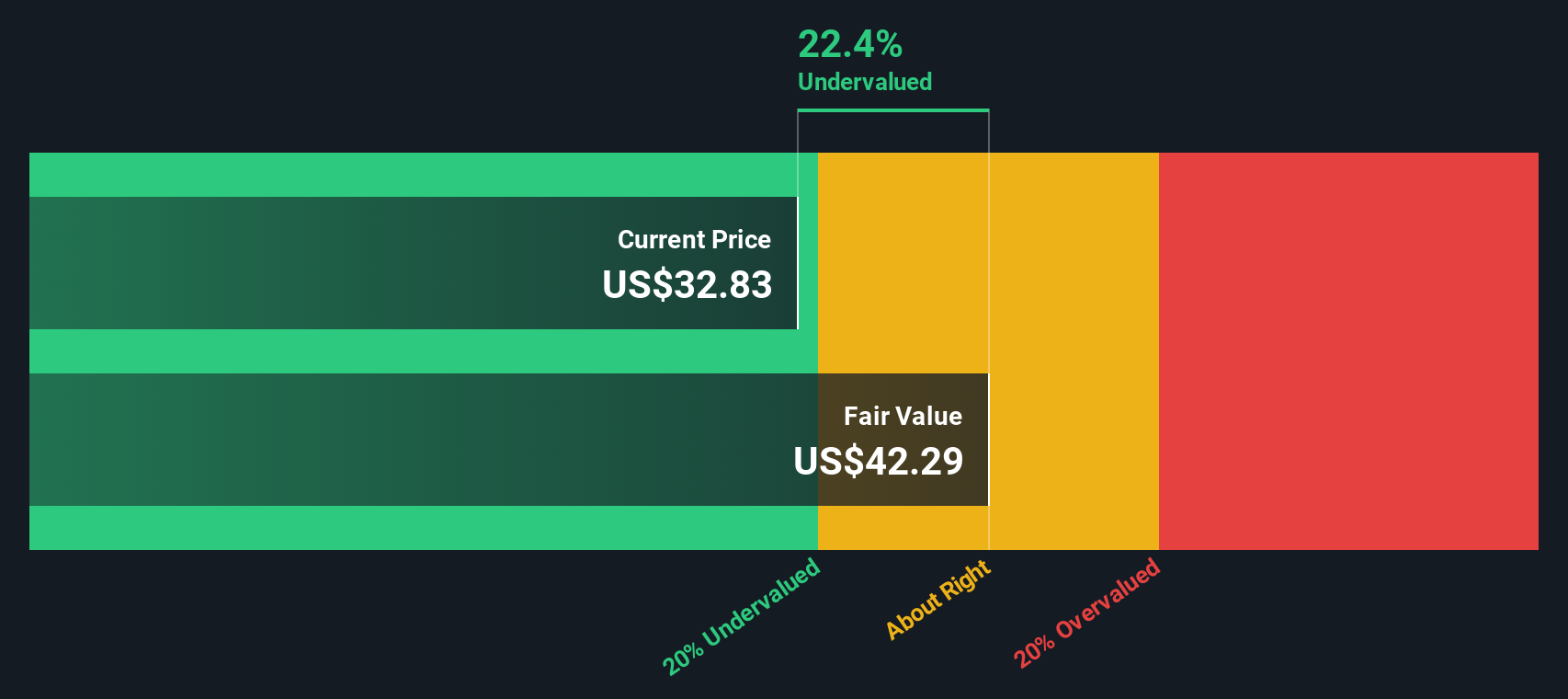

Valuation isn’t one-dimensional. The SWS DCF model offers a fresh perspective, estimating First Financial Bankshares’ fair value at $42.25, about 20.7% above the current share price. This suggests the shares could actually be undervalued, which contrasts sharply with the overvaluation implied by the price-to-earnings ratio. Is the market missing a longer-term trend, or is the premium in multiples a red flag?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Financial Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Financial Bankshares Narrative

If you see the numbers differently or want to dig even deeper, it only takes a few minutes to build your own view and narrative. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Financial Bankshares.

Looking for more investment ideas?

Don’t let a single stock define your opportunities. Widen your horizons today and access pre-screened stocks driving financial breakthroughs, long-term value, and exciting new markets.

- Tap into high potential by checking out these 896 undervalued stocks based on cash flows, which are pricing in less than their future cash flows suggest.

- See what’s next in healthcare innovation by reviewing these 31 healthcare AI stocks, where companies are transforming patient care through artificial intelligence.

- Boost your steady income with these 19 dividend stocks with yields > 3%, offering yields above 3% for resilient, rewarding portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives