- United States

- /

- Capital Markets

- /

- NYSE:GAM

Top Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

The United States market has been flat over the last week but is up 13% over the past year, with earnings anticipated to grow by 14% annually in the coming years. In such an environment, dividend stocks can offer a stable income stream and potential for capital appreciation, making them an attractive option for investors seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.14% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.92% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.54% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.36% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.90% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.82% | ★★★★★★ |

| Universal (NYSE:UVV) | 5.20% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.14% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.02% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.90% | ★★★★★☆ |

Click here to see the full list of 144 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Fidelity D & D Bancorp (NasdaqGM:FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc., with a market cap of $229.26 million, operates as the bank holding company for The Fidelity Deposit and Discount Bank, offering a variety of banking, trust, and financial services to individuals, small businesses, and corporate clients.

Operations: Fidelity D & D Bancorp, Inc. generates revenue of $81.32 million from its Banking, Trust, and Financial Services segment.

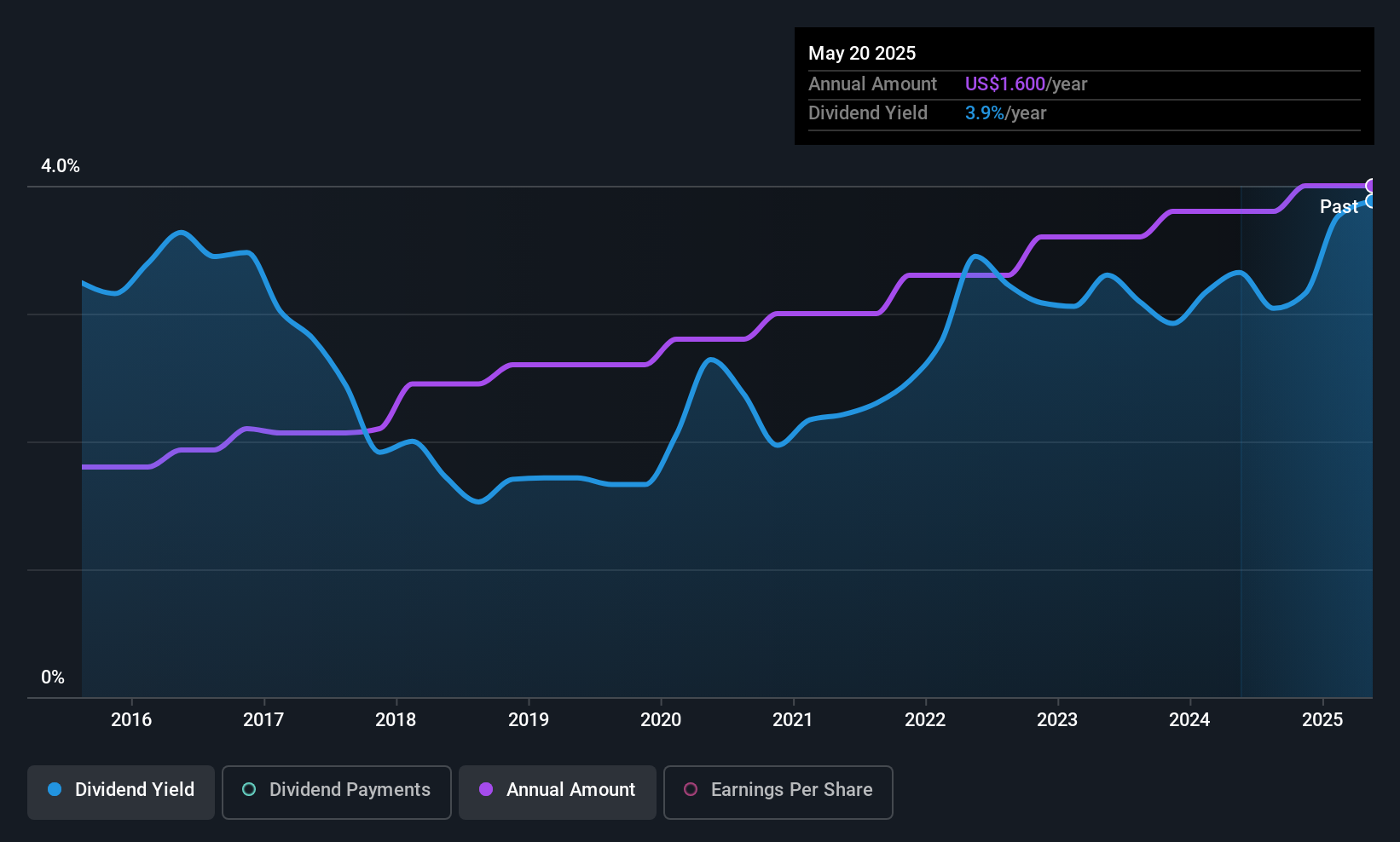

Dividend Yield: 3.9%

Fidelity D & D Bancorp offers a stable dividend profile with reliable payments over the past decade, supported by a low payout ratio of 41.2%, indicating coverage by earnings. Despite trading at 58.7% below estimated fair value, its dividend yield of 3.88% falls short compared to the top tier in the US market. Recent affirmations include a declared second-quarter dividend of US$0.40 per share, payable on June 10, 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Fidelity D & D Bancorp.

- Our expertly prepared valuation report Fidelity D & D Bancorp implies its share price may be lower than expected.

Citizens Financial Group (NYSE:CFG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens Financial Group, Inc. is a bank holding company offering a range of retail and commercial banking products and services to various customer segments in the United States, with a market cap of approximately $17.37 billion.

Operations: Citizens Financial Group generates revenue through its Consumer Banking segment, contributing $5.50 billion, and its Commercial Banking segment, which adds $2.42 billion.

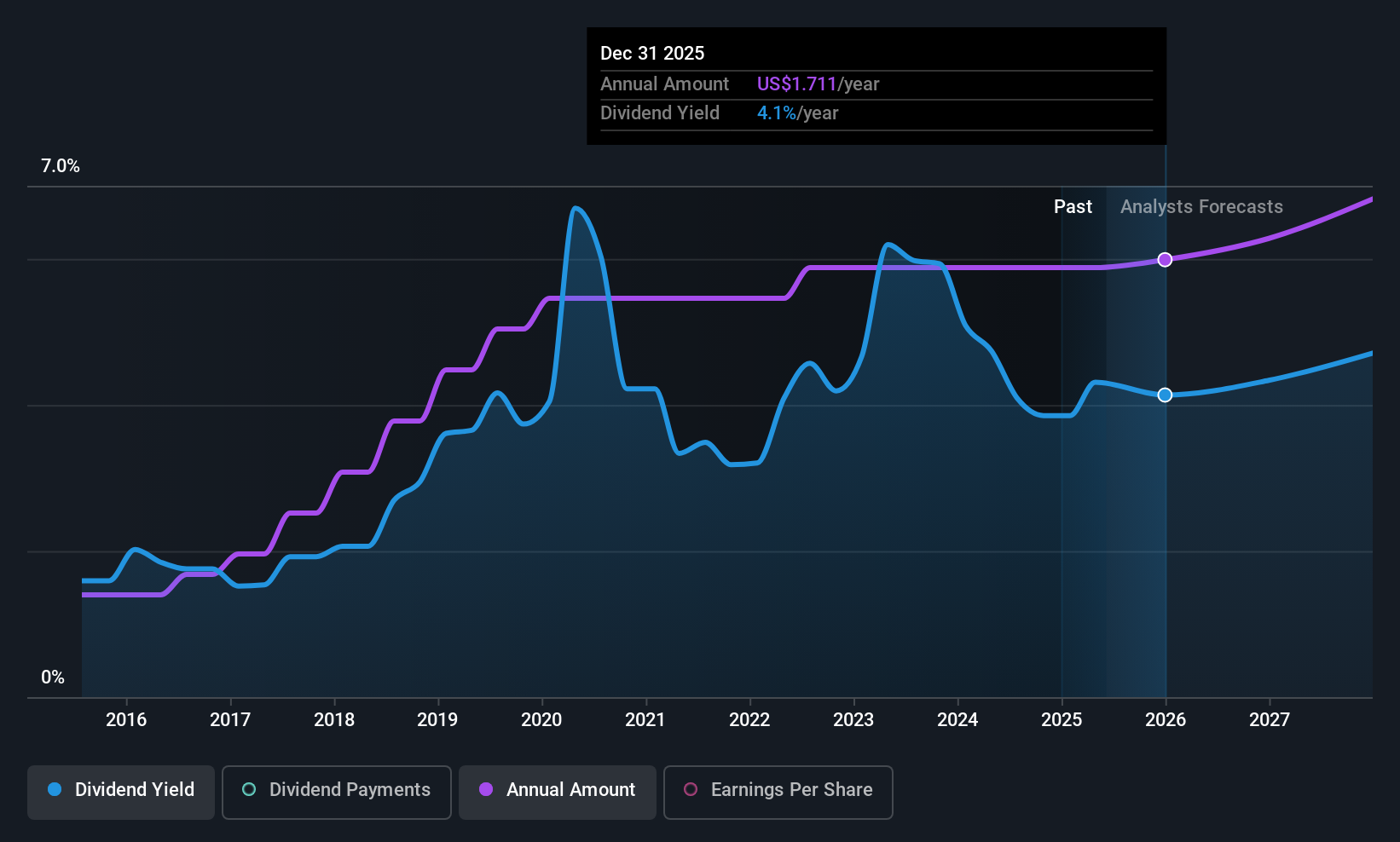

Dividend Yield: 4.1%

Citizens Financial Group maintains a reliable dividend history with stable payments over the past decade, supported by a reasonable payout ratio of 53.1%, ensuring coverage by earnings. Although its 4.11% yield is below the top US dividend payers, dividends are forecasted to remain well-covered in three years (34.9% payout). Recent events include redeeming US$4.35 billion Subordinated Notes and declaring a quarterly common stock dividend of US$0.42 per share payable May 14, 2025.

- Unlock comprehensive insights into our analysis of Citizens Financial Group stock in this dividend report.

- Our valuation report here indicates Citizens Financial Group may be undervalued.

General American Investors Company (NYSE:GAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of approximately $1.27 billion.

Operations: General American Investors Company, Inc. generates revenue from its Financial Services - Closed End Funds segment, amounting to $28.40 million.

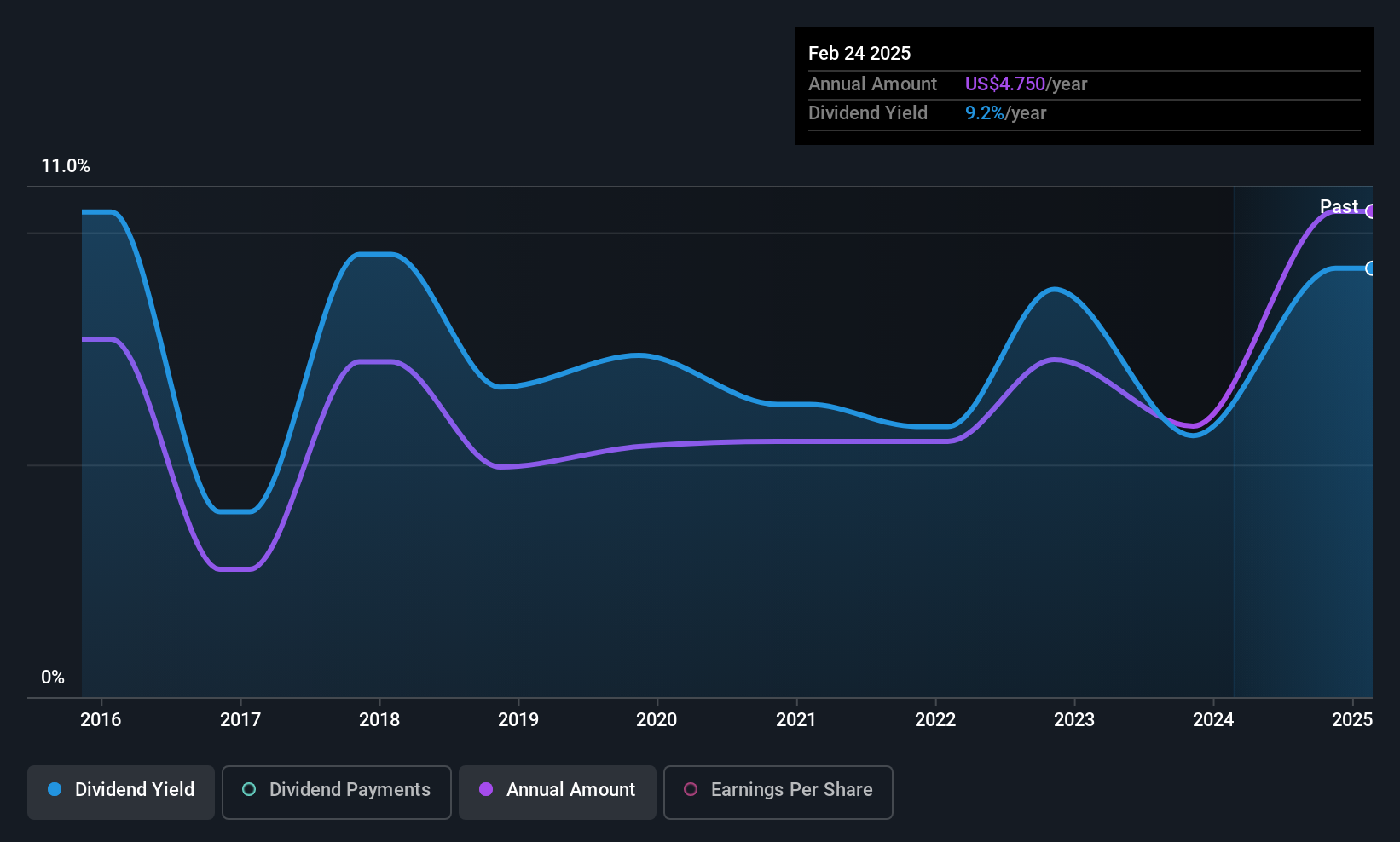

Dividend Yield: 8.7%

General American Investors Company offers a high dividend yield of 8.71%, placing it among the top 25% of US dividend payers, though payments have been volatile over the past decade. The payout ratio is low at 47.6%, indicating dividends are well-covered by earnings despite an unstable track record and lack of cash flow data for sustainability assessment. Recent announcements include a preferred stock dividend and an expanded equity buyback plan, increasing authorization to 21.6 million shares.

- Get an in-depth perspective on General American Investors Company's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that General American Investors Company is priced lower than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 144 companies within our Top US Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAM

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives