- United States

- /

- Banks

- /

- NYSEAM:BHB

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements with technology shares rebounding and the Dow Jones Industrial Average declining for a second consecutive day, investors are closely watching economic indicators following a prolonged government shutdown. In such uncertain times, dividend stocks can provide a measure of stability and income, making them an attractive option for those looking to bolster their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 4.06% | ★★★★★☆ |

| Provident Financial Services (PFS) | 5.12% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.68% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.27% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.92% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.98% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.12% | ★★★★★★ |

| Ennis (EBF) | 5.89% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.36% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.74% | ★★★★★★ |

Click here to see the full list of 130 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

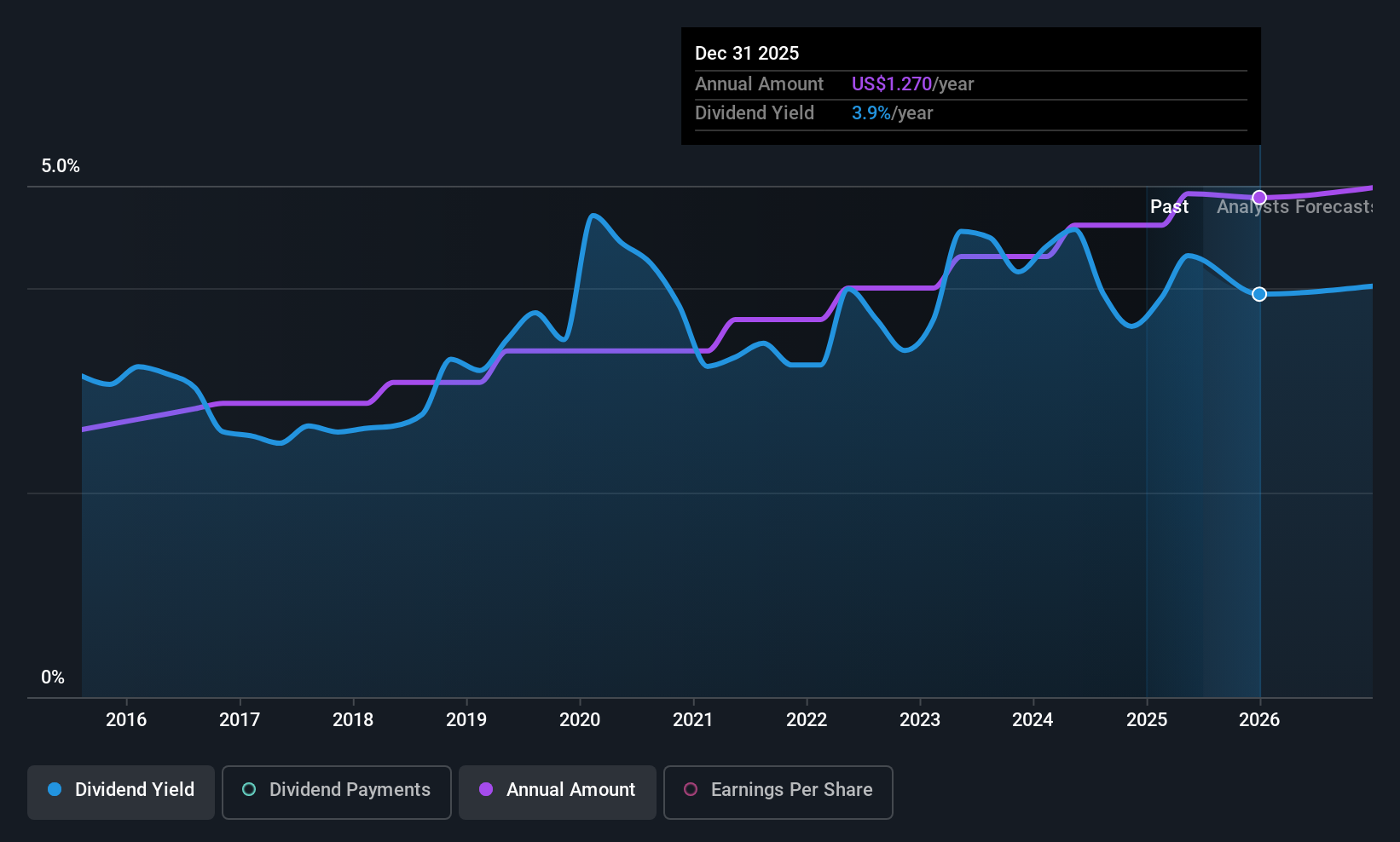

Fidelity D & D Bancorp (FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering banking, trust, and financial services to individuals and businesses with a market cap of $257.97 million.

Operations: Fidelity D & D Bancorp, Inc. generates revenue from its Banking, Trust, and Financial Services segment amounting to $88.60 million.

Dividend Yield: 3.8%

Fidelity D & D Bancorp recently announced a 7.5% increase in its quarterly dividend to $0.43 per share, demonstrating a commitment to returning value to shareholders. With a payout ratio of 35.3%, the dividend is well-covered by earnings, suggesting sustainability despite its yield being lower than the top quartile of US dividend payers. The company's earnings have shown significant growth, enhancing its ability to maintain stable and reliable dividends over the past decade.

- Dive into the specifics of Fidelity D & D Bancorp here with our thorough dividend report.

- The valuation report we've compiled suggests that Fidelity D & D Bancorp's current price could be quite moderate.

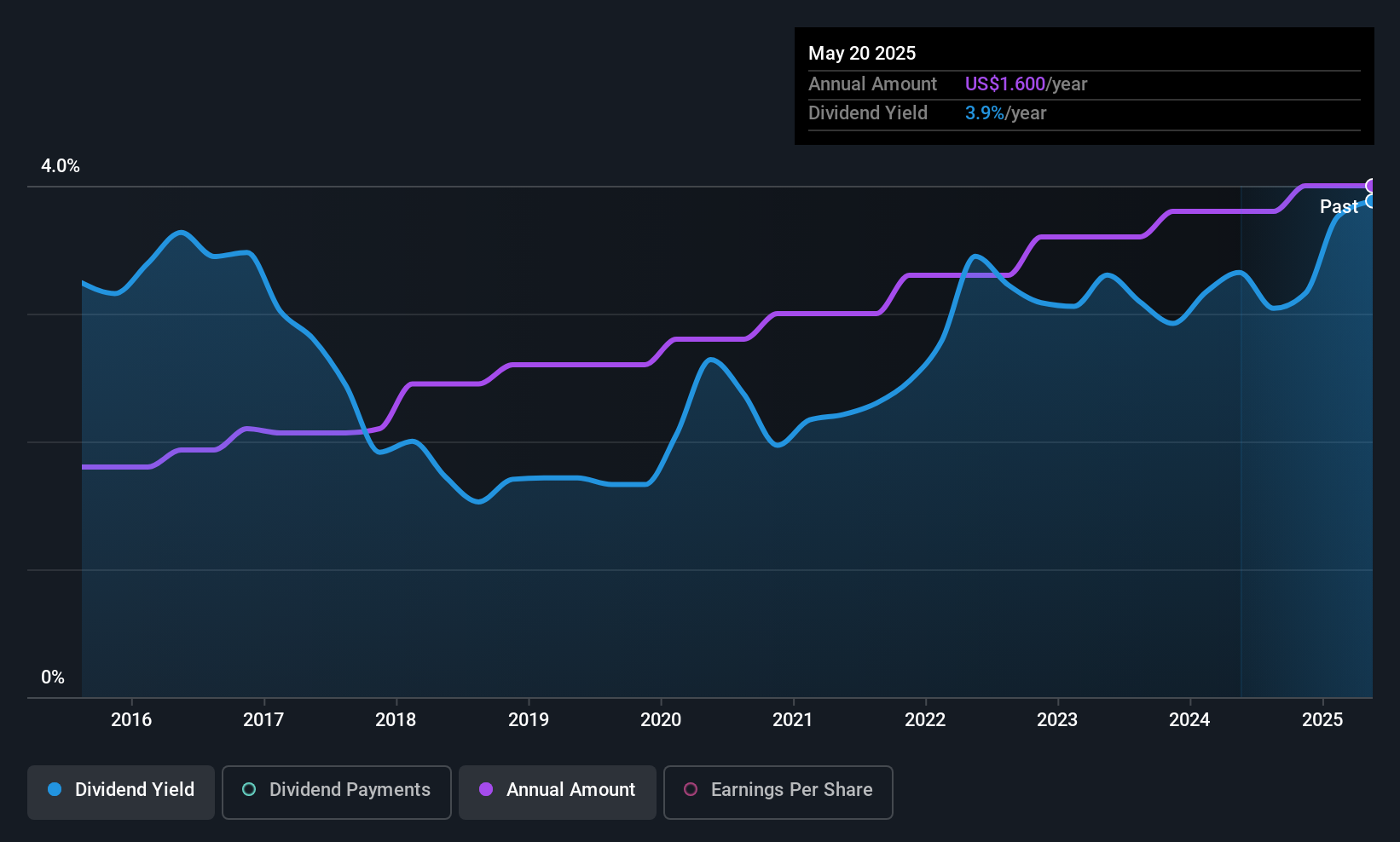

Bar Harbor Bankshares (BHB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bar Harbor Bankshares, with a market cap of $496.49 million, operates as the holding company for Bar Harbor Bank & Trust, offering a range of banking and nonbanking products and services to consumers and businesses.

Operations: Bar Harbor Bankshares generates revenue primarily from its community banking industry segment, which amounts to $152.61 million.

Dividend Yield: 4.3%

Bar Harbor Bankshares declared a quarterly dividend of US$0.32 per share, reflecting its consistent dividend history over the past decade. Despite a decrease in net income for Q3 2025 to US$8.86 million from US$12.19 million the previous year, dividends remain covered with a 53.3% payout ratio and are forecasted to be sustainable with future earnings coverage expected at 35.9%. However, its current yield of 4.3% is slightly below top-tier US dividend payers.

- Click here to discover the nuances of Bar Harbor Bankshares with our detailed analytical dividend report.

- The analysis detailed in our Bar Harbor Bankshares valuation report hints at an deflated share price compared to its estimated value.

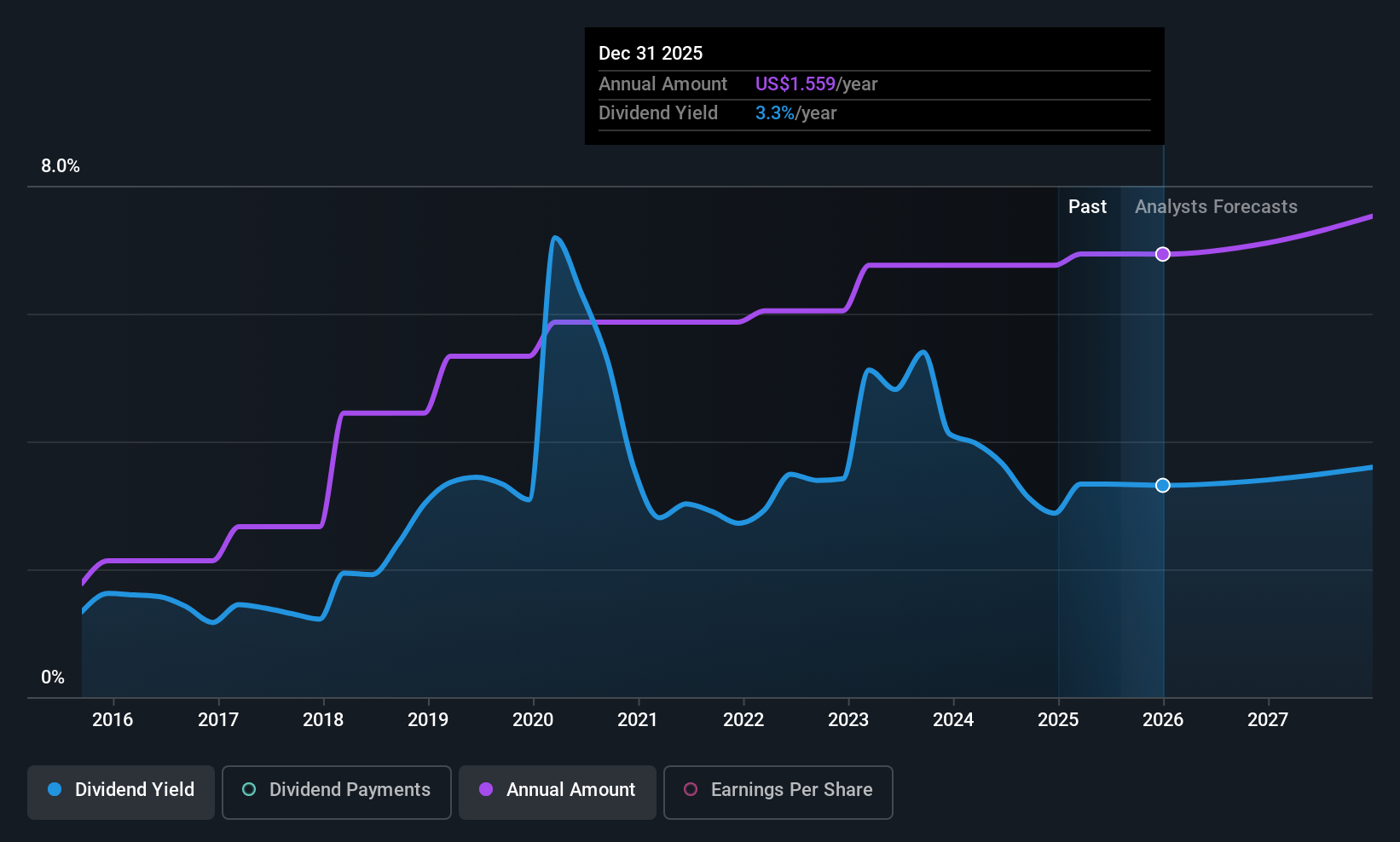

Synovus Financial (SNV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Synovus Financial Corp. is a bank holding company for Synovus Bank, offering commercial and consumer banking products and services in the United States, with a market cap of approximately $6.44 billion.

Operations: Synovus Financial Corp.'s revenue segments include Consumer Banking at $590.11 million, Community Banking at $435.68 million, Wholesale Banking at $671.95 million, Treasury and Corporate Other at $330.51 million, and Financial Management Services (FMS) at $263.55 million.

Dividend Yield: 3.4%

Synovus Financial's dividend payments have shown stability and growth over the past decade, supported by a low payout ratio of 28.8%, indicating strong earnings coverage. The company's recent Q3 2025 results highlighted an increase in net income to US$196.99 million from US$181.56 million a year ago, reinforcing its capacity to sustain dividends. Although the dividend yield of 3.38% is below top-tier levels, Synovus trades at a significant discount to estimated fair value, suggesting potential for appreciation.

- Click to explore a detailed breakdown of our findings in Synovus Financial's dividend report.

- Upon reviewing our latest valuation report, Synovus Financial's share price might be too pessimistic.

Seize The Opportunity

- Get an in-depth perspective on all 130 Top US Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bar Harbor Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BHB

Bar Harbor Bankshares

Operates as the holding company for Bar Harbor Bank & Trust that provides banking and nonbanking products and services primarily to consumers and businesses.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives