- United States

- /

- Machinery

- /

- NYSE:MEC

Exploring Undervalued Small Caps With Insider Activity In September 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to rally, with major indices like the Nasdaq hitting record highs amid anticipation of potential Federal Reserve rate cuts, small-cap stocks are drawing increased attention from investors seeking opportunities in a dynamic economic landscape. In this environment, identifying promising small-cap stocks often involves looking for those that show strong insider activity and appear undervalued relative to their growth potential, offering a unique chance for diversification within an investor's portfolio.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.1x | 3.0x | 31.78% | ★★★★★☆ |

| Peoples Bancorp | 10.5x | 2.0x | 41.64% | ★★★★★☆ |

| Angel Oak Mortgage REIT | 6.4x | 4.1x | 31.05% | ★★★★★☆ |

| Citizens & Northern | 11.8x | 2.9x | 39.48% | ★★★★☆☆ |

| Limbach Holdings | 34.6x | 2.2x | 41.55% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 28.13% | ★★★★☆☆ |

| Tilray Brands | NA | 1.5x | 6.64% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 17.91% | ★★★★☆☆ |

| Shore Bancshares | 10.6x | 2.7x | -90.97% | ★★★☆☆☆ |

| Farmland Partners | 7.0x | 8.5x | -43.67% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

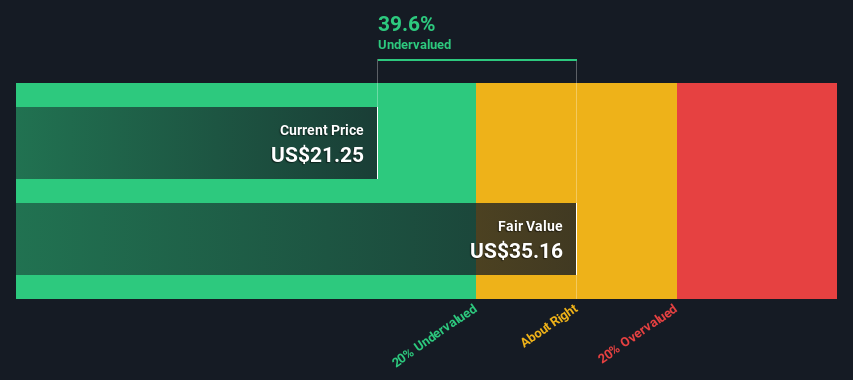

Citizens & Northern (CZNC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Citizens & Northern is a community banking institution with operations focused on providing financial services, and it has a market capitalization of approximately $0.41 billion.

Operations: Community Banking is the primary revenue stream, generating $108.31 million. The company's gross profit margin consistently stands at 100%, while net income margin has shown variability, reaching 24.67% in recent periods. Operating expenses have been a significant cost factor, with general and administrative expenses being the largest component, totaling $60.68 million recently.

PE: 11.8x

Citizens & Northern, a smaller company in the financial sector, recently reported steady net income growth for the second quarter of 2025, with US$6.12 million compared to US$6.11 million last year. Their earnings per share remained consistent at US$0.4. Despite an increase in net charge-offs to $548,000 from $91,000 earlier this year, insider confidence is evident through recent purchases by executives over the past months. The company's forecasted earnings growth of 10.6% annually suggests potential for future expansion amidst its current low valuation status.

- Take a closer look at Citizens & Northern's potential here in our valuation report.

Explore historical data to track Citizens & Northern's performance over time in our Past section.

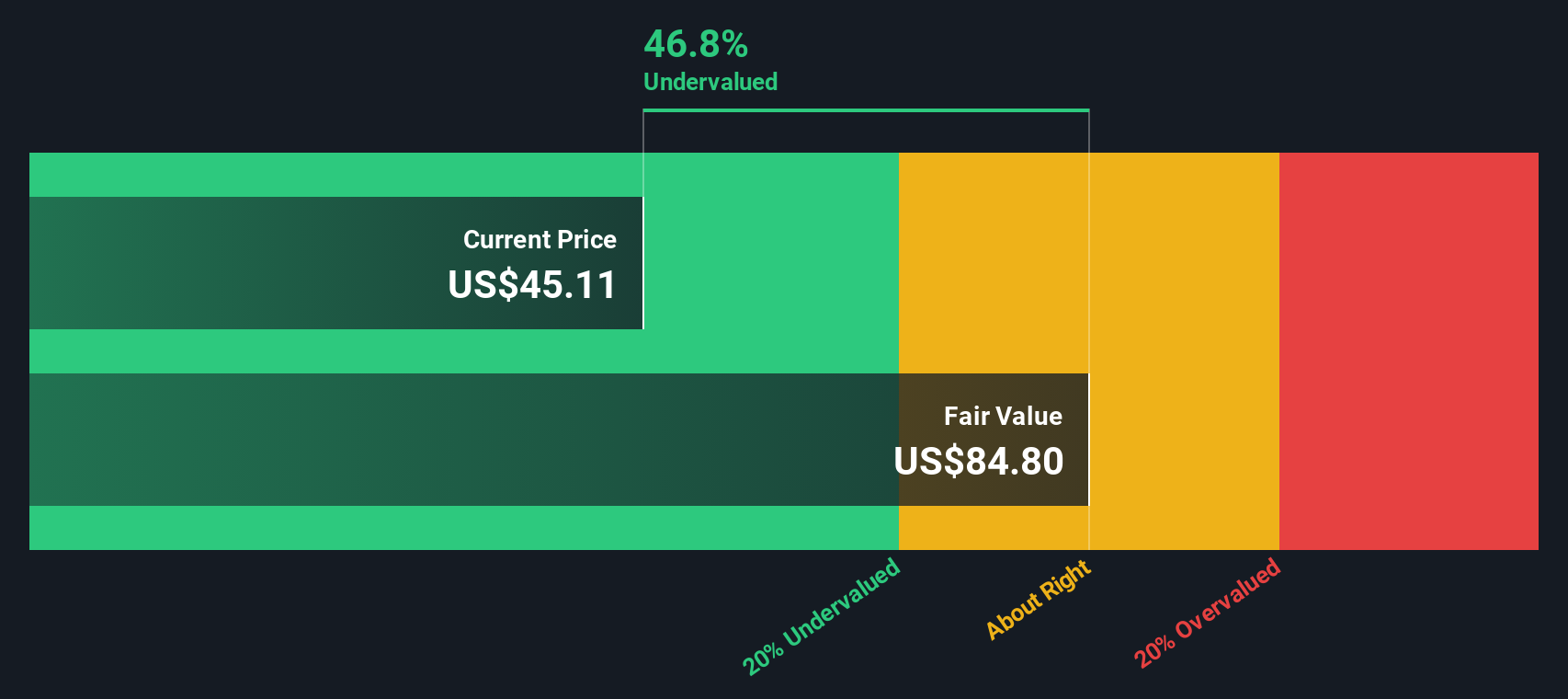

Fidelity D & D Bancorp (FDBC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp operates in the banking, trust, and financial services sector with a market capitalization of approximately $0.35 billion.

Operations: The company generates revenue primarily from banking, trust, and financial services. Its net income margin has shown fluctuations, reaching 27.91% in the latest period. Operating expenses are a significant component of its cost structure, with general and administrative expenses being the largest portion at $47.16 million.

PE: 10.8x

Fidelity D & D Bancorp, a smaller player in the financial sector, has shown promising financial performance. For Q2 2025, net interest income rose to US$17.93 million from US$15.12 million the previous year, while net income increased to US$6.92 million from US$4.94 million year-over-year. Basic earnings per share climbed to US$1.2 from US$0.86, indicating strong operational efficiency despite executive changes with Eugene J. Walsh's retirement on July 25, 2025.

- Get an in-depth perspective on Fidelity D & D Bancorp's performance by reading our valuation report here.

Learn about Fidelity D & D Bancorp's historical performance.

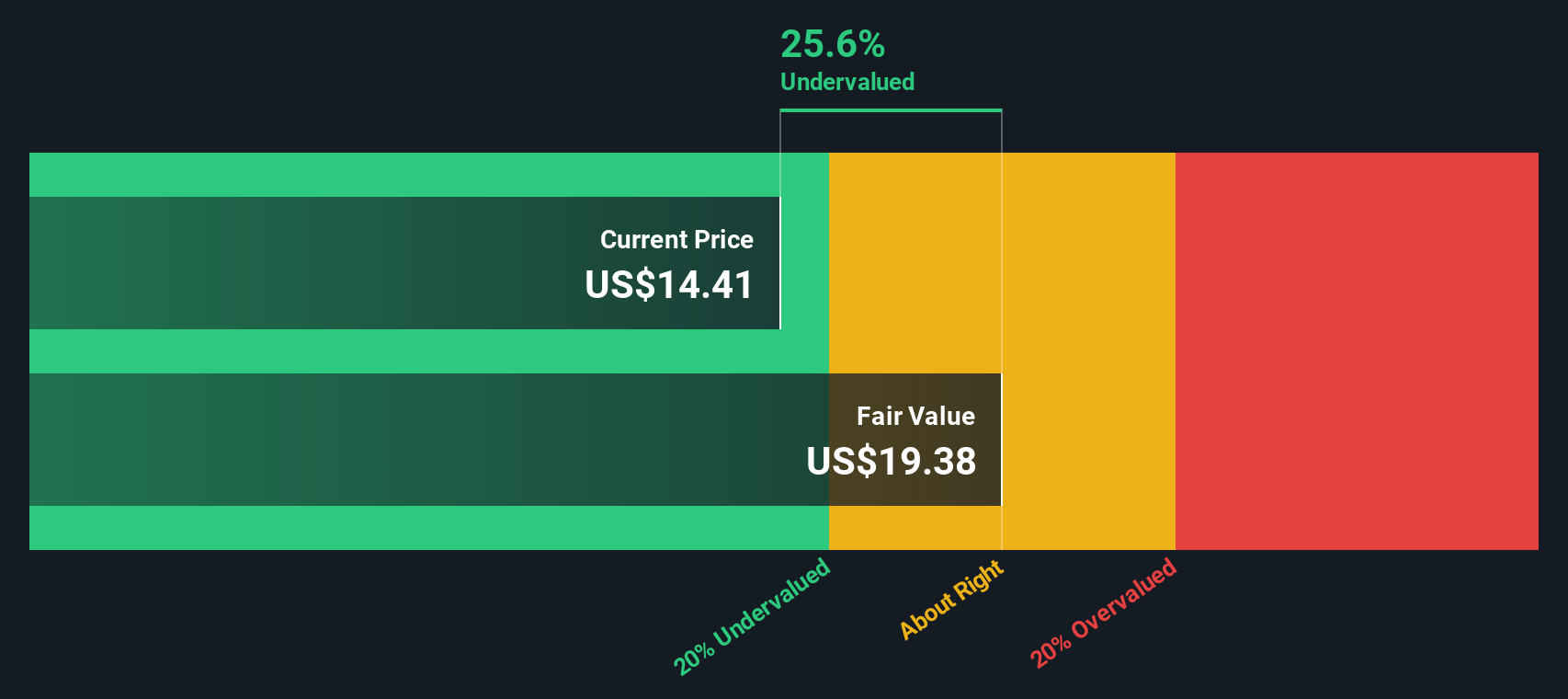

Mayville Engineering Company (MEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mayville Engineering Company operates as a metal fabricator, specializing in metal processing and fabrication, with a market capitalization of approximately $0.37 billion.

Operations: The company's revenue primarily stems from its operations in metal processing and fabrication, with recent figures reaching $524.61 million. The gross profit margin has shown variability, most recently recorded at 12.10% as of June 2025. Operating expenses are significant, with general and administrative expenses being a notable component within the cost structure.

PE: 17.1x

Mayville Engineering Company, a dynamic player in the manufacturing sector, recently revised its 2025 sales guidance to US$528 million-US$562 million. Despite a challenging second quarter with sales dropping to US$132.33 million and a net loss of US$1.1 million, insider confidence remains strong with significant share repurchases totaling 644,441 shares for US$10.59 million as of June 30, 2025. The company expanded its credit facility to US$350 million to support ongoing operations and growth initiatives.

Summing It All Up

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 77 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MEC

Mayville Engineering Company

Engages in the production, design, prototyping and tooling, fabrication, aluminum extrusion, coating, and assembling of aftermarket components in the United States.

Good value with proven track record.

Market Insights

Community Narratives