- United States

- /

- Oil and Gas

- /

- NYSE:DHT

3 Dividend Stocks To Consider With Up To 7.5% Yield

Reviewed by Simply Wall St

As U.S. markets continue to rally, with major indexes reaching new highs amid hopes for interest rate cuts, investors are increasingly looking towards dividend stocks as a reliable income source in the current economic climate. In this environment of fluctuating rates and record-setting indices, selecting dividend stocks with strong yields can provide a steady stream of income while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| OTC Markets Group (OTCM) | 4.41% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.50% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.72% | ★★★★★★ |

| Ennis (EBF) | 5.42% | ★★★★★★ |

| Employers Holdings (EIG) | 3.02% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.54% | ★★★★★☆ |

| Dillard's (DDS) | 4.49% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.35% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.53% | ★★★★★☆ |

| Chevron (CVX) | 4.44% | ★★★★★★ |

Click here to see the full list of 121 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

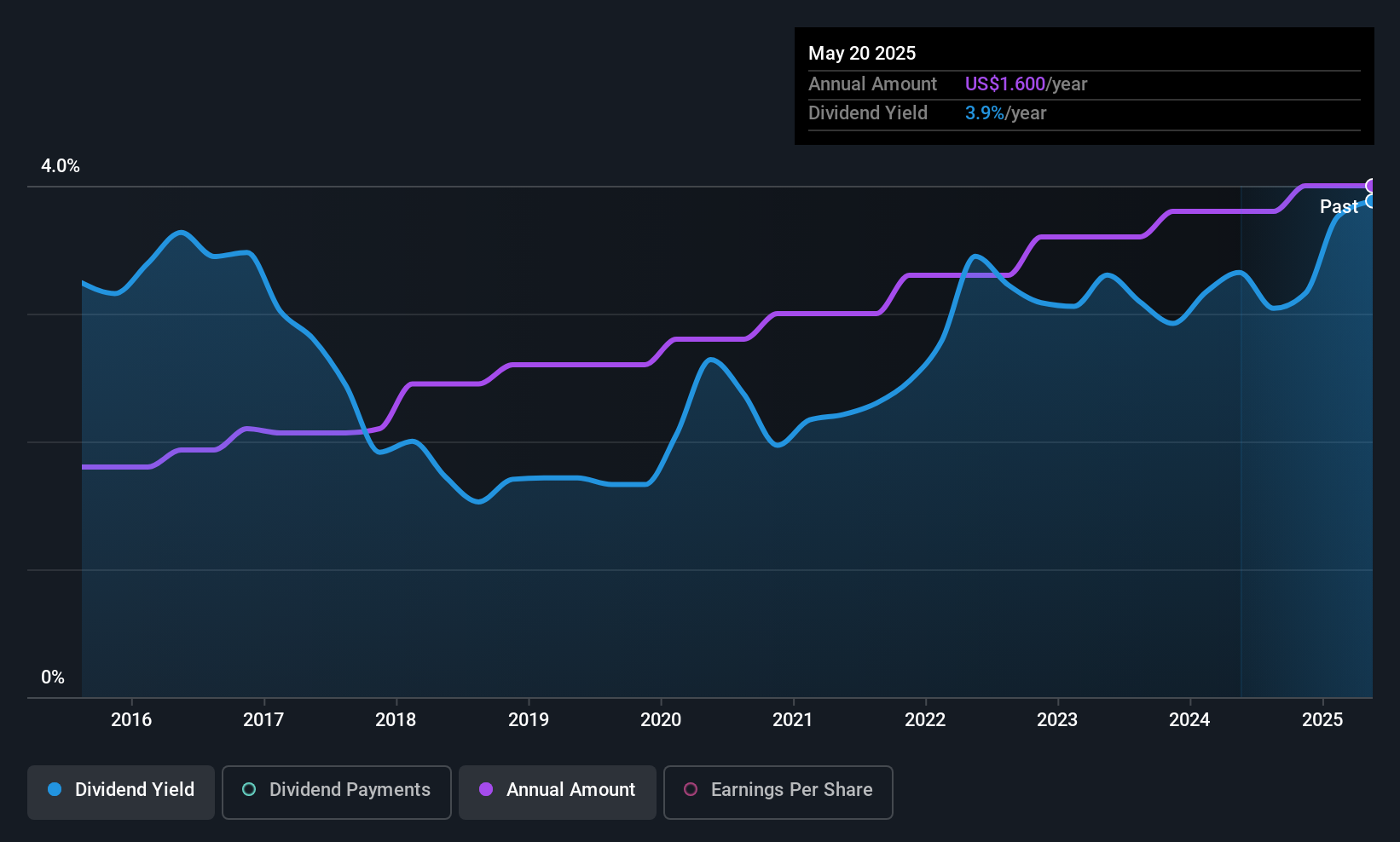

Fidelity D & D Bancorp (FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering various banking, trust, and financial services to individuals, small businesses, and corporate customers with a market cap of $253.47 million.

Operations: Fidelity D & D Bancorp, Inc. generates its revenue primarily through its Banking, Trust and Financial Services segment, which accounts for $84.97 million.

Dividend Yield: 3.6%

Fidelity D & D Bancorp offers a stable dividend history with payments increasing over the past decade, currently yielding 3.61%. Despite being lower than top-tier yields in the US market, its dividends are well covered by earnings due to a low payout ratio of 38.3%. Recent earnings growth supports this stability, with net income and interest income rising significantly. However, there is insufficient data to predict long-term sustainability or coverage beyond three years.

- Click here to discover the nuances of Fidelity D & D Bancorp with our detailed analytical dividend report.

- Our expertly prepared valuation report Fidelity D & D Bancorp implies its share price may be lower than expected.

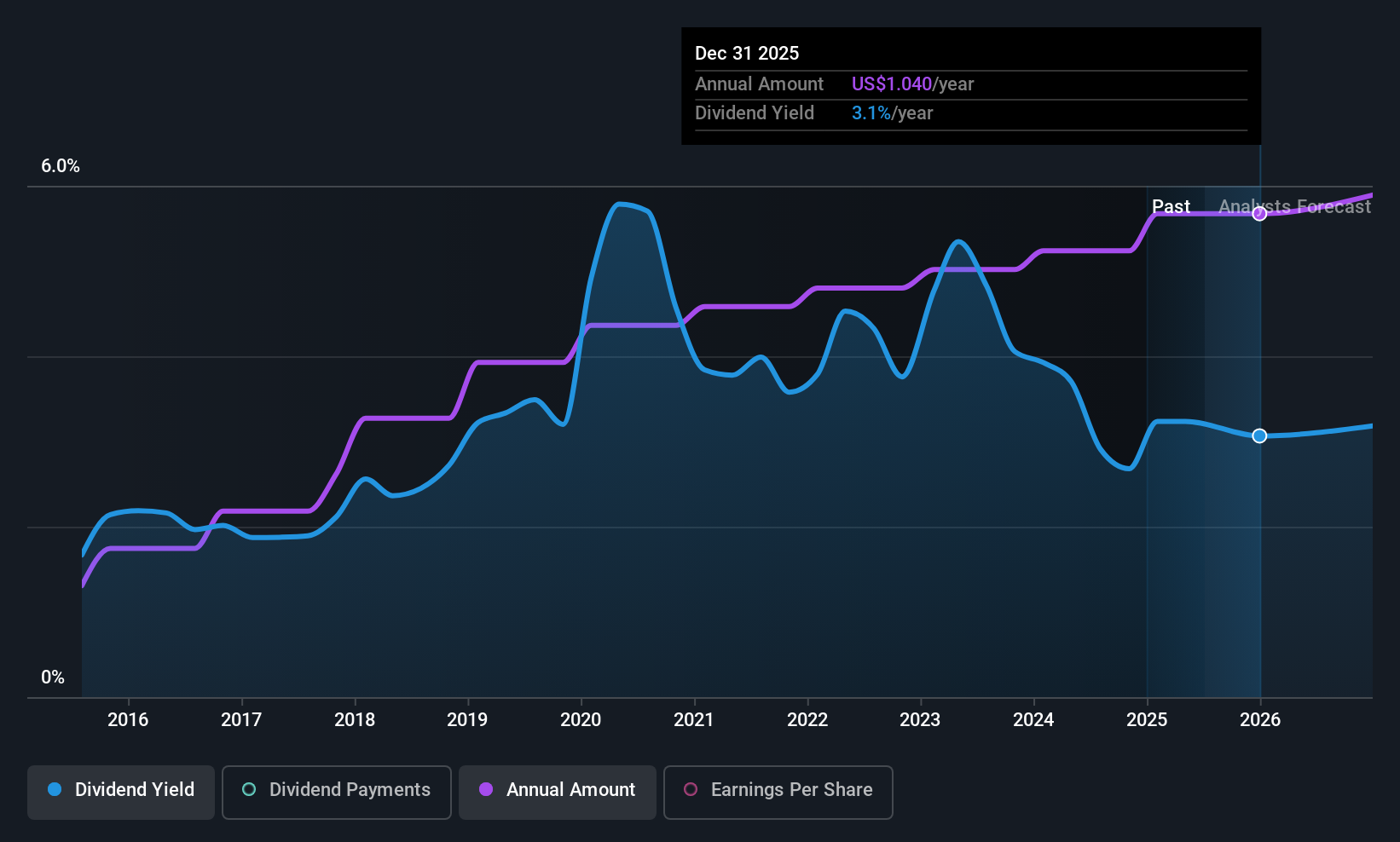

Independent Bank (IBCP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Independent Bank Corporation, with a market cap of $679.69 million, operates as the bank holding company for Independent Bank, offering a range of banking services across the United States.

Operations: Independent Bank Corporation generates revenue primarily through its banking services, with Independent Bank contributing $220.58 million to its revenue segments.

Dividend Yield: 3.2%

Independent Bank provides a reliable dividend yield of 3.16%, supported by a low payout ratio of 32.2%. Though not among the highest in the US market, its dividends have been stable and growing over the past decade. Recent earnings show net interest income growth, though net income declined slightly year-over-year. The company recently declared a quarterly dividend of $0.26 per share and completed a share buyback worth $7.33 million, enhancing shareholder value despite recent executive changes and loan charge-offs.

- Get an in-depth perspective on Independent Bank's performance by reading our dividend report here.

- The analysis detailed in our Independent Bank valuation report hints at an deflated share price compared to its estimated value.

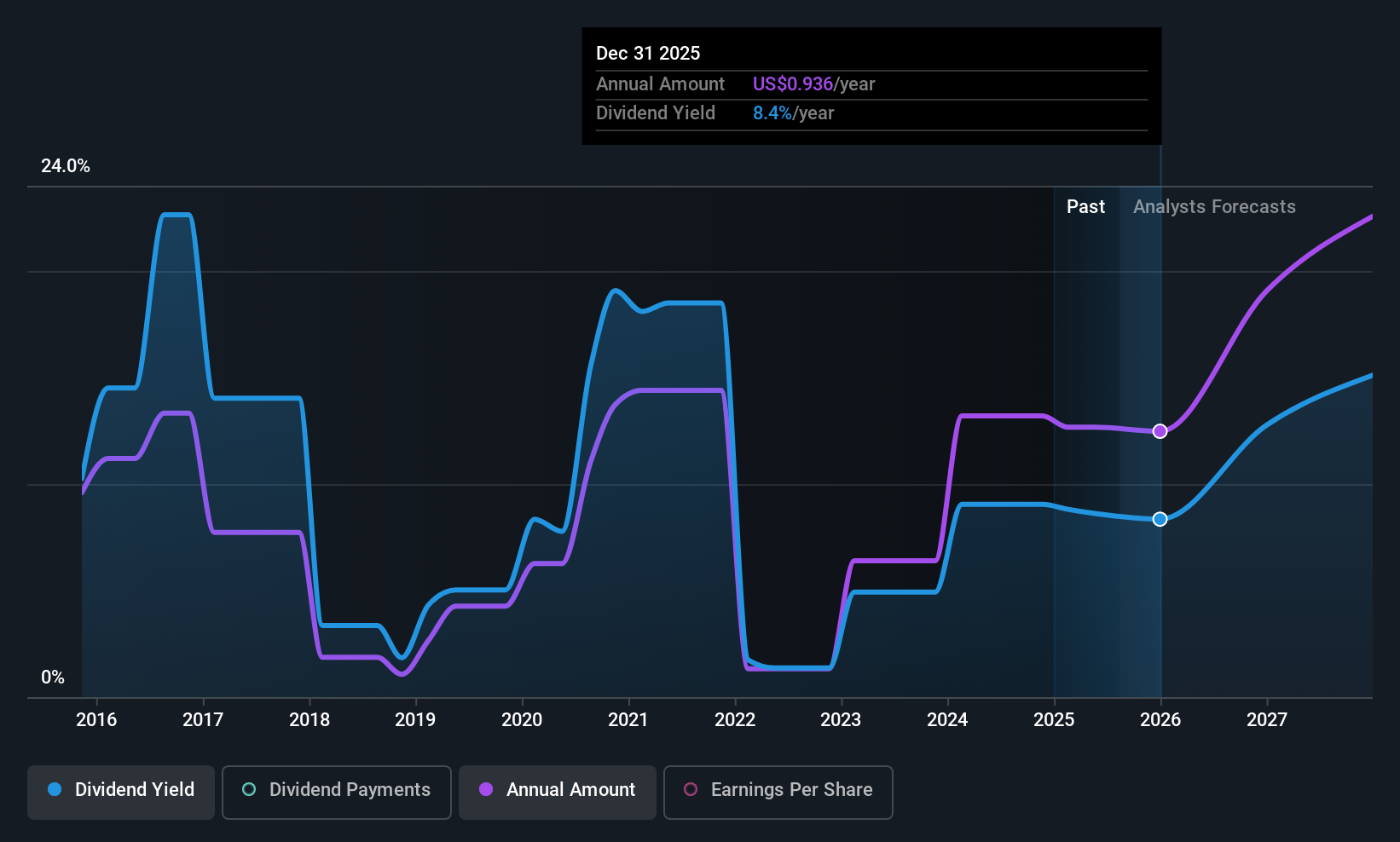

DHT Holdings (DHT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DHT Holdings, Inc. owns and operates crude oil tankers through its subsidiaries in Monaco, Singapore, Norway, and India with a market cap of $2.00 billion.

Operations: DHT Holdings, Inc. generates revenue of $557.64 million from its fleet of crude oil tankers.

Dividend Yield: 7.5%

DHT Holdings offers a compelling dividend yield of 7.52%, ranking in the top quartile of US payers. Its dividends are covered by earnings with a payout ratio of 66% and cash flows at an 83.9% cash payout ratio, although its dividend history is volatile. Recent earnings showed net income growth to US$56.1 million despite reduced revenue, while securing a $308.4 million credit facility supports future fleet expansion, potentially impacting future dividends stability and growth.

- Delve into the full analysis dividend report here for a deeper understanding of DHT Holdings.

- Our valuation report unveils the possibility DHT Holdings' shares may be trading at a discount.

Turning Ideas Into Actions

- Discover the full array of 121 Top US Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives