- United States

- /

- Banks

- /

- NasdaqGS:DCOM

January 2025 US Dividend Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market attempts to rebound from a recent losing streak, with major indices like the Dow Jones and Nasdaq showing early signs of recovery, investors are keenly observing how tech shares are regaining momentum. In this fluctuating environment, dividend stocks can offer stability and income potential, making them an attractive consideration for those seeking to navigate uncertain market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.64% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.36% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.77% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.88% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.77% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

Click here to see the full list of 162 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dime Community Bancshares (NasdaqGS:DCOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dime Community Bancshares, Inc. serves as the holding company for Dime Community Bank, offering a range of commercial banking and financial services, with a market cap of approximately $1.34 billion.

Operations: Dime Community Bancshares, Inc. generates its revenue primarily from its Community Banking segment, which accounts for $313.74 million.

Dividend Yield: 3.3%

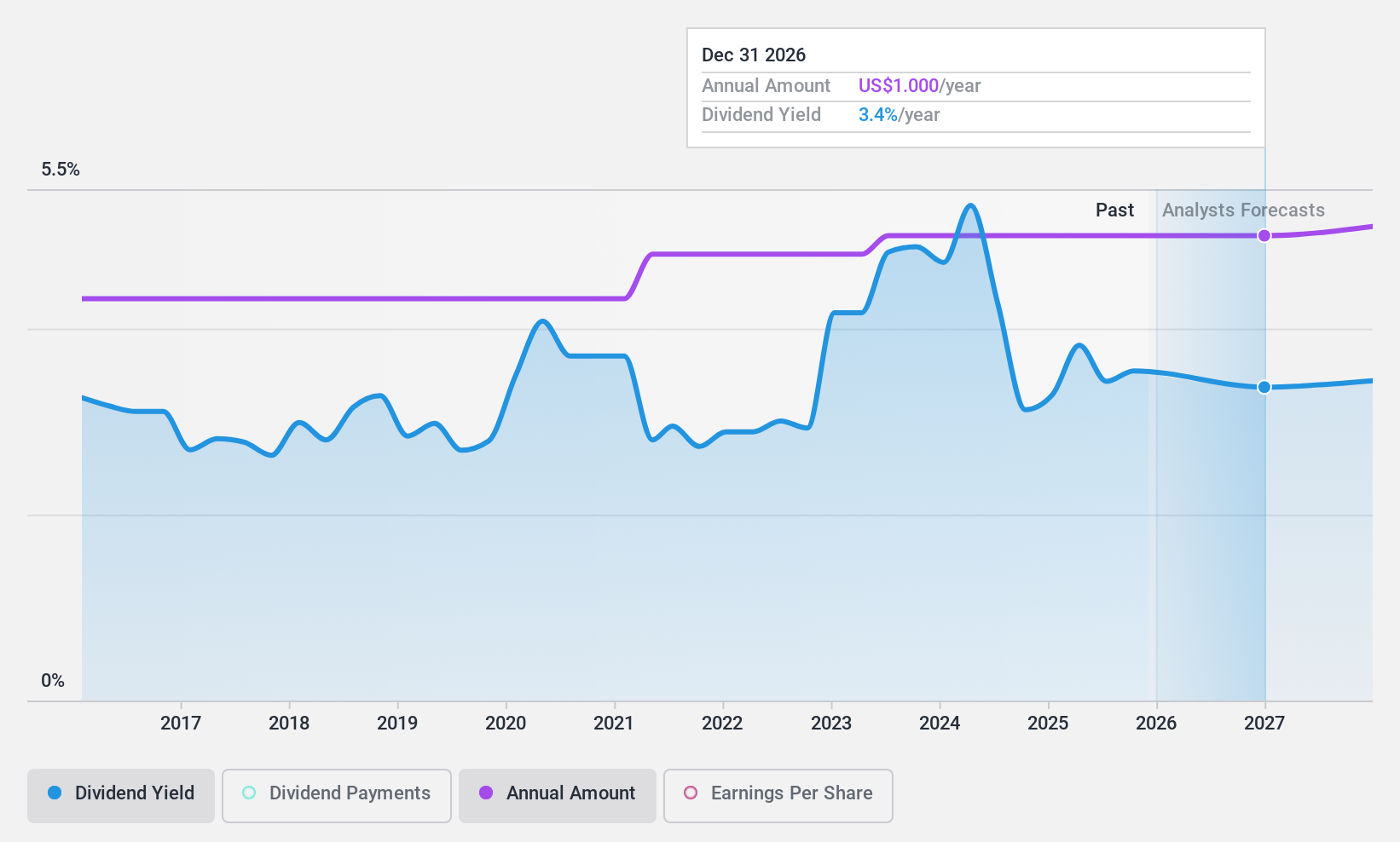

Dime Community Bancshares offers a stable dividend, currently yielding 3.3%, with consistent growth over the past decade. Although the payout ratio of 66.6% suggests dividends are well-covered by earnings, recent shareholder dilution through a $125 million equity offering could affect future returns. Despite trading below fair value estimates and having reliable dividends, profit margins have declined from last year, which might impact future dividend sustainability and growth potential.

- Get an in-depth perspective on Dime Community Bancshares' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Dime Community Bancshares' share price might be too pessimistic.

TriCo Bancshares (NasdaqGS:TCBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TriCo Bancshares operates as a bank holding company for Tri Counties Bank, offering commercial banking services to individual and corporate customers, with a market cap of approximately $1.44 billion.

Operations: TriCo Bancshares generates revenue primarily from its Community Banking segment, which accounts for $387.20 million.

Dividend Yield: 3.1%

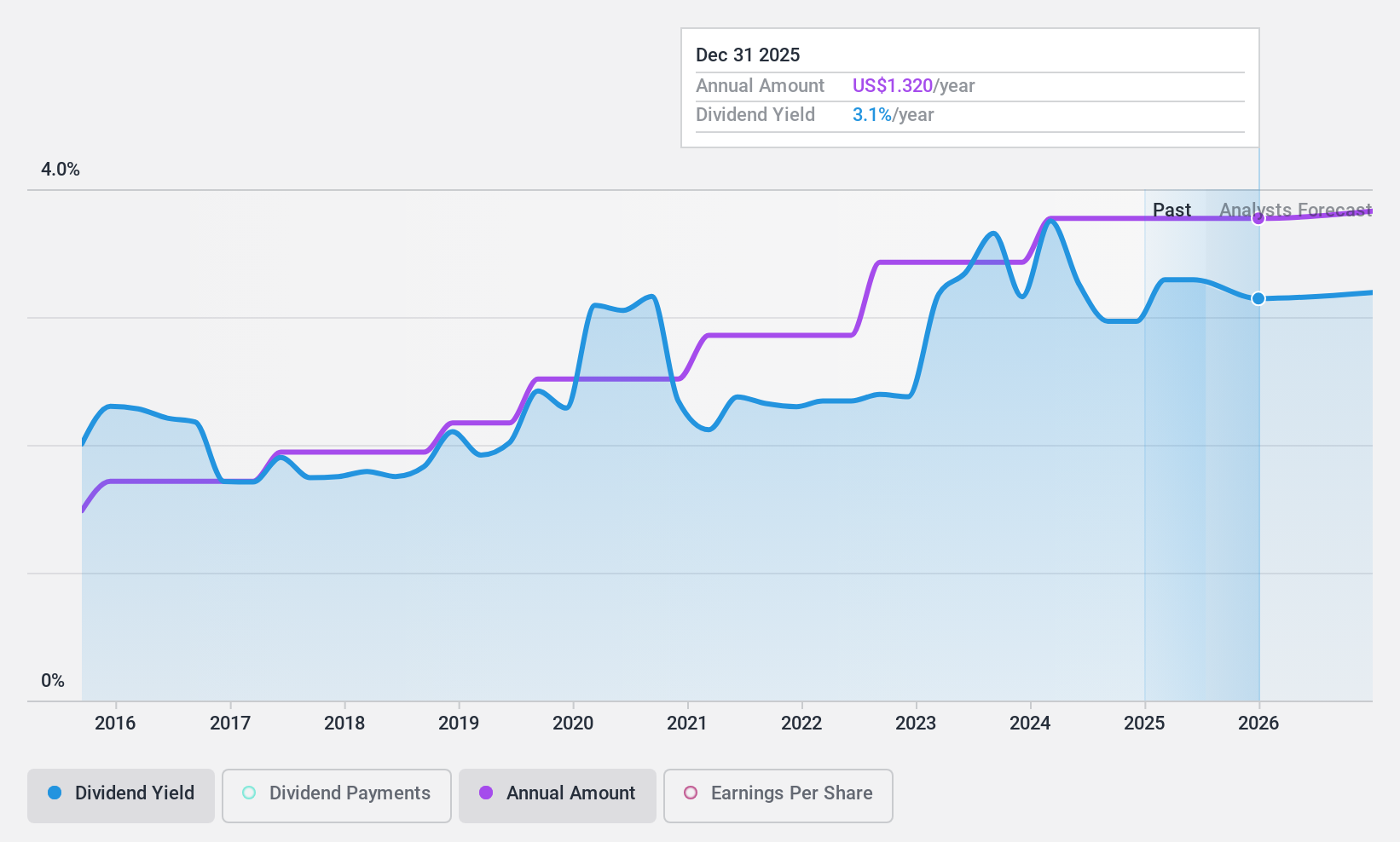

TriCo Bancshares maintains a reliable dividend yield of 3.06%, with stable and growing payouts over the past decade, supported by a low payout ratio of 38.2%. Despite trading at 42.8% below estimated fair value, its dividends remain well-covered by earnings, projected to stay sustainable in the coming years. Recent financials show slight declines in net interest income and net income compared to last year, but loan charge-offs have significantly decreased, indicating improved asset quality.

- Dive into the specifics of TriCo Bancshares here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that TriCo Bancshares is priced higher than what may be justified by its financials.

XP (NasdaqGS:XP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: XP Inc. offers financial products and services in Brazil, with a market capitalization of approximately $6.36 billion.

Operations: XP Inc.'s revenue is primarily derived from its brokerage segment, which generated R$15.89 billion.

Dividend Yield: 9.9%

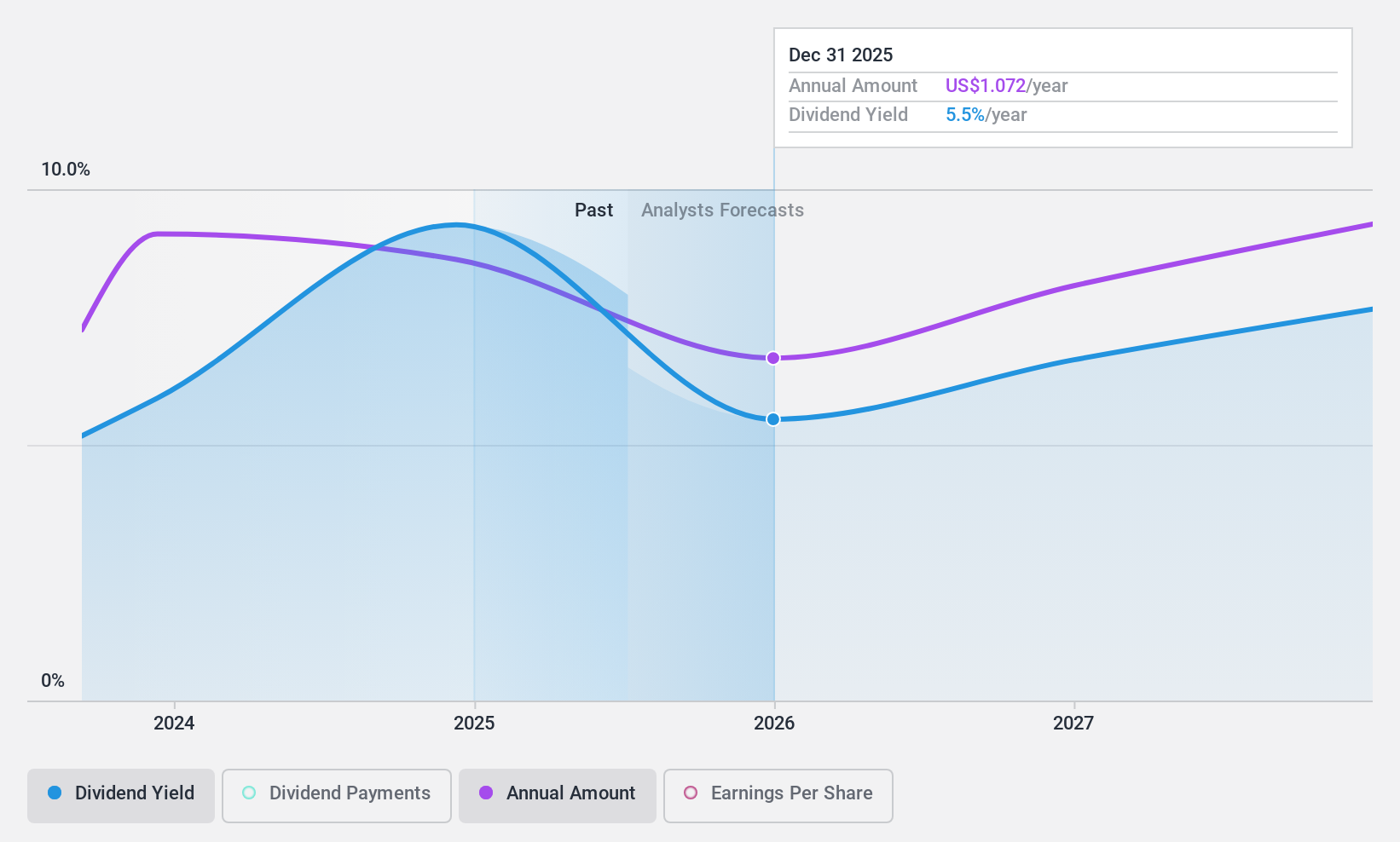

XP's dividend yield of 9.92% ranks in the top 25% of US payers, though it's too early to assess reliability or growth trends. The dividend is well-covered by earnings and cash flows with payout ratios of 41.7% and 34.2%, respectively. Recent financials reveal revenue growth to BRL 4.32 billion, supporting a USD 0.65 per share dividend declaration for December 2024, alongside an active share repurchase program worth BRL 1 billion.

- Take a closer look at XP's potential here in our dividend report.

- Our valuation report unveils the possibility XP's shares may be trading at a discount.

Where To Now?

- Discover the full array of 162 Top US Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dime Community Bancshares, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DCOM

Dime Community Bancshares

Operates as the holding company for Dime Community Bank that engages in the provision of various commercial banking and financial services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives