- United States

- /

- Banks

- /

- NasdaqGM:CZWI

Citizens Community Bancorp (CZWI) Earnings Decline Reinforces Market Concerns on Growth Trajectory

Reviewed by Simply Wall St

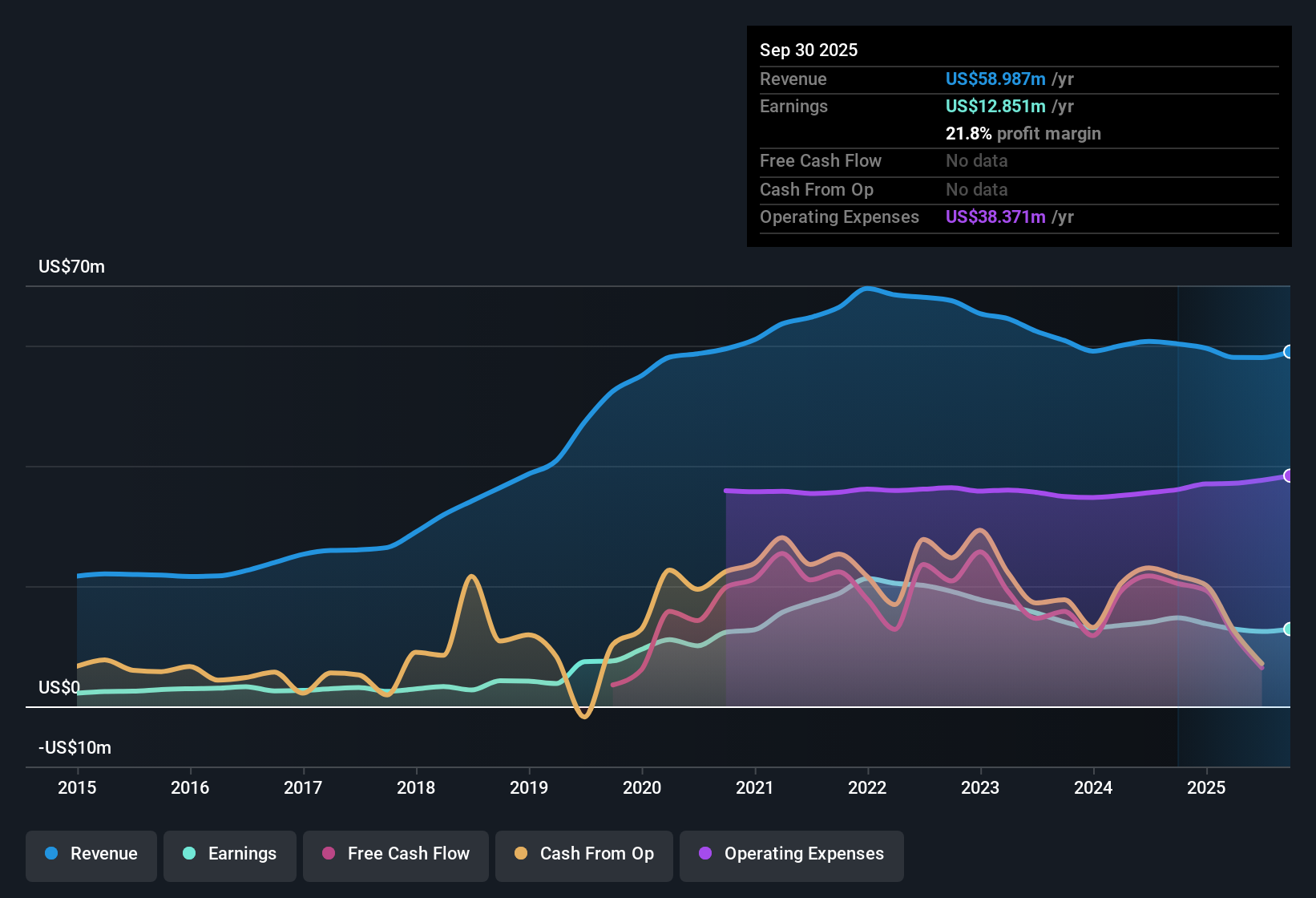

Citizens Community Bancorp (CZWI) reported that profits have declined by 5.2% annually over the past five years, with net profit margins narrowing to 21.5% from last year’s 23%. The company’s earnings growth was negative in the past year, and while revenue is forecast to grow by 8.6% per year, this is still behind the broader US market’s 10.1% pace. Attractive valuation metrics and a solid dividend proposition remain on the table for investors, despite these headwinds to profitability and growth.

See our full analysis for Citizens Community Bancorp.Up next, we put these latest figures in context by measuring them against the current market narratives. We highlight where the results confirm expectations and where they might upend the consensus.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Narrow, Quality of Earnings Holds Up

- Net profit margins decreased to 21.5% from 23% last year, but profits remain solidly above many regional peers.

- Bulls highlight that Citizens Community Bancorp’s earnings quality is described as high, pointing out that disciplined lending policies are helping sustain above-average profitability even as sector pressures mount.

- The margin contraction has not triggered a drop in reported asset quality or an outsized move in credit costs. This reinforces the bullish argument that the bank’s fundamentals are holding steadier than industry laggards.

- While margins dipped, the company continues to outperform on capital discipline, which proponents say underpins long-term stability in its regional footprint.

Revenue Growth Trails the Market

- Revenue is projected to grow by 8.6% annually, a pace below the US market average of 10.1%, emphasizing that the company’s expansion is modest by sector standards.

- Prevailing analysis notes that this slower growth rate sparks debate about Citizens Community Bancorp’s ability to capture new business, especially since wider industry players are reporting stronger top-line momentum.

- Analysts tracking sector trends question if this lower forecast signals a maturing loan book or increasing competitive pressure in the bank’s core operating markets.

- The modest revenue projection challenges expectations of a breakout and spotlights the critical role of repeat business and strong customer retention in supporting ongoing results.

Valuation Gap: Trading Well Below DCF Fair Value

- The current share price of $15.89 is materially below the DCF fair value estimate of $27.73 and also trades at a 12.6x Price-To-Earnings ratio, which is lower than peer averages of 15.3x, but above the wider US Banks industry average of 11.2x.

- This discount is seen as a potential opportunity by those focused on value metrics, as it heavily supports the view that the market has yet to price in Citizens Community Bancorp’s high earnings quality and attractive dividend relative to peers.

- Backers of the valuation thesis argue that, given the company’s outperformance on capital discipline and persistent profit margins, the current price represents a significant upside if sector sentiment improves.

- Still, skeptics point out that ongoing growth concerns and sector pressures may be weighing on the multiple, cautioning against immediate re-rating unless top-line trends accelerate.

- See what the community is saying about Citizens Community Bancorp

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Citizens Community Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Citizens Community Bancorp faces modest revenue growth and narrowing profit margins, which raises doubts about its ability to keep pace with faster-growing industry peers.

If you’re looking for steadier performers, check out stable growth stocks screener (2111 results) to find companies demonstrating consistent results and growth momentum year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CZWI

Citizens Community Bancorp

Operates as a bank holding company for Citizens Community Federal N.A.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives