- United States

- /

- Banks

- /

- NasdaqCM:CZFS

Undiscovered Gems in the United States to Explore This December 2024

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but it has seen a remarkable 31% rise over the past year, with earnings forecast to grow by 15% annually. In this dynamic environment, discovering stocks with strong growth potential and solid fundamentals can be key to capitalizing on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Citizens Financial Services (NasdaqCM:CZFS)

Simply Wall St Value Rating: ★★★★★★

Overview: Citizens Financial Services, Inc. is a bank holding company offering a range of banking products and services to individual, business, governmental, and institutional clients with a market cap of $335.23 million.

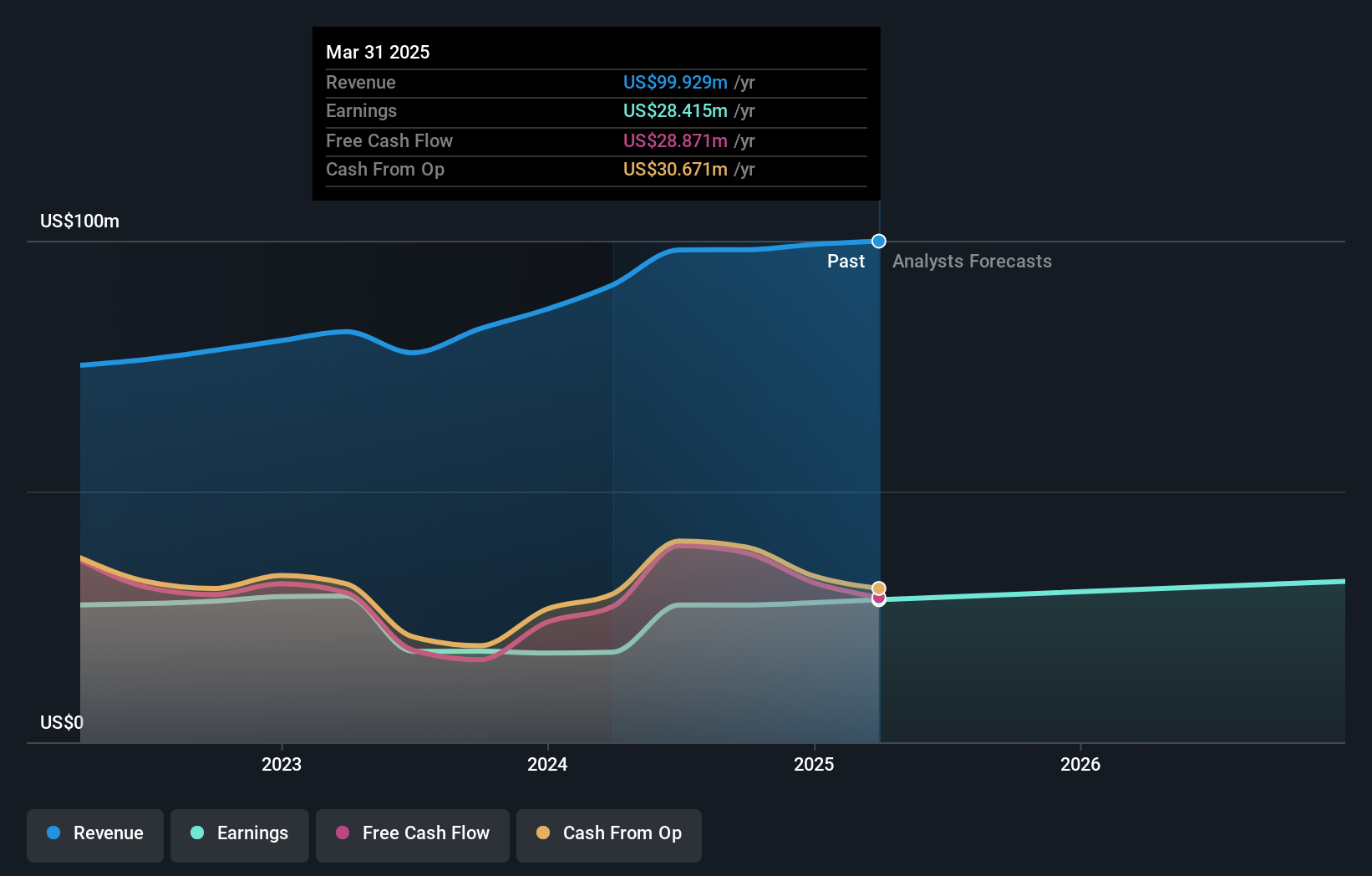

Operations: Citizens Financial Services generates its revenue primarily from community banking, amounting to $98.20 million.

Citizens Financial Services, with assets totaling US$3 billion and equity of US$298.7 million, has been making waves in the financial sector. The bank's total deposits stand at US$2.5 billion, while loans amount to US$2.3 billion, supported by a net interest margin of 3.2%. Earnings growth over the past year was a robust 50.9%, significantly outpacing the industry's -12%. The company maintains a prudent allowance for bad loans at 0.9% of total loans and has repurchased shares worth $0.13 million recently, reflecting confidence in its valuation which trades at 51% below estimated fair value.

Capital City Bank Group (NasdaqGS:CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. operates as the financial holding company for Capital City Bank, offering a variety of banking-related services to individual and corporate clients, with a market capitalization of approximately $665.07 million.

Operations: Capital City Bank Group generates revenue primarily from its Commercial Banking segment, amounting to $226.02 million. The company's financial performance reflects a focus on banking services for both individual and corporate clients.

Capital City Bank Group, with assets totaling US$4.2 billion and equity of US$476.5 million, operates primarily through low-risk customer deposits amounting to US$3.6 billion against loans of US$2.7 billion. The bank's allowance for bad loans is robust at 0.2%, reflecting prudent management practices in a challenging environment where industry growth lagged behind its own 2.8% earnings increase over the past year. Despite significant insider selling recently, the company trades at an attractive 45% below estimated fair value and continues to pay dividends, offering shareholders a quarterly payout of $0.23 per share annually totaling $0.92 per share.

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Loma Negra Compañía Industrial Argentina Sociedad Anónima, along with its subsidiaries, is engaged in the manufacturing and sale of cement and related products in Argentina, with a market capitalization of approximately $1.43 billion.

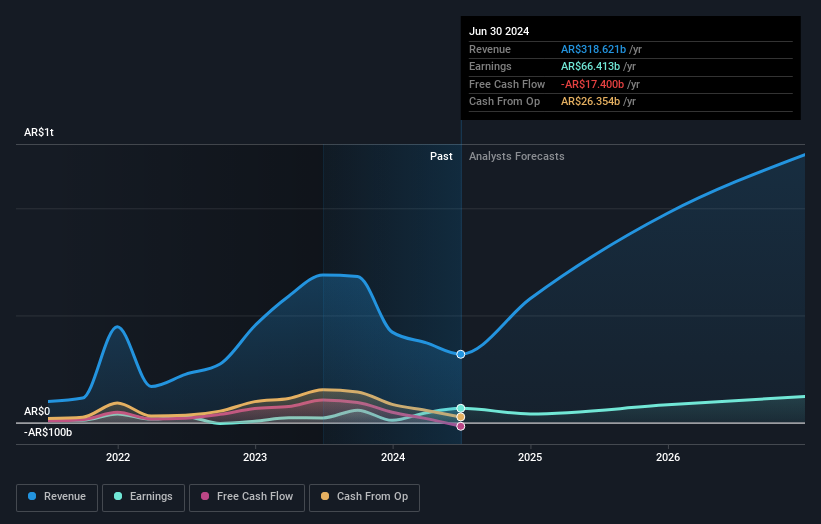

Operations: Loma Negra generates revenue primarily from the sale of cement, masonry cement, and lime, contributing ARS 433.41 billion. Additional revenue streams include its railroad segment at ARS 44.14 billion and concrete sales at ARS 39.61 billion.

Loma Negra, a notable player in the basic materials sector, showcases a mixed financial landscape. The company's net debt to equity ratio stands at 24.1%, reflecting satisfactory management of leverage over five years, down from 40.7%. However, its EBIT covers interest payments only 1.9 times, indicating potential challenges in managing debt obligations effectively. Despite recent negative earnings growth of 8.1%, Loma Negra's price-to-earnings ratio of 20.6x suggests it offers better value compared to the industry average of 24.9x. Recent sales figures show ARS180 billion for Q3 and ARS486 billion for nine months ended September 2024, highlighting ongoing operational hurdles amidst executive changes.

Next Steps

- Click this link to deep-dive into the 232 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZFS

Citizens Financial Services

A bank holding company, provides various banking products and services for individual, business, governmental, and institutional customers.

Flawless balance sheet, undervalued and pays a dividend.