- United States

- /

- Banks

- /

- NasdaqGS:INDB

3 US Dividend Stocks Yielding Up To 4.2%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indexes like the S&P 500 and Dow Jones Industrial Average recently declining due to pressures in technology and energy sectors, investors are increasingly looking for stability through dividend stocks. In such volatile times, a good dividend stock is often characterized by a reliable yield and strong fundamentals that can weather economic uncertainties while providing consistent income.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.70% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.25% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.58% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.64% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.49% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.94% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.41% | ★★★★★★ |

Click here to see the full list of 168 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

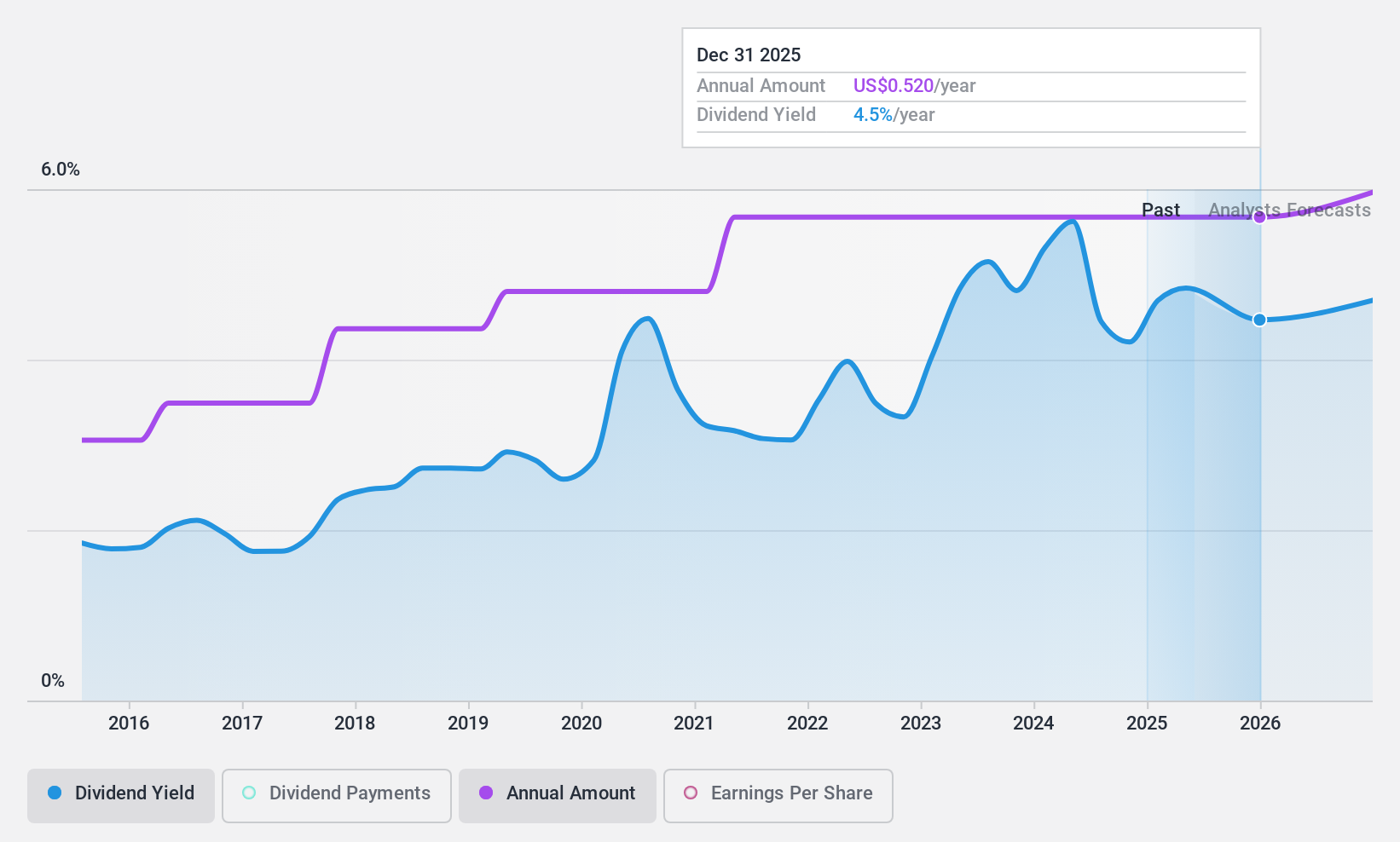

Citizens Financial Services (NasdaqCM:CZFS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Citizens Financial Services, Inc., a bank holding company, offers a range of banking products and services to individual, business, governmental, and institutional customers with a market cap of $282.31 million.

Operations: The company's revenue is primarily derived from its Community Banking segment, totaling $98.19 million.

Dividend Yield: 3.3%

Citizens Financial Services offers a stable dividend with a 3.27% yield, though lower than the top US dividend payers. The company's dividends are well-covered by earnings, evidenced by a low payout ratio of 33.7%. Recent financials show strong earnings growth, with net income reaching US$5.28 million in Q2 2024 from a prior loss. Despite recent net charge-offs and modest share buybacks, its consistent dividend history over the past decade enhances its appeal to income-focused investors.

- Unlock comprehensive insights into our analysis of Citizens Financial Services stock in this dividend report.

- In light of our recent valuation report, it seems possible that Citizens Financial Services is trading behind its estimated value.

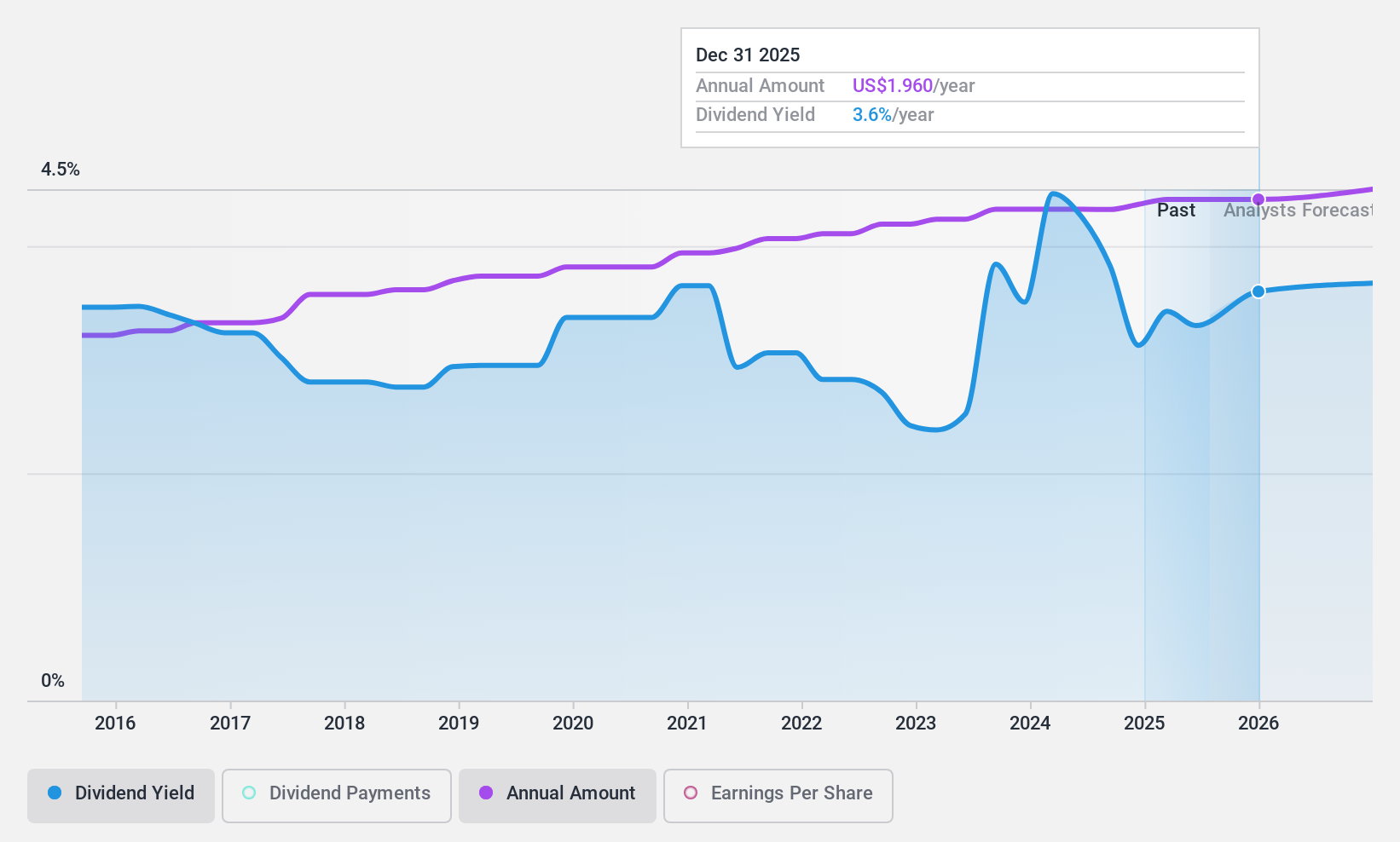

Independent Bank (NasdaqGS:INDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Independent Bank Corp., the bank holding company for Rockland Trust Company, offers commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of $2.68 billion.

Operations: Independent Bank Corp.'s revenue from its Community Banking segment amounts to $677.67 million.

Dividend Yield: 3.6%

Independent Bank's dividend yield of 3.62% is reliable, with stable growth over the past decade and a manageable payout ratio of 45%, ensuring coverage by earnings. The recent US$0.57 per share dividend affirms its commitment to shareholders. Despite a decline in net income to US$51.33 million for Q2 2024, the bank remains focused on disciplined credit underwriting and potential M&A opportunities, supported by strong capital positioning and historical acquisition strategy success.

- Navigate through the intricacies of Independent Bank with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Independent Bank is priced lower than what may be justified by its financials.

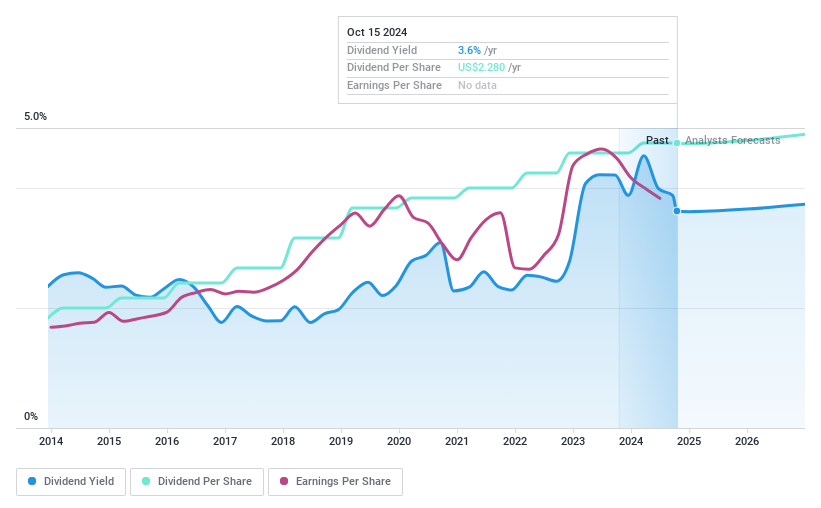

Northfield Bancorp (Staten Island NY) (NasdaqGS:NFBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northfield Bancorp, Inc. (Staten Island, NY) is the bank holding company for Northfield Bank, offering a range of banking products and services to individuals and corporate customers, with a market cap of $525.14 million.

Operations: Northfield Bancorp, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $126.91 million.

Dividend Yield: 4.3%

Northfield Bancorp offers a stable dividend yield of 4.28%, with consistent growth over the past decade. The payout ratio of 77.3% ensures dividends are covered by earnings, though profit margins have decreased from last year. Recently added to the S&P Regional Banks Select Industry Index, Northfield continues shareholder returns through buybacks and dividends, despite a drop in net income to US$5.96 million for Q2 2024 compared to US$9.56 million previously.

- Click to explore a detailed breakdown of our findings in Northfield Bancorp (Staten Island NY)'s dividend report.

- According our valuation report, there's an indication that Northfield Bancorp (Staten Island NY)'s share price might be on the cheaper side.

Next Steps

- Gain an insight into the universe of 168 Top US Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet established dividend payer.