- United States

- /

- Banks

- /

- NasdaqGM:CVLY

Is Now The Time To Put Codorus Valley Bancorp (NASDAQ:CVLY) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Codorus Valley Bancorp (NASDAQ:CVLY). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Codorus Valley Bancorp

Codorus Valley Bancorp's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Codorus Valley Bancorp's EPS skyrocketed from US$1.51 to US$2.10, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 39%.

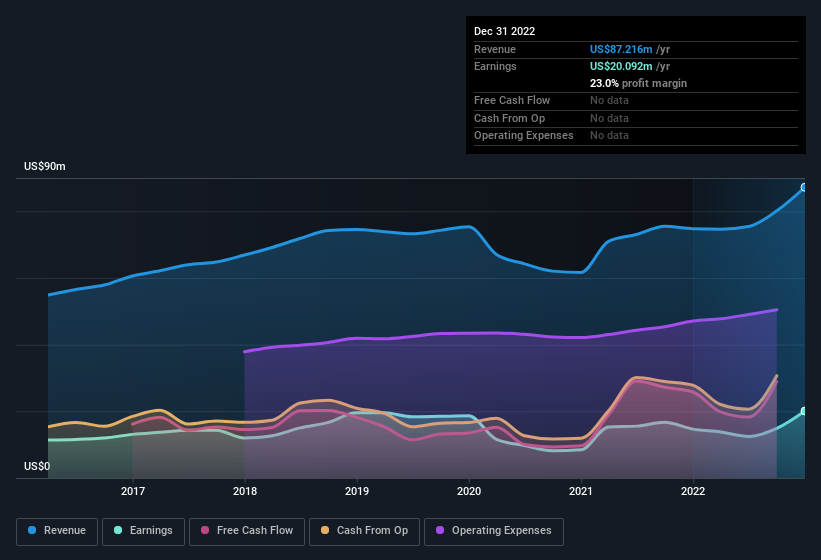

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Codorus Valley Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Codorus Valley Bancorp remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 17% to US$87m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Codorus Valley Bancorp is no giant, with a market capitalisation of US$208m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Codorus Valley Bancorp Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Codorus Valley Bancorp insiders did net US$30k selling stock over the last year, they invested US$471k, a much higher figure. An optimistic sign for those with Codorus Valley Bancorp in their watchlist. It is also worth noting that it was Director Scott Fainor who made the biggest single purchase, worth US$65k, paying US$20.50 per share.

Recent insider purchases of Codorus Valley Bancorp stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations between US$100m and US$400m, like Codorus Valley Bancorp, the median CEO pay is around US$1.7m.

Codorus Valley Bancorp's CEO took home a total compensation package worth US$1.1m in the year leading up to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Codorus Valley Bancorp Deserve A Spot On Your Watchlist?

You can't deny that Codorus Valley Bancorp has grown its earnings per share at a very impressive rate. That's attractive. And that's not the only positive either. We have both insider buying and reasonable and remuneration to consider. On balance the message seems to be that this stock is worth looking at, at least for a while. You should always think about risks though. Case in point, we've spotted 2 warning signs for Codorus Valley Bancorp you should be aware of, and 1 of them is significant.

The good news is that Codorus Valley Bancorp is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CVLY

Codorus Valley Bancorp

Operates as the bank holding company for the PeoplesBank that provides community banking services in South Central Pennsylvania and Central Maryland.

Flawless balance sheet and fair value.

Market Insights

Community Narratives