- United States

- /

- Banks

- /

- NasdaqGS:CVBF

Does CVB Financial’s (CVBF) Modest Buyback Signal Changing Capital Allocation Priorities for Investors?

Reviewed by Sasha Jovanovic

- CVB Financial Corp. reported third quarter 2025 results, with net interest income of US$115.58 million and net income of US$52.59 million, both slightly above the prior year, and completed a US$43.5 million buyback program that reduced shares outstanding by 1.7% since November 2024.

- The completed share repurchase reflects the company’s ongoing effort to return capital to shareholders, while earnings provide insight into its margin and profitability trajectory amid a competitive regional banking sector.

- We’ll explore how CVB Financial’s modest earnings growth and completed buyback effort affect the broader investment narrative discussed by analysts.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CVB Financial Investment Narrative Recap

To be a shareholder in CVB Financial, you need to believe that the company’s disciplined capital management and consistent earnings, such as those reflected in its latest buyback and steady profit growth, can offset sector pressures and California-specific risks. The recent completion of a US$43.5 million buyback is unlikely to significantly shift the key short-term catalyst, stabilizing net interest margins, or the biggest risk: increased competition for loans and deposits compressing margins. One relevant announcement concerns the Q3 earnings release, which showed modest, steady increases in net interest income and net income year over year. This result, occurring alongside the completed buyback, offers some reassurance around profitability and capital allocation, yet does little to address lingering headwinds such as slow loan growth, which remains the critical short-term variable shaping performance. Yet, despite recurring themes around profitability, investors should be conscious of the impact that persistent weakness in loan demand could ultimately have on...

Read the full narrative on CVB Financial (it's free!)

CVB Financial's outlook anticipates $581.6 million in revenue and $223.8 million in earnings by 2028. This is based on an expected annual revenue growth rate of 4.6% and a $21.5 million increase in earnings from the current $202.3 million.

Uncover how CVB Financial's forecasts yield a $22.80 fair value, a 22% upside to its current price.

Exploring Other Perspectives

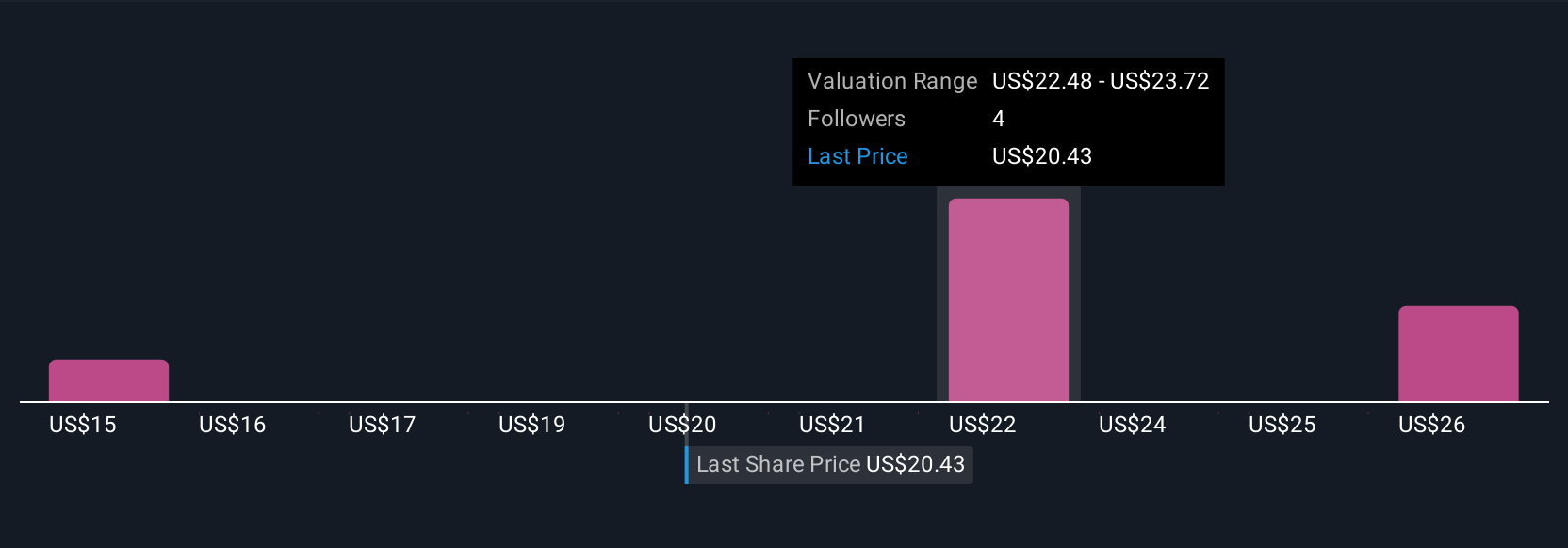

Simply Wall St Community members set CVB Financial’s fair value between US$15 and US$27.28, with three estimates spanning this range. With sluggish loan growth cited as a key business headwind, it is clear your view on revenue resilience could set you apart from the crowd.

Explore 3 other fair value estimates on CVB Financial - why the stock might be worth as much as 47% more than the current price!

Build Your Own CVB Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVB Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CVB Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVB Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVBF

CVB Financial

Operates as a bank holding company for Citizens Business Bank, a state-chartered bank that provides banking and financial services to small to mid-sized businesses and individuals.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives