- United States

- /

- Banks

- /

- NasdaqGS:COLB

Is Columbia Banking System a Value Opportunity After Recent Share Price Rebound?

Reviewed by Bailey Pemberton

- Wondering if Columbia Banking System at around $27.67 is quietly turning into a value opportunity, or if the market is still pricing in too much risk, you are not alone.

- After a choppy year where the share price is down about 3.2% over 12 months but still up 47.1% over five years, investors are trying to work out whether the recent 2.8% 30 day rise is the start of a new trend or just more noise.

- Recent headlines around regional banks have focused on balance sheet strength, deposit stability, and how well management teams are navigating higher rates. Columbia has been part of that wider conversation. Regulatory scrutiny across the sector and shifting expectations for interest rate cuts are also shaping how investors think about the risk and reward profile for regional lenders like this one.

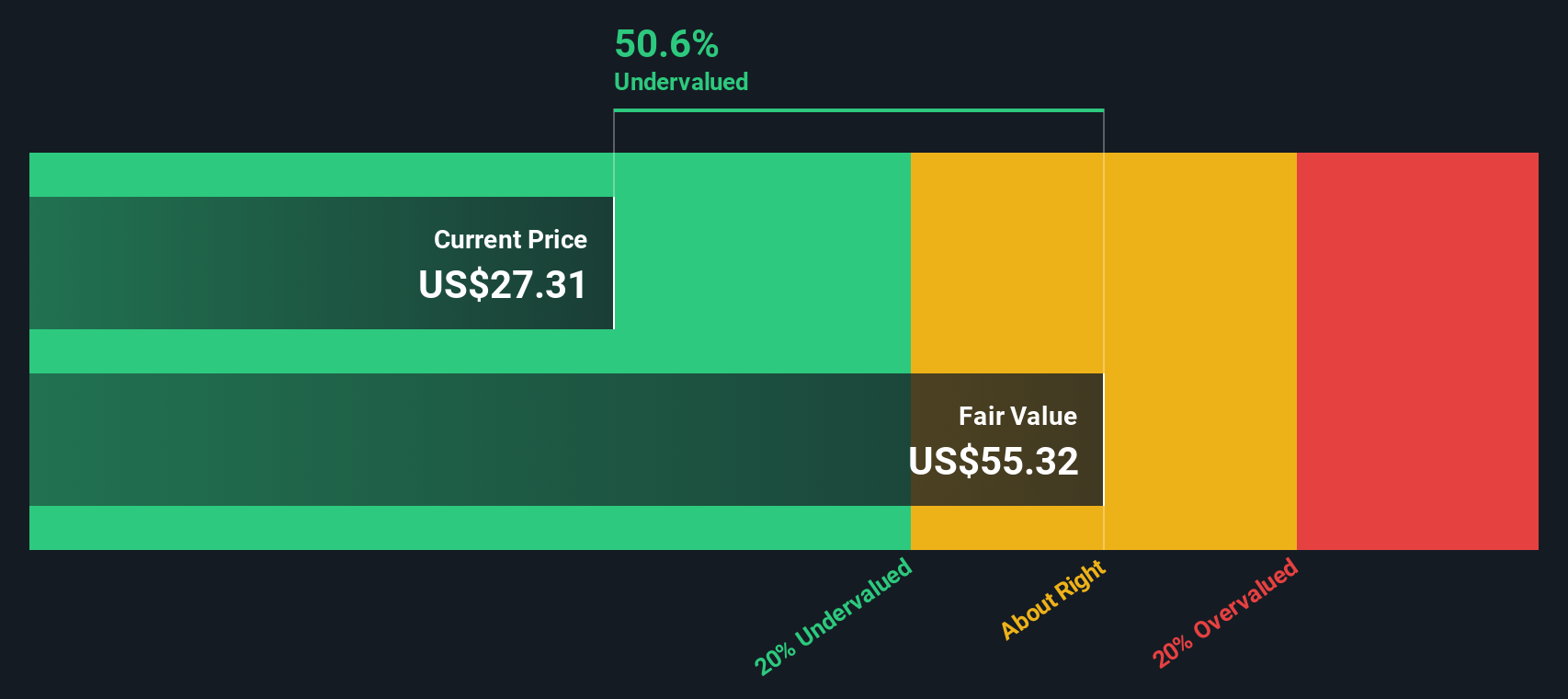

- Right now, Columbia Banking System scores a 4/6 valuation check score, suggesting it screens as undervalued on most but not all of our metrics. Next, we will unpack those different valuation lenses, before finishing with a more nuanced way to think about what the stock is really worth.

Find out why Columbia Banking System's -3.2% return over the last year is lagging behind its peers.

Approach 1: Columbia Banking System Excess Returns Analysis

The Excess Returns model looks at how much profit Columbia Banking System can generate above the return that shareholders demand, based on the bank's equity base. Instead of focusing on near term earnings swings, it asks whether management can keep compounding value from the capital already invested.

For Columbia, the starting Book Value is $26.04 per share, rising to a Stable Book Value estimate of $27.79 per share, based on forecasts from 10 analysts. Stable EPS is projected at $3.04 per share, derived from weighted future Return on Equity estimates from 8 analysts, implying an Average Return on Equity of 10.93%.

Against a Cost of Equity of $1.93 per share, the model calculates an Excess Return of $1.11 per share. Discounting these excess returns back to today gives an intrinsic value of about $57.69 per share. Compared with a share price around $27.67, this framework suggests the stock is roughly 52.0% undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Columbia Banking System is undervalued by 52.0%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Columbia Banking System Price vs Earnings

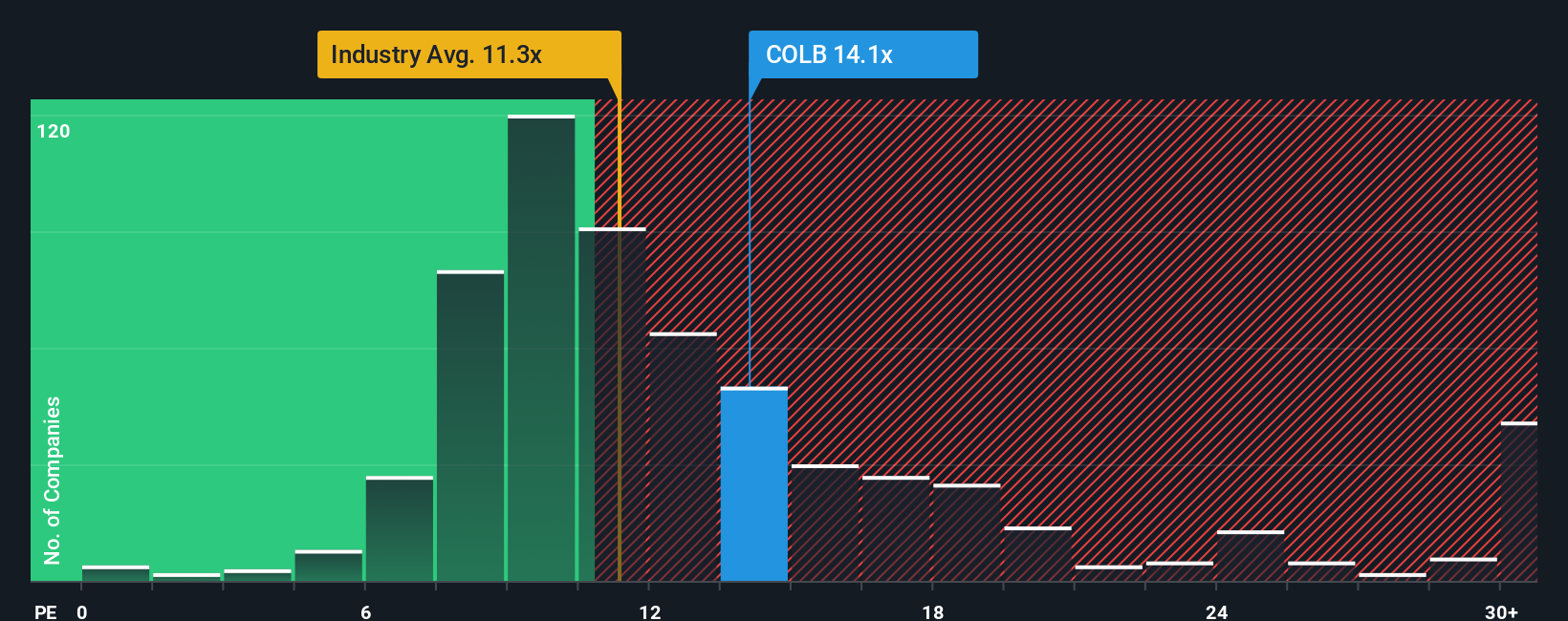

For profitable banks like Columbia, the price to earnings (PE) ratio is a useful way to gauge what the market is willing to pay for each dollar of current earnings. It ties directly to bottom line profitability, which is a key driver of long term value for established lenders.

In general, higher expected growth and lower perceived risk justify a higher, or more generous, PE multiple, while slower growth or elevated risk usually mean a lower, more cautious multiple. Columbia currently trades on a PE of about 17.3x, above the wider Banks industry average of around 11.5x, but below the roughly 30.0x average of its peer group, which includes some faster growing or more richly valued names.

Simply Wall St’s Fair Ratio framework estimates that, given Columbia’s earnings growth outlook, industry, profit margins, market cap and risk profile, a PE of about 18.7x would be reasonable. This is more tailored than simple industry or peer comparisons because it adjusts for company specific strengths and risks rather than assuming one size fits all. With the shares on 17.3x versus a Fair Ratio of 18.7x, the stock screens as modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

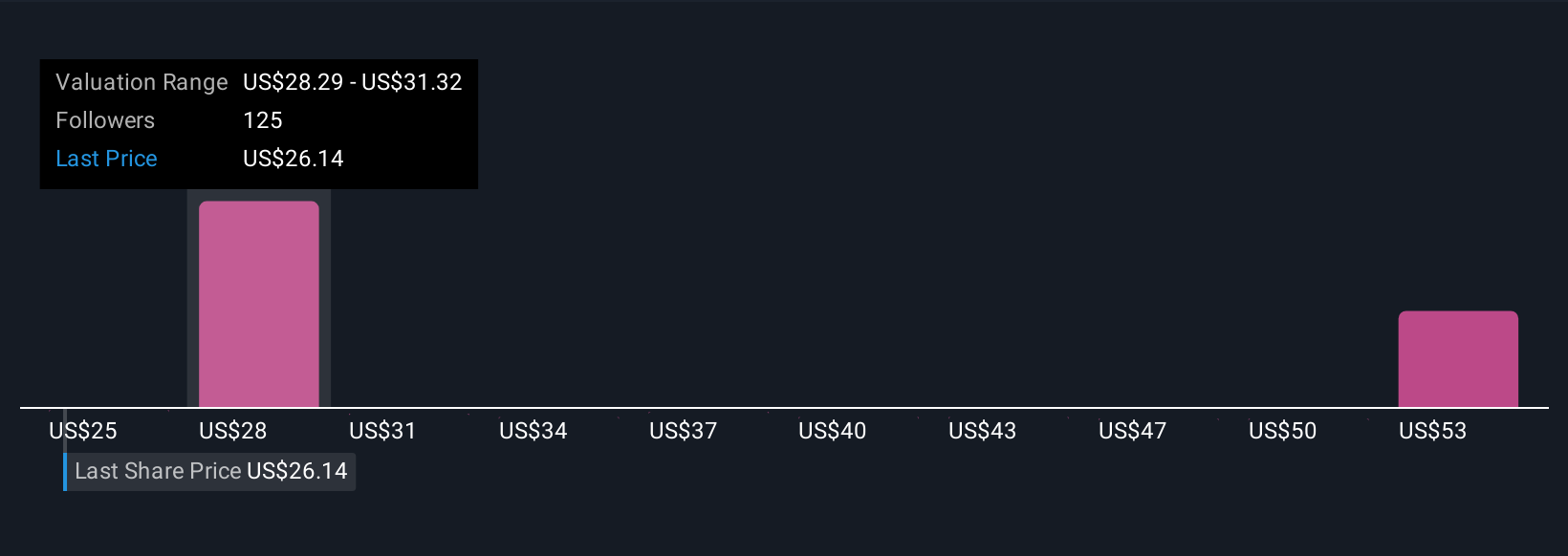

Upgrade Your Decision Making: Choose your Columbia Banking System Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Columbia Banking System’s business to a set of numbers, from future revenue, earnings and margins through to a personal fair value estimate, all within the Community page on Simply Wall St that millions of investors use. A Narrative is your story behind the numbers, linking what you believe about Columbia’s strategy, competitive position and risks to a forward looking forecast and, ultimately, a fair value that you can compare to today’s share price to decide whether it looks like a buy, a hold, or a sell. Because Narratives on the platform update dynamically when new earnings, news or guidance is released, they stay alive and relevant instead of being a one off spreadsheet. For Columbia right now, one investor’s Narrative might lean toward the higher end of recent analyst targets, expecting benefits from digital investments and expansion to justify a fair value closer to $35, while another, more cautious Narrative could anchor around $25, emphasizing integration risks and funding pressures.

Do you think there's more to the story for Columbia Banking System? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026