- United States

- /

- Banks

- /

- NasdaqCM:COFS

Undiscovered Gems in the US Market May 2025

Reviewed by Simply Wall St

As the U.S. market navigates a landscape marked by strong earnings from major tech companies and concerns over economic contraction, the S&P 500 and Dow have extended their winning streaks, reflecting investor optimism amidst ongoing tariff uncertainties. In this environment, identifying promising small-cap stocks can be particularly rewarding as these companies often offer unique growth opportunities that larger firms might not provide.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Value Rating: ★★★★★★

Overview: ChoiceOne Financial Services, Inc. is a bank holding company for ChoiceOne Bank, offering banking services in Michigan with a market cap of $425.14 million.

Operations: ChoiceOne Financial Services generates revenue primarily through interest income from loans and investments. The company's net profit margin is 23.5%, reflecting its efficiency in managing expenses relative to its income.

ChoiceOne Financial Services, with assets totaling US$2.7 billion and equity of US$260.4 million, stands out for its robust financial health. It boasts a net interest margin of 3% and has total deposits of US$2.2 billion against loans of US$1.5 billion, reflecting strong liquidity management. The company maintains an appropriate non-performing loan level at 0.2%, supported by a substantial allowance for bad loans at 447%. Despite recent shareholder dilution, ChoiceOne's earnings have grown by 25.7% over the past year, outpacing the industry average growth rate of 4.1%, indicating solid performance in a competitive sector.

GBank Financial Holdings (NasdaqCM:GBFH)

Simply Wall St Value Rating: ★★★★★☆

Overview: GBank Financial Holdings Inc. is a bank holding company for GBank, offering banking services to commercial and consumer clients in Nevada, with a market cap of $570.09 million.

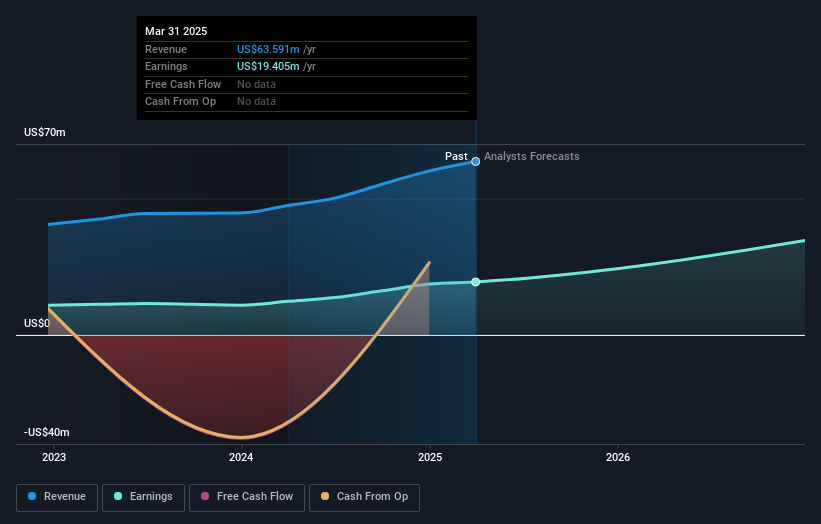

Operations: The company generates revenue primarily from its banking segment, amounting to $60.14 million.

GBank Financial Holdings, a nimble player with total assets of US$1.1 billion, showcases robust growth with earnings surging 70.7% last year, outpacing the industry average of 4.1%. Customer deposits form 95% of its funding base, highlighting low-risk financial management. Despite an insufficient allowance for bad loans at 64%, non-performing loans remain appropriate at 1.7%. Recent inclusion in the NASDAQ Composite Index underscores its rising profile, while a shelf registration for US$33.51 million suggests strategic capital initiatives ahead. With total deposits at US$935 million and loans reaching US$806 million, it maintains a solid net interest margin of 4.8%.

- Delve into the full analysis health report here for a deeper understanding of GBank Financial Holdings.

Learn about GBank Financial Holdings' historical performance.

Weyco Group (NasdaqGS:WEYS)

Simply Wall St Value Rating: ★★★★★★

Overview: Weyco Group, Inc. is a company that designs, markets, and distributes footwear for men, women, and children across the United States, Canada, Australia, Asia, and South Africa with a market cap of $276.26 million.

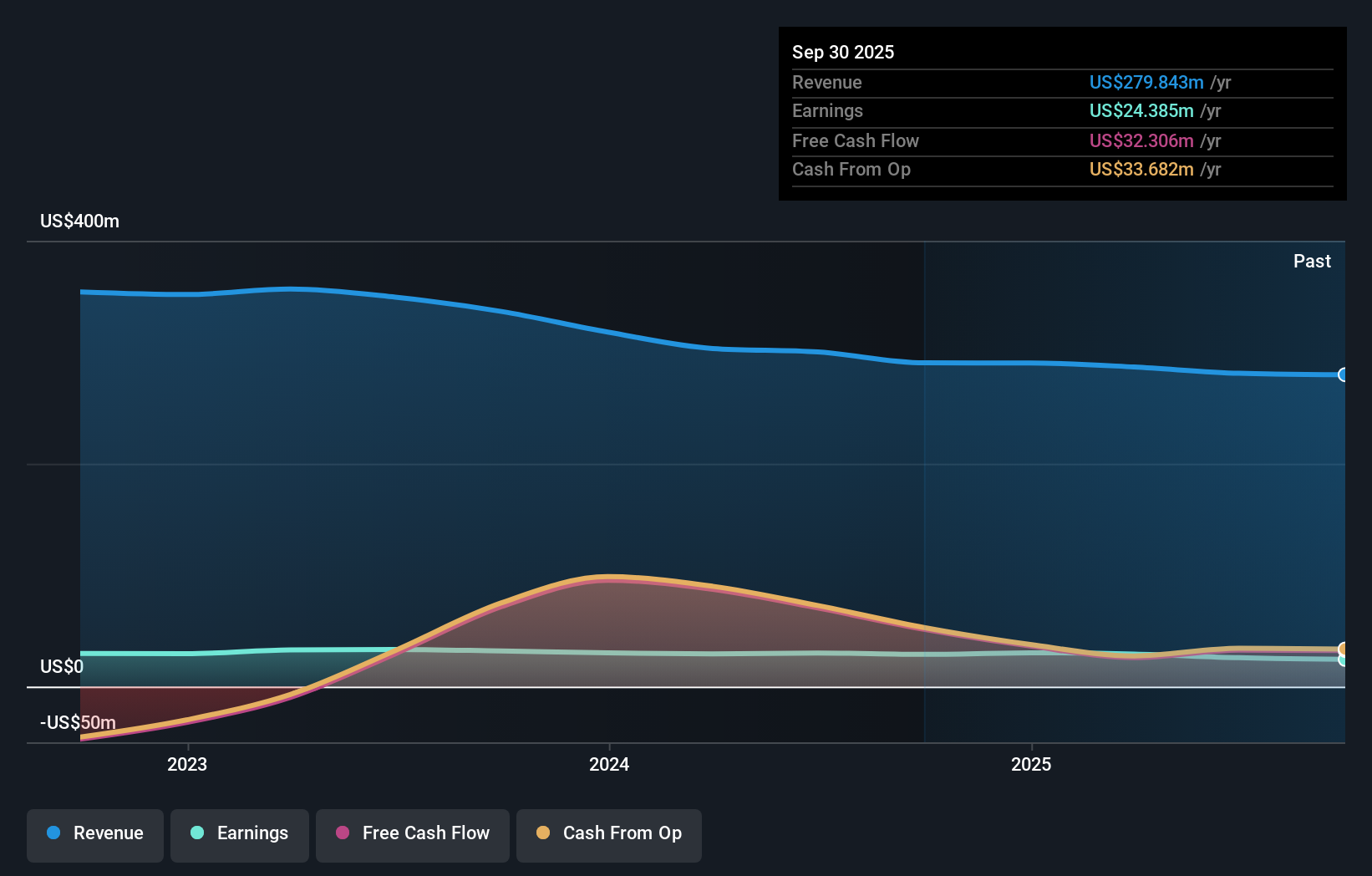

Operations: Weyco Group generates revenue primarily through its wholesale segment, accounting for $227.94 million, and retail operations contributing $38.70 million.

Weyco Group, a footwear company with no debt and a P/E ratio of 9.4x, stands out in its industry for its high-quality earnings. Over the past year, earnings grew by 0.4%, outperforming the Retail Distributors sector which saw a -21.2% change. Despite recent challenges like board changes following Robert Feitler's resignation and Nasdaq compliance issues, Weyco remains profitable with strong free cash flow of US$87 million as of March 2025. The company continues to reward shareholders with regular quarterly dividends, recently declaring US$0.26 per share payable at the end of March 2025.

- Get an in-depth perspective on Weyco Group's performance by reading our health report here.

Assess Weyco Group's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Delve into our full catalog of 289 US Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ChoiceOne Financial Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COFS

ChoiceOne Financial Services

Operates as the bank holding company for ChoiceOne Bank that provides banking services in Michigan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives