- United States

- /

- Banks

- /

- NasdaqGS:CNOB

A Look at ConnectOne Bancorp's (CNOB) Valuation Following Strong Dividend Growth and Upbeat 2025 Outlook

Reviewed by Kshitija Bhandaru

ConnectOne Bancorp (CNOB) is catching the eye of investors after recent reports highlighted its above-average dividend yield, steady track record of dividend hikes, and a significantly higher earnings growth projection for next year.

See our latest analysis for ConnectOne Bancorp.

ConnectOne Bancorp’s stock has shown steady momentum lately, closing at $26.28 and delivering a 1-year total shareholder return of 8.4%. After a series of upbeat reports and robust dividend growth figures, interest in the stock appears to be building as investors weigh its earnings outlook alongside recent price trends.

If you’re interested in expanding your search beyond the latest banking buzz, now’s a great moment to discover fast growing stocks with high insider ownership.

Despite recent gains and a robust dividend track record, the real question for investors is whether ConnectOne Bancorp’s future growth is still up for grabs or if the current share price has already factored in the upside.

Most Popular Narrative: 9.8% Undervalued

The narrative places ConnectOne Bancorp’s fair value estimate above the recent close, suggesting room for further price appreciation if projections are realised.

The recent merger with First of Long Island Bank has significantly expanded ConnectOne's geographic footprint and client base. This has increased its scale and enhanced market access, especially in high-growth Long Island, and positioned the company to capture additional revenue opportunities from lending and deposit growth in economically vibrant metro areas.

What’s fueling this target? Expect a bold narrative around eye-catching revenue expansion, margin transformation, and ambitious profit forecasts. The next move may surprise you. Tap in for the full calculation details, hidden drivers, and why the narrative expects a step-change in ConnectOne’s earnings power.

Result: Fair Value of $29.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as increased exposure to commercial real estate and geographic concentration could potentially weigh on loan growth and profitability if conditions shift.

Find out about the key risks to this ConnectOne Bancorp narrative.

Another View: Are Multiples Sending a Different Signal?

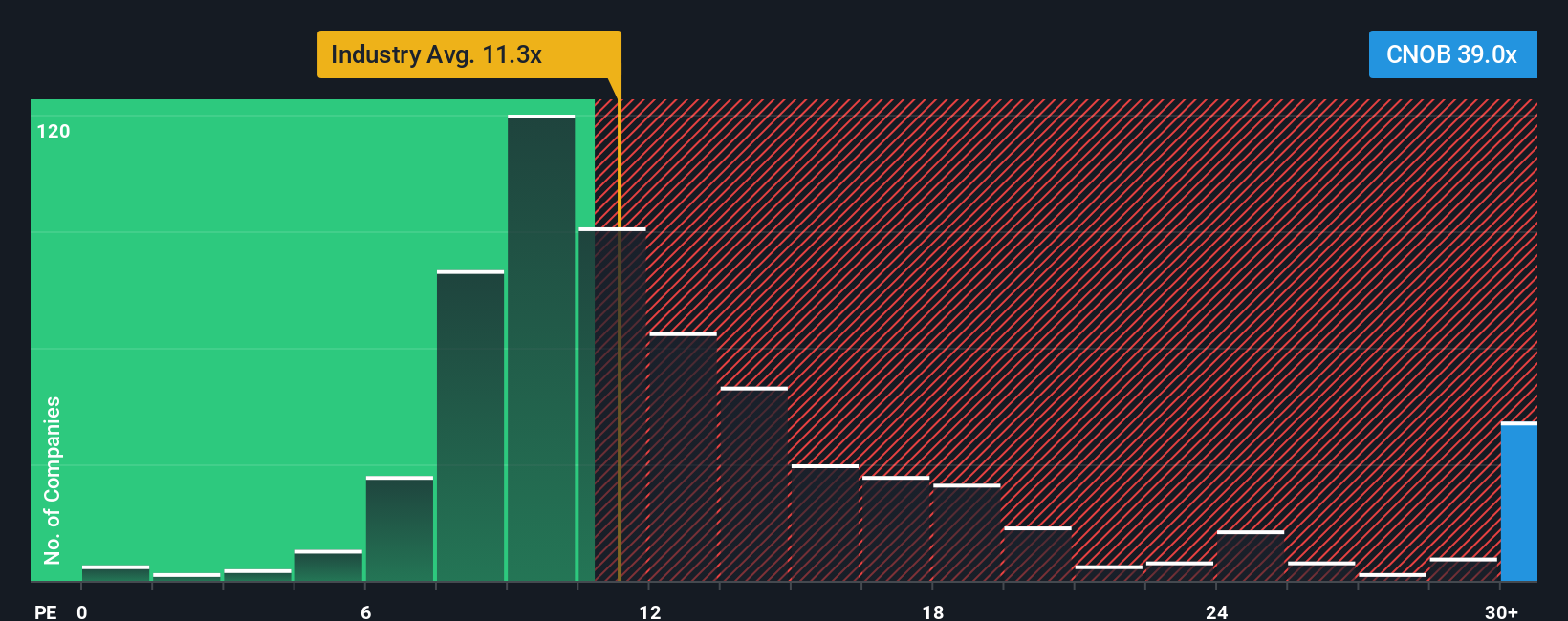

While analyst forecasts and fair value estimates suggest ConnectOne Bancorp is undervalued, comparing its price-to-earnings ratio of 42x to the US Banks industry average of 11.8x tells a very different story. This sharp gap could mean investors are pricing in high expectations, leaving little room for error. Will the stock’s lofty multiple hold or face a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ConnectOne Bancorp Narrative

If you see things differently or want to dig into the numbers yourself, it’s quick and easy to craft your own perspective in just minutes. Do it your way

A great starting point for your ConnectOne Bancorp research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Let Simply Wall Street’s platform open the door to stock picks you might not have even thought about yet. Every list is updated and ready for you, so don’t miss a chance to get ahead with ideas built for today’s market!

- Unlock potential for rapid growth by checking out these 3574 penny stocks with strong financials with strong financials and solid track records in emerging sectors.

- Stay ahead of innovation by reviewing these 25 AI penny stocks poised to capitalize on the expanding artificial intelligence landscape.

- Tap into reliable returns by reviewing these 19 dividend stocks with yields > 3% that offer attractive yields above 3% for income-focused portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNOB

ConnectOne Bancorp

Operates as the bank holding company for ConnectOne Bank that provides commercial banking products and services for small and mid-sized businesses, local professionals, and individuals in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives