- United States

- /

- Banks

- /

- NasdaqGS:CLBK

Here's Why We Think Columbia Financial (NASDAQ:CLBK) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Columbia Financial (NASDAQ:CLBK). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Columbia Financial

Columbia Financial's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Columbia Financial's EPS soared from US$0.42 to US$0.66, over the last year. That's a commendable gain of 56%.

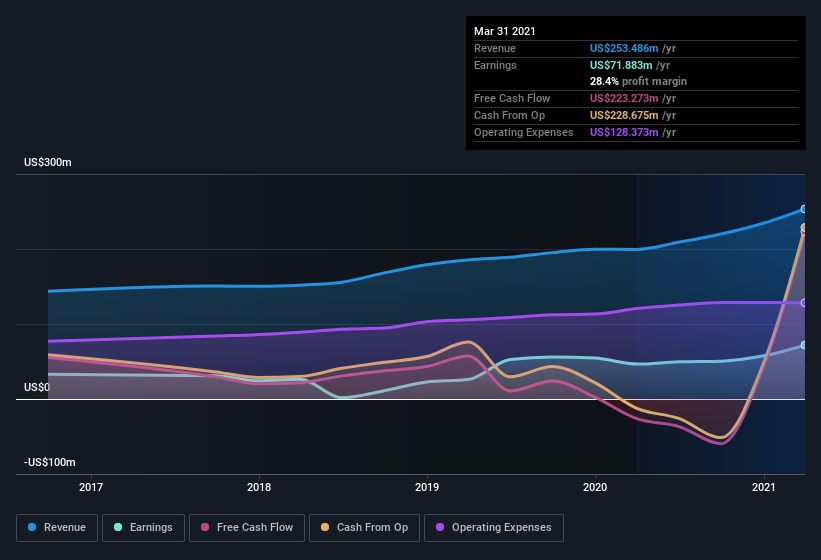

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Columbia Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Columbia Financial's EBIT margins were flat over the last year, revenue grew by a solid 27% to US$253m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Columbia Financial EPS 100% free.

Are Columbia Financial Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Columbia Financial insiders spent US$148k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Executive VP and Chief Information & Digital Officer, Damodaram Bashyam, who made the biggest single acquisition, paying US$60k for shares at about US$11.92 each.

On top of the insider buying, it's good to see that Columbia Financial insiders have a valuable investment in the business. Indeed, they hold US$32m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Columbia Financial Deserve A Spot On Your Watchlist?

For growth investors like me, Columbia Financial's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Columbia Financial that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Columbia Financial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Columbia Financial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CLBK

Columbia Financial

Operates as a bank holding company for Columbia Bank that provides banking and other financial services to businesses and consumers in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives