- United States

- /

- Banks

- /

- NasdaqGS:CLBK

Does Columbia Financial (NASDAQ:CLBK) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Columbia Financial (NASDAQ:CLBK), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Columbia Financial

How Fast Is Columbia Financial Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Columbia Financial's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 51%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

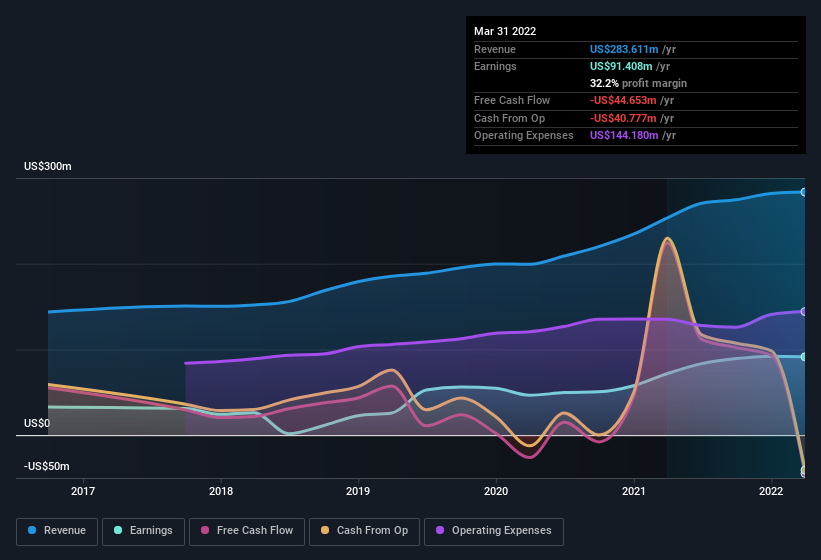

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Columbia Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Columbia Financial achieved similar EBIT margins to last year, revenue grew by a solid 12% to US$284m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Columbia Financial?

Are Columbia Financial Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Columbia Financial insiders refrain from selling stock during the year, but they also spent US$120k buying it. This is a good look for the company as it paints an optimistic picture for the future. We also note that it was the Executive VP & Head of Consumer Banking, Allyson Schlesinger, who made the biggest single acquisition, paying US$50k for shares at about US$21.36 each.

Along with the insider buying, another encouraging sign for Columbia Financial is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$40m. This considerable investment should help drive long-term value in the business. Despite being just 1.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Tom Kemly is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Columbia Financial, with market caps between US$2.0b and US$6.4b, is around US$6.9m.

The CEO of Columbia Financial only received US$2.1m in total compensation for the year ending December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Columbia Financial To Your Watchlist?

Columbia Financial's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Columbia Financial deserves timely attention. You still need to take note of risks, for example - Columbia Financial has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Columbia Financial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CLBK

Columbia Financial

Operates as a bank holding company for Columbia Bank that provides banking and other financial services to businesses and consumers in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives