- United States

- /

- Banks

- /

- NasdaqGS:CHCO

City Holding (CHCO): Evaluating Valuation Following 10% Dividend Increase and Renewed Investor Interest

Reviewed by Kshitija Bhandaru

City Holding (CHCO) just made a statement that is hard to ignore if you are weighing your options with the stock. The company boosted its quarterly dividend by 10%, up to 87 cents per share, for shareholders of record as of mid-October. This jump sends a clear message that management is confident in City Holding’s underlying strength and its ability to support bigger payouts, a signal that rarely goes unnoticed by the market.

Following news of the dividend hike, City Holding’s shares have reflected renewed investor interest, likely due to management’s show of financial resilience and ongoing commitment to shareholder returns. In the past year, the stock has climbed 11%, building positive momentum after a modest dip last month. Over the past three and five years, the stock’s upward trend has been even more pronounced, pointing to long-term confidence and compounding results.

Now the big question is whether City Holding can keep up this pace. Are you looking at an undervalued opportunity or has the recent dividend move already priced in what is ahead for the bank?

Price-to-Earnings of 15.1x: Is it justified?

City Holding is currently valued at a price-to-earnings ratio of 15.1x, which puts it above both its estimated fair price-to-earnings ratio of 10.5x and the US Banks industry average of 11.8x. This suggests the stock may be trading at a premium relative to similar companies and the broader sector.

The price-to-earnings (P/E) ratio is a key measure for banks, reflecting how much investors are willing to pay for each dollar of the company’s earnings. Investors often use it to compare a stock’s valuation to peers and to assess whether future earnings growth or stability might warrant a higher price.

Currently, City Holding’s elevated P/E ratio could imply confidence in its consistent earnings quality or management’s track record. However, it also signals the market may be expecting more than the company has delivered recently, possibly betting on continued financial strength or improvements that justify a premium over peers.

Result: Fair Value of $126.53 (OVERVALUED)

See our latest analysis for City Holding.However, slowing net income growth and a modest dip in the last month could challenge the positive outlook and signal caution for prospective investors.

Find out about the key risks to this City Holding narrative.Another View: Discounted Cash Flow Tells a Different Story

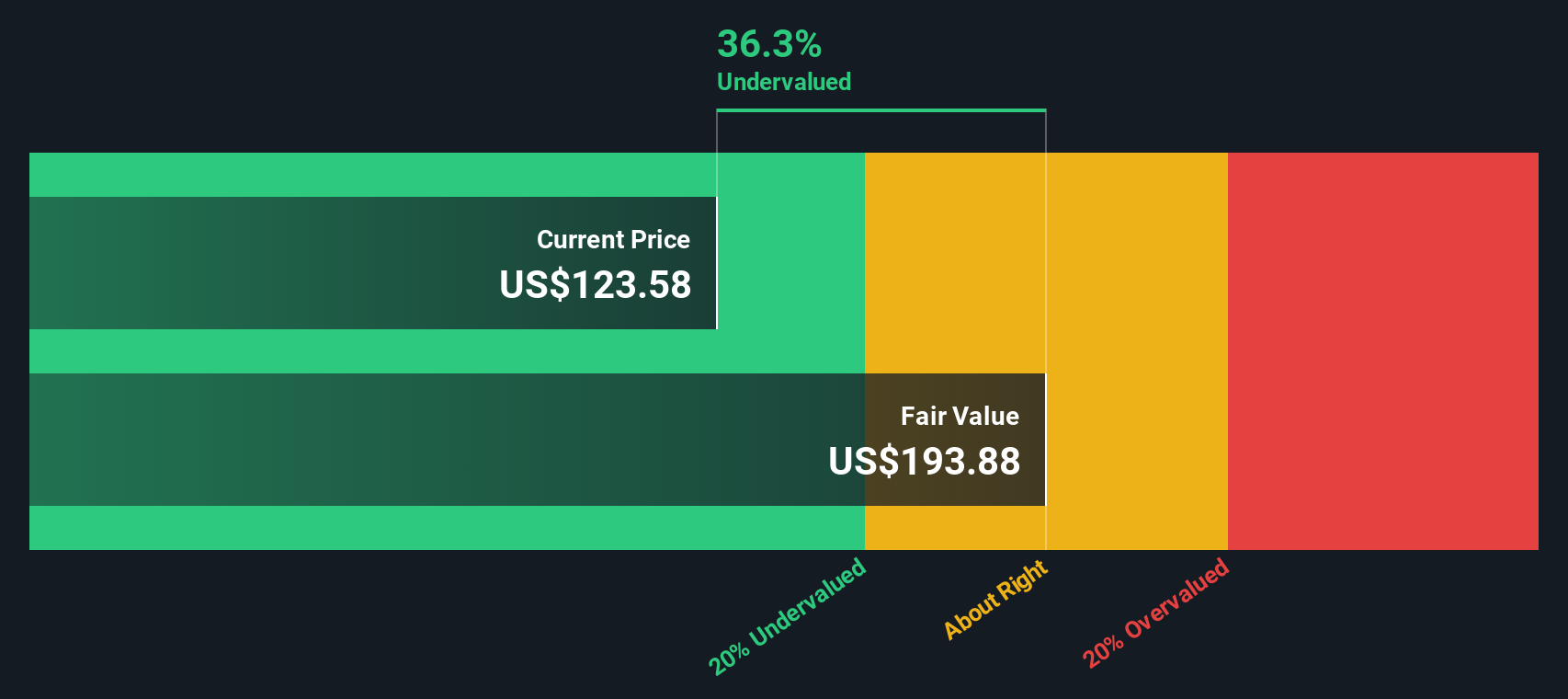

While traditional valuation metrics suggest City Holding could be expensive compared to its industry, our SWS DCF model offers a contrasting perspective and indicates the stock may actually be undervalued by the market. Which method will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own City Holding Narrative

If you see things differently or want to dig deeper into City Holding’s data, you can easily shape your own narrative using our tools in just a few minutes. Do it your way

A great starting point for your City Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investors know that the right opportunities are always just a step away. With Simply Wall Street’s free Screener, you can easily spot exciting stocks that fit your strategy and get ahead of the market before the crowd.

- Elevate your income strategy with companies offering robust yields by checking out our dividend stocks with yields > 3% for the latest in high-return stocks.

- Position yourself at the forefront of tomorrow’s world by targeting firms innovating in healthcare through our healthcare AI stocks, which blends medical breakthroughs with artificial intelligence.

- Capture hidden value before others do by seizing special opportunities that our undervalued stocks based on cash flows uncovers in the current market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHCO

City Holding

Operates as a financial holding company for City National Bank of West Virginia that provides banking, trust and investment management, and other financial solutions in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives