- United States

- /

- Banks

- /

- NasdaqCM:CFBK

Can You Imagine How Jubilant CF Bankshares' (NASDAQ:CFBK) Shareholders Feel About Its 136% Share Price Gain?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of CF Bankshares Inc. (NASDAQ:CFBK) stock is up an impressive 136% over the last five years. Also pleasing for shareholders was the 25% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 15% in 90 days).

Check out our latest analysis for CF Bankshares

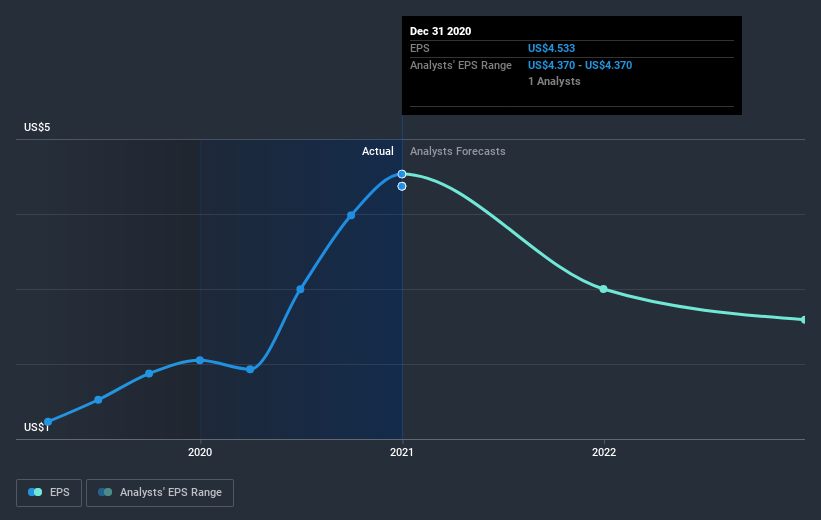

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, CF Bankshares achieved compound earnings per share (EPS) growth of 29% per year. This EPS growth is higher than the 19% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 3.87 also suggests market apprehension.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that CF Bankshares has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on CF Bankshares' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

CF Bankshares provided a TSR of 20% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 19% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for CF Bankshares (1 is concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade CF Bankshares, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CFBK

CF Bankshares

Operates as the bank holding company for CFBank, National Association that provides various banking products and services.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives