- United States

- /

- Banks

- /

- NasdaqGS:CCB

Coastal Financial (CCB): Assessing Valuation After Sector-Wide Jitters on Weak Consumer Confidence and Fed Outlook

Reviewed by Kshitija Bhandaru

Coastal Financial (CCB) shares took a hit after a slide in the Consumer Confidence Index and fresh commentary from the Federal Reserve, which fueled investor concerns about economic headwinds facing the banking sector.

See our latest analysis for Coastal Financial.

It has been a bumpy ride for Coastal Financial in the face of sector-wide jitters, with its share price seeing only cautious moves in recent weeks despite a handful of executive transitions at the top. Over the past year, the company’s total shareholder return has been mildly positive, signaling steady long-term momentum even as short-term sentiment has cooled.

If recent volatility in the banking sector has you curious about what else is moving, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Coastal Financial’s shares trading at a discount to analyst targets and ongoing sector volatility, the key question for investors remains: Is the market offering a genuine buying opportunity, or is it already factoring in all future growth?

Price-to-Earnings of 34.7x: Is it justified?

With a price-to-earnings ratio (P/E) of 34.7x, Coastal Financial is trading at a premium compared to its peers, despite its last close of $109.32. This elevated multiple raises questions about whether the market is too optimistic or rightly rewarding the company’s growth prospects.

The P/E ratio is a measure of how much investors are willing to pay for one dollar of earnings. For banks, it offers insight into market confidence in the company’s future earnings power. A higher ratio can signal expectations of faster growth, but it might also mean the stock is overvalued compared to industry norms.

Coastal Financial’s P/E is much higher than both the peer average of 12.8x and the US Banks industry standard of 11.8x. It also stands significantly above the estimated fair P/E of 20.6x, highlighting investor willingness to pay up for perceived future potential. If the market reassesses its growth outlook, this multiple could shift closer to the fair ratio benchmark.

Explore the SWS fair ratio for Coastal Financial

Result: Price-to-Earnings of 34.7x (OVERVALUED)

However, market sentiment could quickly reverse if revenue growth slows or if broader economic conditions worsen, impacting both valuation and future returns.

Find out about the key risks to this Coastal Financial narrative.

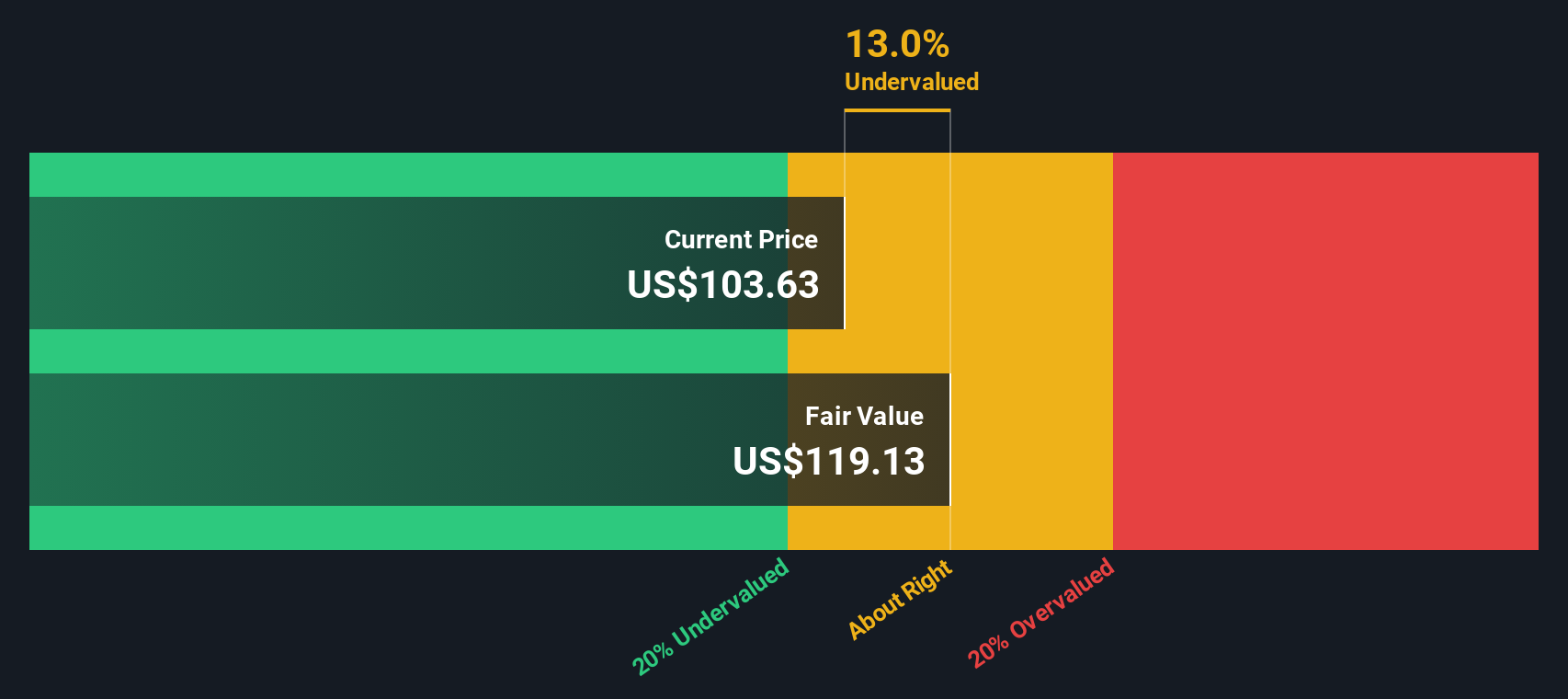

Another View: Discounted Cash Flow Shows Upside

While the price-to-earnings ratio paints Coastal Financial as overvalued compared to peers, our DCF model offers a different perspective. Based on a cash flow forecast, shares are trading roughly 13% below our estimate of fair value. This suggests the market might be underestimating the company’s potential. Could this discount signal a hidden opportunity, or is it a case of cautious optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coastal Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coastal Financial Narrative

If you see things differently or want to draw your own conclusions from the data, you can easily craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Coastal Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Make sure you’re not leaving potential gains on the table. The right picks are often just a click away. See what you could be missing today.

- Boost your portfolio with consistent payouts by checking out these 19 dividend stocks with yields > 3% that offer reliable yields above 3%.

- Spot untapped potential in the technology sector by browsing these 24 AI penny stocks where AI innovation meets market momentum.

- Capitalize on market mispricings and secure value buys through these 896 undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives