- United States

- /

- Banks

- /

- NasdaqGM:CBFV

Dividend Investors: Don't Be Too Quick To Buy CB Financial Services, Inc. (NASDAQ:CBFV) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see CB Financial Services, Inc. (NASDAQ:CBFV) is about to trade ex-dividend in the next 4 days. If you purchase the stock on or after the 3rd of December, you won't be eligible to receive this dividend, when it is paid on the 15th of December.

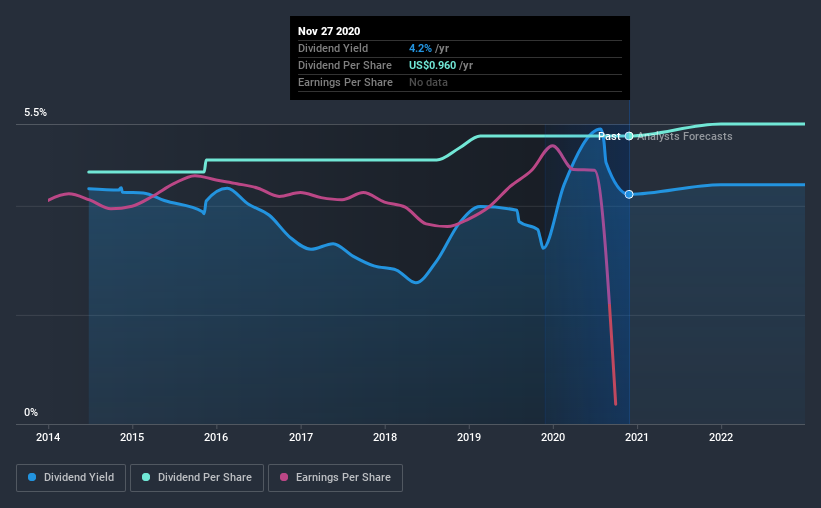

CB Financial Services's next dividend payment will be US$0.24 per share, on the back of last year when the company paid a total of US$0.96 to shareholders. Based on the last year's worth of payments, CB Financial Services stock has a trailing yield of around 4.2% on the current share price of $22.8. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether CB Financial Services can afford its dividend, and if the dividend could grow.

See our latest analysis for CB Financial Services

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. CB Financial Services lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. CB Financial Services was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last six years, CB Financial Services has lifted its dividend by approximately 2.3% a year on average.

Get our latest analysis on CB Financial Services's balance sheet health here.

Final Takeaway

From a dividend perspective, should investors buy or avoid CB Financial Services? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Worse, the general trend in its earnings looks negative in recent years. All things considered, we're not optimistic about its dividend prospects, and would be inclined to leave it on the shelf for now.

With that in mind though, if the poor dividend characteristics of CB Financial Services don't faze you, it's worth being mindful of the risks involved with this business. Our analysis shows 1 warning sign for CB Financial Services and you should be aware of this before buying any shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade CB Financial Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade CB Financial Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:CBFV

CB Financial Services

Operates as the bank holding company for Community Bank that provides various banking products and services for individuals and businesses in southwestern Pennsylvania and West Virginia.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives