- United States

- /

- Banks

- /

- NasdaqGS:CBC

NASDAQ Composite Inclusion and ESOP Share Offering Could Be A Game Changer For Central Bancompany (CBC)

Reviewed by Sasha Jovanovic

- In November 2025, Central Bancompany, Inc. filed a US$57.43 million shelf registration for 2,500,000 shares of Class A common stock tied to an ESOP offering.

- Around the same time, Central Bancompany was added to the NASDAQ Composite Index, a change that can broaden its visibility with index-tracking investors.

- Against this backdrop, we’ll examine how Central Bancompany’s NASDAQ Composite inclusion shapes its investment narrative and potential investor base.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Central Bancompany's Investment Narrative?

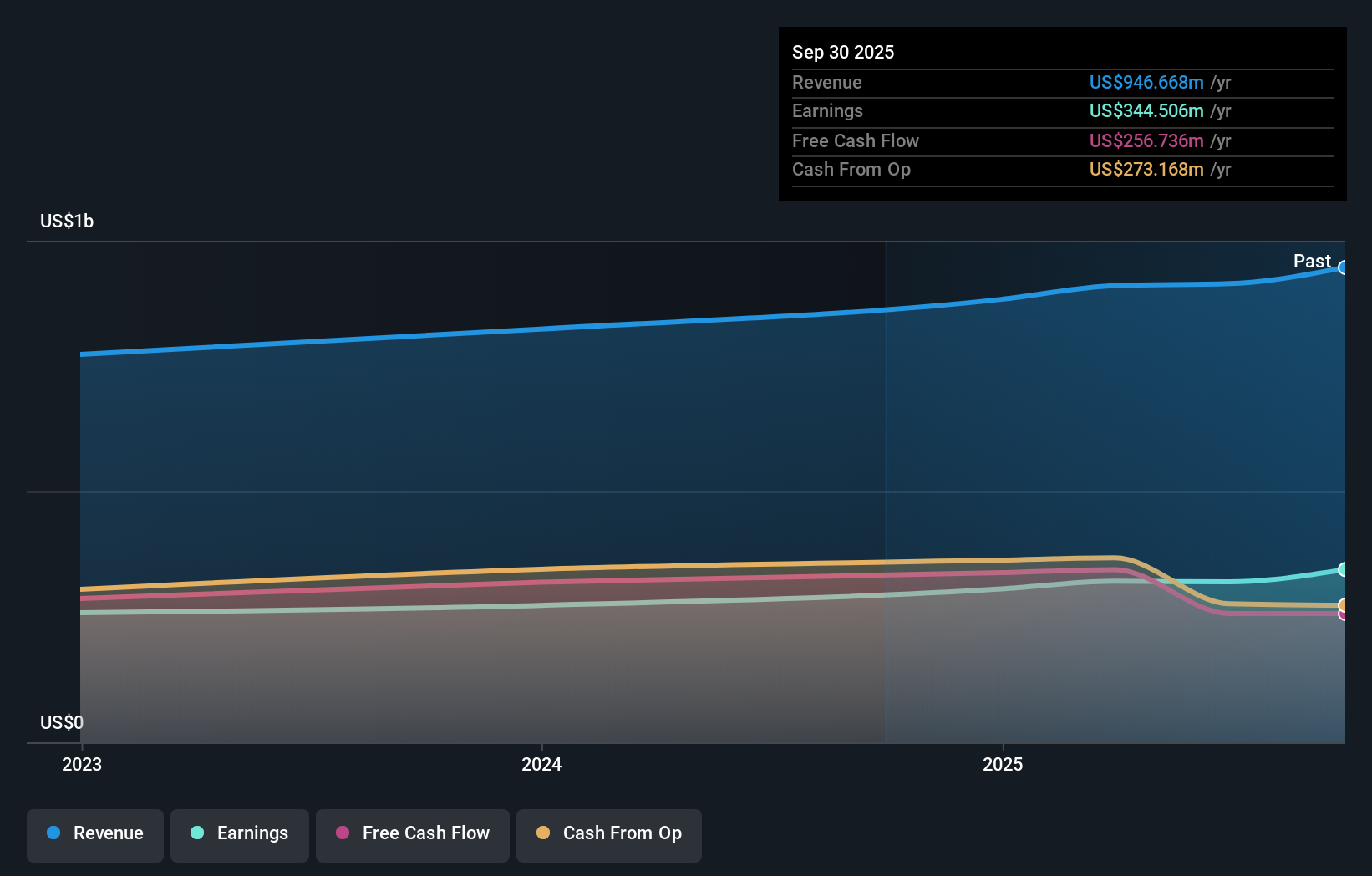

To own Central Bancompany, you need to be comfortable backing a regional bank that has paired consistent profit growth and high quality earnings with an active capital return profile, including sizable regular and special dividends. The recent IPO and strong share price gains leave the stock trading on a richer multiple than many U.S. bank peers, so short term sentiment is likely to be driven less by index inclusion and more by how management balances growth, credit quality and shareholder payouts. The new US$57.43 million ESOP shelf and NASDAQ Composite inclusion mainly strengthen liquidity and broaden the shareholder base, rather than altering the core earnings story, but they do add some dilution and governance trade offs for investors to weigh.

However, investors should be aware of how insider lock up expiries might affect trading conditions. Central Bancompany's shares have been on the rise but are still potentially undervalued by 8%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Central Bancompany - why the stock might be a potential multi-bagger!

Build Your Own Central Bancompany Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Central Bancompany research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Central Bancompany research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Central Bancompany's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBC

Central Bancompany

Operates as the bank holding company for The Central Trust Bank that provides consumer, commercial and wealth management products and services.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026