- United States

- /

- Banks

- /

- NasdaqGS:CATY

How Investors Are Reacting To Cathay General Bancorp (CATY) Balancing Higher Earnings With Rising Credit Losses

Reviewed by Sasha Jovanovic

- Cathay General Bancorp recently reported its third quarter 2025 results, with net interest income rising to US$189.59 million and net income reaching US$77.65 million, while also disclosing much higher net charge-offs compared to the prior year.

- Alongside improved earnings and ongoing share buybacks, the significant rise in provisions for credit losses highlights evolving risk factors despite robust core financial performance.

- We’ll now explore how the balance between stronger revenue and rising credit loss provisions affects Cathay General Bancorp’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Cathay General Bancorp Investment Narrative Recap

To be a shareholder in Cathay General Bancorp, you need to believe that the company’s strong position in core Asian-American markets and its disciplined lending can underpin steady earnings and solid shareholder returns, even as credit quality pressures emerge. The latest results highlight robust revenue growth and consistent profitability, but the sharp increase in net charge-offs signals that asset quality concerns, particularly in commercial real estate, remain the most significant near-term risk. For now, the most important short-term catalyst, continued loan and deposit growth in core regions, does not appear materially threatened by these rising charge-offs, but ongoing asset quality issues could change that outlook quickly.

The latest share buyback update, with 1,070,000 shares repurchased for US$50.1 million in the quarter, stands out as particularly relevant. This commitment to returning capital to shareholders is encouraging, but is set against the backdrop of elevated provisions for credit losses, which may introduce uncertainty regarding future capital allocation decisions if loan quality pressures persist.

However, investors should also be aware that rising net charge-offs and higher provisioning signal that asset quality trends may shift more than expected...

Read the full narrative on Cathay General Bancorp (it's free!)

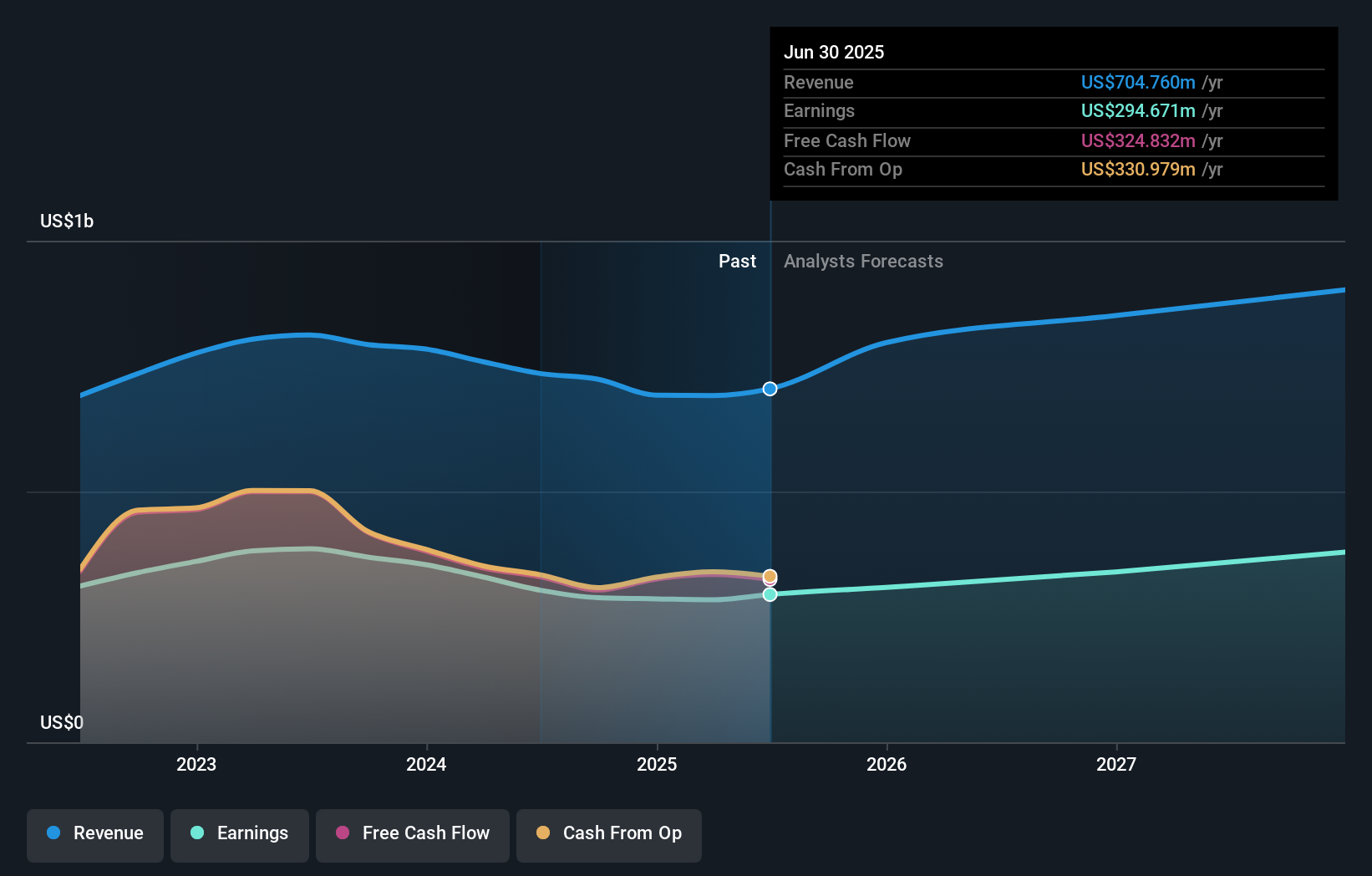

Cathay General Bancorp's outlook anticipates $964.1 million in revenue and $393.8 million in earnings by 2028. This projection is based on an annual revenue growth rate of 11.0% and a $99.1 million increase in earnings from the current $294.7 million.

Uncover how Cathay General Bancorp's forecasts yield a $52.40 fair value, a 12% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for Cathay General Bancorp are tightly clustered at US$52.40, based on a single contributor so far. While market participants can interpret these signals differently, the spike in net charge-offs reported this quarter could shape how shareholders view the bank’s risk profile and future performance. Explore more community views to see how others are assessing potential opportunities and risks.

Explore another fair value estimate on Cathay General Bancorp - why the stock might be worth just $52.40!

Build Your Own Cathay General Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cathay General Bancorp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Cathay General Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cathay General Bancorp's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CATY

Cathay General Bancorp

Operates as the holding company for Cathay Bank that offers various commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives