- United States

- /

- Banks

- /

- NasdaqGS:CATY

Cathay General Bancorp (CATY) Profit Margin Tops Expectations, Reinforcing Positive Valuation Narratives

Reviewed by Simply Wall St

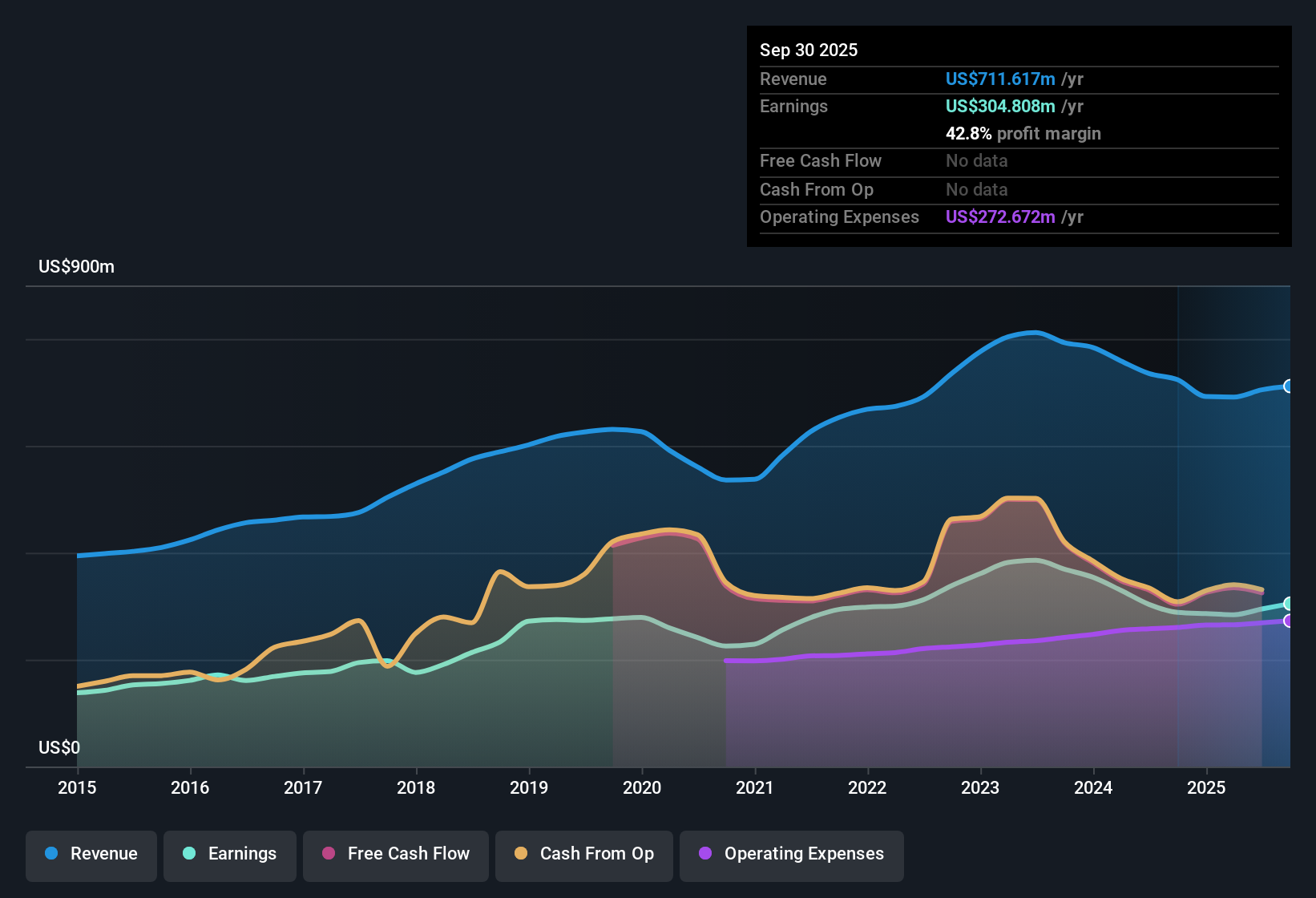

Cathay General Bancorp (CATY) posted a net profit margin of 42.8%, topping last year's 39.8%, with EPS climbing 5.7% over the past year and outpacing its five-year growth average. Looking ahead, the bank is expected to maintain earnings growth of 6.8% per year and revenue growth of 9.1% per year. However, both are projected to trail broader US market rates. Strong margins and a price-to-earnings ratio below industry peers highlight CATY's operational strength and investor value story this earnings season.

See our full analysis for Cathay General Bancorp.Next, we will see how these numbers measure up against the market's most closely watched narratives. Some assumptions may get confirmed, while others could be reconsidered.

See what the community is saying about Cathay General Bancorp

Loan Growth in Key Urban Markets

- Analysts are forecasting revenue to grow by 11.0% per year over the next three years, significantly driven by sustained demand for new commercial and real estate lending in Cathay General's core Asian-American markets across California and New York.

- According to the analysts' consensus view, steady economic expansion in these highly concentrated regions is seen as fueling new loan generation and supporting reliable top-line growth.

- Revenue guidance upward revision reflects both the resilience of urban business formation and ongoing loan demand in targeted demographic segments.

- Analysts expect this growth to provide a consistent pipeline for both commercial and CRE loans, offsetting some sector headwinds and helping support future net interest income.

- To see how the balance of risks and long-term catalysts shapes the investment outlook, read the full consensus narrative for Cathay General Bancorp. 📊 Read the full Cathay General Bancorp Consensus Narrative.

Disciplined Capital Allocation Boosting Returns

- Over the next three years, the number of shares outstanding is expected to decline by roughly 2.96% each year, thanks to active share repurchase programs. This positions Cathay General to drive higher earnings per share and total shareholder returns.

- The consensus narrative highlights how prudent capital return strategies, paired with ongoing dividends and margin improvements from enhanced digital capability, help strengthen the bank’s value proposition.

- Noninterest income growth, such as from higher foreign exchange and derivative fees, is starting to play a larger role as efficiency investments unlock new sources of profitability.

- Consistent buybacks can amplify EPS growth, provided that core operating performance and asset quality remain stable.

Valuation Still Deeply Discounted to DCF Fair Value

- Cathay General trades at $46.17, less than half its estimated DCF fair value of $109.10, and at a price-to-earnings multiple of 10.3x. This is below both the US Banks industry average (11.2x) and peers (11.7x).

- Analysts' consensus view is that even with a modest price target of $51.60 (just 4.5% above the current price), the stock remains undervalued compared to fundamentals, especially if projected revenue and earnings growth materialize as forecast.

- This wide discount to fair value, combined with ongoing buybacks and continuous profitability, has the potential to draw value-focused investors and support a positive re-rating.

- However, consensus stops short of pricing in aggressive upside, reflecting measured expectations amid sector risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cathay General Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the figures another way? Share your perspective and craft your unique narrative in just a few minutes with us. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Cathay General Bancorp.

See What Else Is Out There

While Cathay General Bancorp’s outlook is solid, its projected earnings and revenue growth are expected to lag behind broader US market rates over the next few years.

If you want stocks that consistently deliver reliable growth despite market swings, use our stable growth stocks screener ( results) to surface companies with proven records of steady expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CATY

Cathay General Bancorp

Operates as the holding company for Cathay Bank that offers various commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives