- United States

- /

- Banks

- /

- NasdaqCM:BYFC

Broadway Financial (NASDAQ:BYFC) shareholders are up 12% this past week, but still in the red over the last three years

While it may not be enough for some shareholders, we think it is good to see the Broadway Financial Corporation (NASDAQ:BYFC) share price up 28% in a single quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. To wit, the share price sky-dived 76% in that time. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Broadway Financial

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Broadway Financial became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 16% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Broadway Financial further; while we may be missing something on this analysis, there might also be an opportunity.

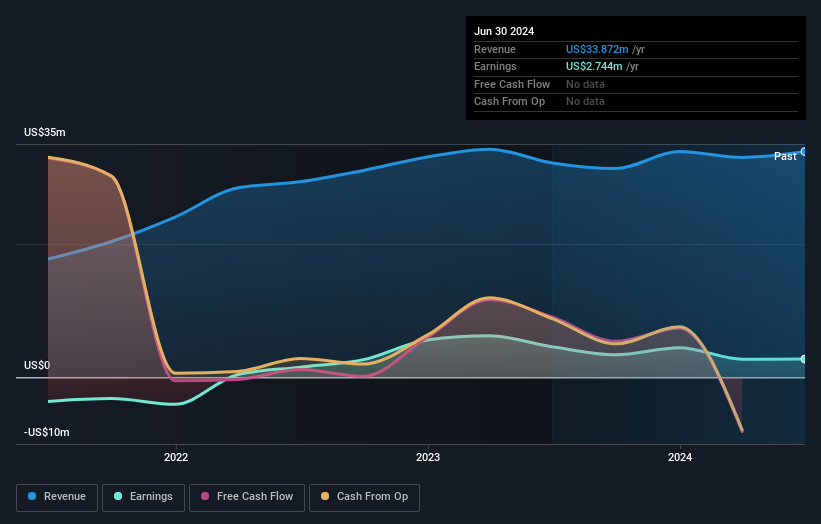

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Broadway Financial stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 27% in the last year, Broadway Financial shareholders lost 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Broadway Financial , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Broadway Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BYFC

Broadway Financial

Operates as the holding company for City First Bank, National Association that provides various banking products and services in the United States.

Excellent balance sheet with questionable track record.