- United States

- /

- Trade Distributors

- /

- NYSE:ZKH

US Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As major indices like the Dow Jones and S&P 500 hover near record highs, investors are keenly observing the impact of strong earnings reports and subsiding tariff concerns on market performance. In this environment, growth companies with high insider ownership can be particularly appealing as they may align management's interests with shareholders, potentially fostering long-term value creation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 33.8% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| Myomo (NYSEAM:MYO) | 12.7% | 56.7% |

| Duos Technologies Group (NasdaqCM:DUOT) | 39.4% | 90.4% |

Let's uncover some gems from our specialized screener.

Bridgewater Bancshares (NasdaqCM:BWB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bridgewater Bancshares, Inc. is a bank holding company for Bridgewater Bank, offering banking products and services to commercial real estate investors, entrepreneurs, business clients, and individuals in the United States with a market cap of $392.62 million.

Operations: The company's revenue is primarily derived from its banking segment, totaling $106.04 million.

Insider Ownership: 20.5%

Revenue Growth Forecast: 14.9% p.a.

Bridgewater Bancshares is poised for significant earnings growth, expected at 20.1% annually over the next three years, outpacing the US market. Despite slower revenue growth at 14.9%, it remains above market average projections. Recent insider activity shows more buying than selling, although no substantial purchases occurred in the last quarter. The company trades significantly below its estimated fair value and recently filed a $150 million shelf registration, indicating potential capital-raising activities ahead.

- Click here to discover the nuances of Bridgewater Bancshares with our detailed analytical future growth report.

- Our expertly prepared valuation report Bridgewater Bancshares implies its share price may be lower than expected.

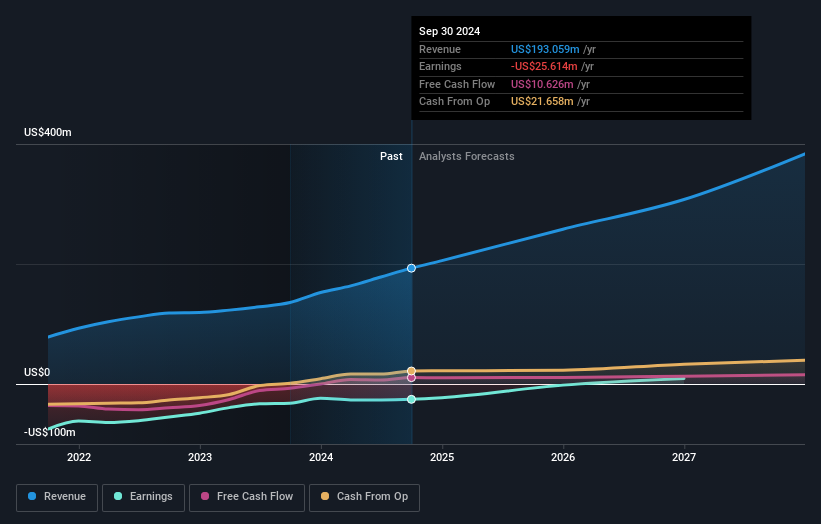

LifeMD (NasdaqGM:LFMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LifeMD, Inc. is a direct-to-patient telehealth company that facilitates connections between consumers and healthcare professionals for medical care in the United States, with a market cap of $273.73 million.

Operations: The company generates revenue from its telehealth services, amounting to $139.81 million, and Worksimpli segment, contributing $53.25 million.

Insider Ownership: 13.9%

Revenue Growth Forecast: 19.3% p.a.

LifeMD's growth trajectory is bolstered by its expanding telehealth platform, including a newly launched pharmacy expected to save US$5 million annually. Despite recent insider selling, the company shows significant earnings potential with profitability forecasted within three years and revenue growth of 19.3% annually, outpacing the US market average. Trading at 34.5% below estimated fair value suggests attractive valuation, although share price volatility remains high. Recent shelf registrations indicate ongoing capital-raising initiatives totaling over US$12 million.

- Navigate through the intricacies of LifeMD with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that LifeMD is trading behind its estimated value.

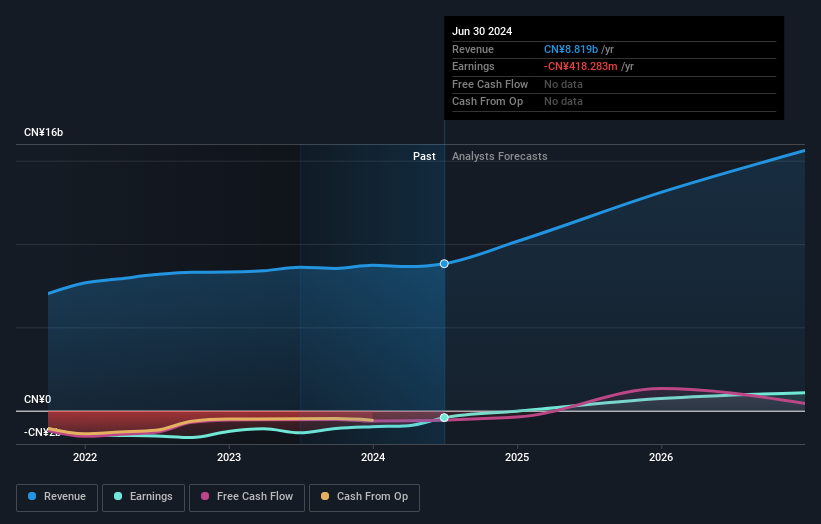

ZKH Group (NYSE:ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for maintenance, repair, and operating (MRO) products in China, with a market cap of approximately $578.36 million.

Operations: The company's revenue is primarily derived from its Business-To-Business Trading and Services of Industrial Products segment, generating CN¥8.84 billion.

Insider Ownership: 17.7%

Revenue Growth Forecast: 10.2% p.a.

ZKH Group's growth prospects are supported by a strategic partnership with Zhejiang Tmall Technology, enhancing its industrial product platform. Revenue is forecast to grow at 10.2% annually, outpacing the US market average. Despite recent losses, earnings are expected to increase significantly by over 120% per year and profitability is anticipated within three years. Trading at a substantial discount to fair value and analyst consensus suggests potential price appreciation of nearly 22%.

- Unlock comprehensive insights into our analysis of ZKH Group stock in this growth report.

- Our valuation report here indicates ZKH Group may be undervalued.

Key Takeaways

- Reveal the 205 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade ZKH Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZKH Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZKH

ZKH Group

Develops and operates a maintenance, repair, and operating (MRO) products trading and service platform that offers spare parts, chemicals, manufacturing parts, general consumables, and office supplies in the People’s Republic of China.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives