- United States

- /

- Banks

- /

- NasdaqGS:BUSE

Don't Ignore The Fact That This Insider Just Sold Some Shares In First Busey Corporation (NASDAQ:BUSE)

We'd be surprised if First Busey Corporation (NASDAQ:BUSE) shareholders haven't noticed that the Independent Director, Michael Cassens, recently sold US$273k worth of stock at US$25.76 per share. On the bright side, that sale was only 5.8% of their holding, so we doubt it's very meaningful, on its own.

View our latest analysis for First Busey

The Last 12 Months Of Insider Transactions At First Busey

Over the last year, we can see that the biggest insider purchase was by Independent Director Stephen King for US$499k worth of shares, at about US$18.44 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of US$25.28. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

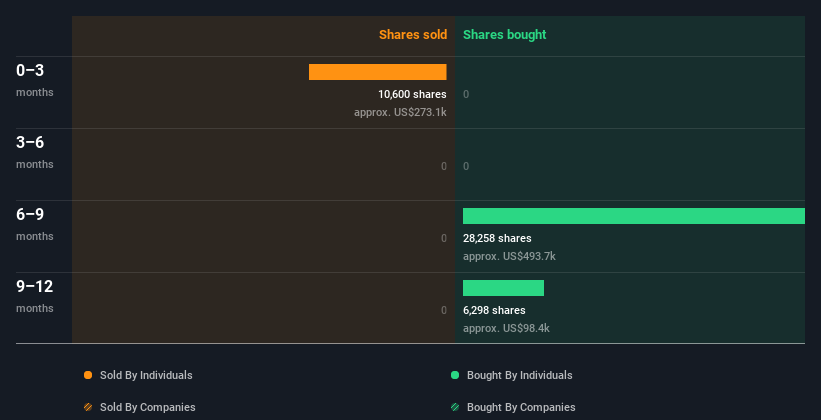

Happily, we note that in the last year insiders paid US$554k for 30.36k shares. But insiders sold 10.60k shares worth US$273k. In total, First Busey insiders bought more than they sold over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

First Busey is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does First Busey Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. First Busey insiders own about US$119m worth of shares (which is 8.7% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About First Busey Insiders?

An insider sold First Busey shares recently, but they didn't buy any. But we take heart from prior transactions. We are also comforted by the high levels of insider ownership. So we're not too bothered by recent selling. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 1 warning sign for First Busey you should know about.

But note: First Busey may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading First Busey or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BUSE

First Busey

Operates as the bank holding company for Busey Bank that engages in the provision of retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026