- United States

- /

- Insurance

- /

- NasdaqCM:ACIC

Undiscovered Gems in the US to Watch This January 2025

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet it boasts a remarkable 23% increase over the past year with earnings expected to grow by 15% annually. In this dynamic environment, identifying stocks that are undervalued or overlooked can provide unique opportunities for investors seeking to capitalize on promising growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

American Coastal Insurance (NasdaqCM:ACIC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Coastal Insurance Corporation, with a market cap of $595.81 million, operates through its subsidiaries in the commercial and personal property and casualty insurance sectors within the United States.

Operations: ACIC generates revenue primarily from underwriting commercial and personal property and casualty insurance policies in the U.S. The company's cost structure includes claims expenses, policy acquisition costs, and administrative expenses. The net profit margin has shown variability over recent periods, reflecting changes in underwriting performance and expense management.

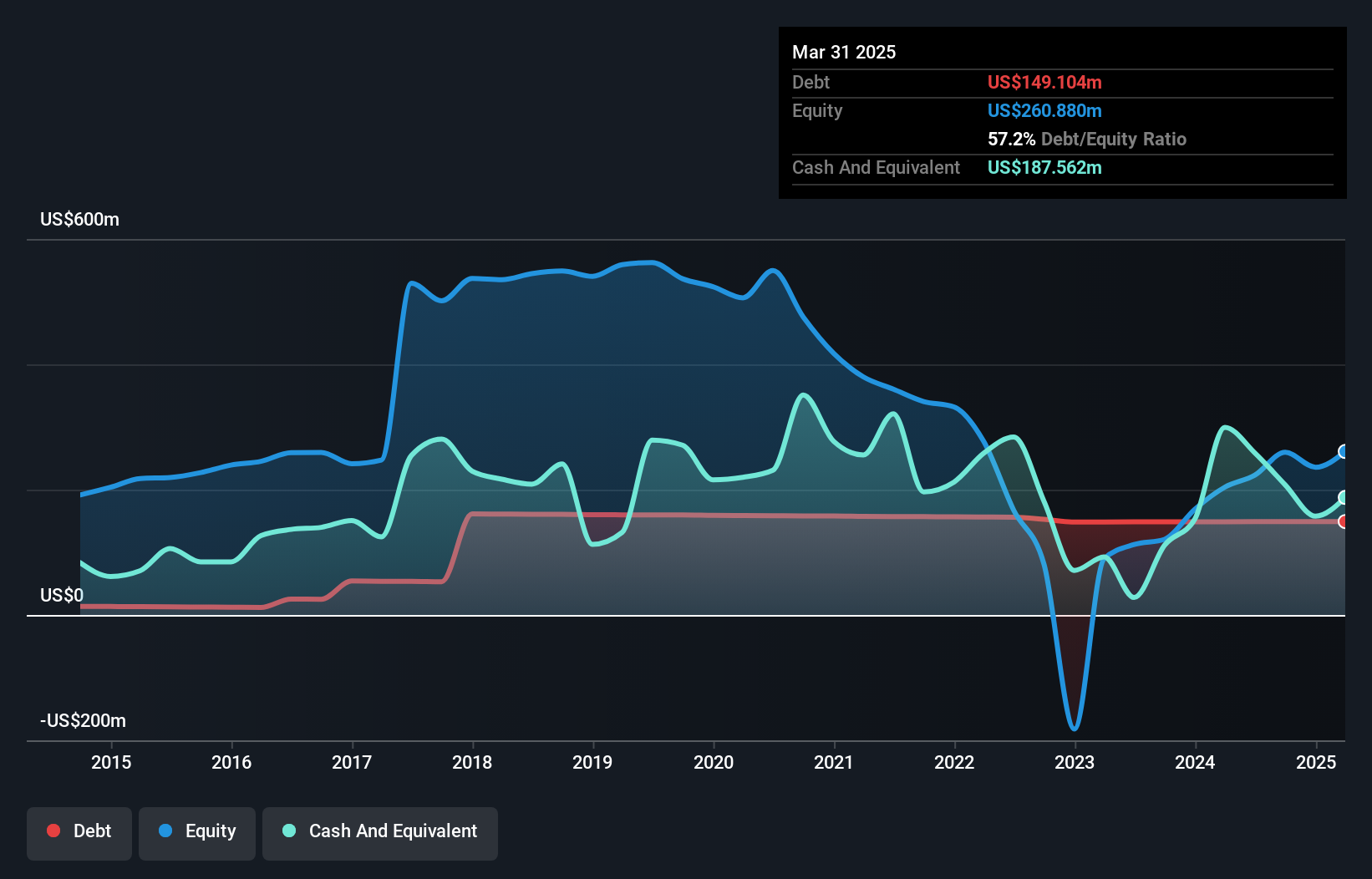

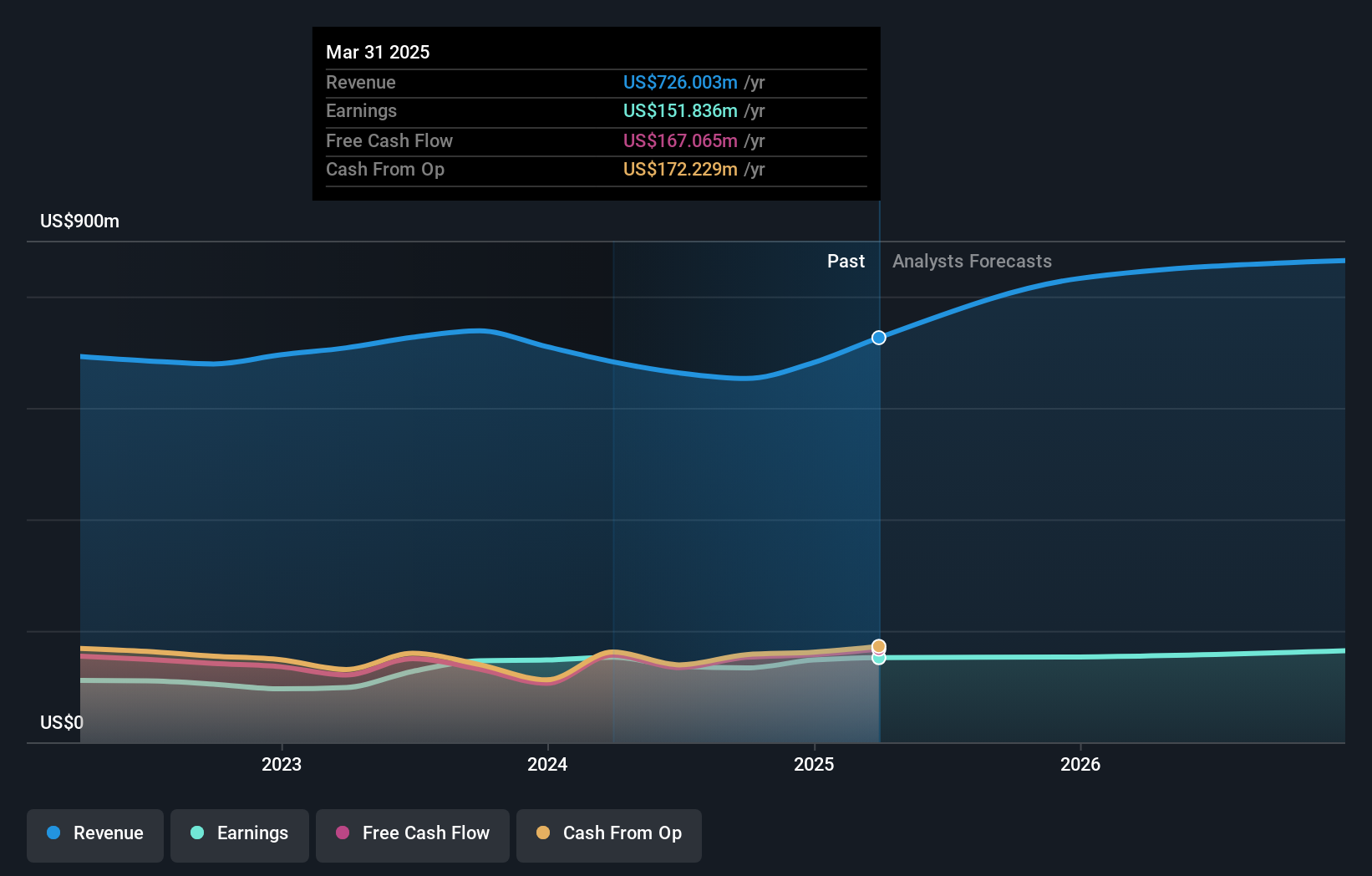

American Coastal Insurance, a small player in the insurance sector, has shown strong financial performance with revenue increasing to US$82.14 million in the recent quarter from US$52.53 million last year. Net income also rose to US$28.12 million from US$10.57 million, reflecting its strategic shift to reduce quota share and retain more underwriting profit amidst favorable reinsurance pricing. Despite challenges like declining profit margins projected at 21.7% due to rising operating expenses, the company remains resilient with a robust capital position and liquidity exceeding total debt, supporting stability against market fluctuations and hurricane risks.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Value Rating: ★★★★★★

Overview: Burke & Herbert Financial Services Corp. is a bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $933.99 million.

Operations: Burke & Herbert generates revenue primarily through its community banking segment, which reported $237.73 million in revenue. The company's financial performance is influenced by its ability to manage costs effectively, impacting its overall profitability.

Burke & Herbert Financial Services, with assets totaling US$7.8 billion and equity of US$730.2 million, presents a robust profile in the banking sector. Its total deposits stand at US$6.5 billion against loans of US$5.6 billion, indicating solid financial health supported by primarily low-risk funding sources—92% from customer deposits. The company boasts a sufficient allowance for bad loans at 0.6% of total loans and demonstrates high-quality earnings with recent growth outperforming the industry by 54%. Despite shareholder dilution last year, it trades significantly below its estimated fair value, suggesting potential upside for investors familiar with its fundamentals.

Perdoceo Education (NasdaqGS:PRDO)

Simply Wall St Value Rating: ★★★★★★

Overview: Perdoceo Education Corporation offers postsecondary education through online, campus-based, and blended learning programs in the United States with a market capitalization of approximately $1.86 billion.

Operations: Perdoceo Education generates revenue primarily from its Colorado Technical University (CTU) and American InterContinental University (AIUS) segments, with CTU contributing $446.73 million and AIUS $205.29 million.

Perdoceo Education, a small cap player in the education sector, has been making strategic moves to bolster its financial standing. The company is trading at 53.8% below its estimated fair value and remains debt-free, which positions it well against industry peers. Despite a recent earnings dip of 9%, Perdoceo's free cash flow remains positive with US$152.58 million as of September 2024. Recent acquisitions like the University of St. Augustine aim to diversify revenue streams and improve operational efficiency, although integration challenges and rising marketing costs could pose risks to future performance projections with profit margins expected to rise from 20.4% to 25.1%.

Taking Advantage

- Discover the full array of 269 US Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACIC

American Coastal Insurance

Through its subsidiaries, primarily engages in the commercial and personal property, and casualty insurance business in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives