- United States

- /

- Mortgage REITs

- /

- NYSE:DX

Spotlight On October 2025's Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

As of October 2025, the United States stock market is experiencing mixed signals, with the Dow Jones Industrial Average reaching record highs while gold prices plummet following a recent peak. Amid this backdrop, small-cap stocks in the S&P 600 index are drawing attention for their potential resilience and growth opportunities, especially when insider activity suggests confidence within these companies. In such an environment, identifying promising small-cap stocks involves looking for those with strong fundamentals and strategic positioning to navigate current economic challenges.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 31.2x | 2.0x | 39.27% | ★★★★★★ |

| PCB Bancorp | 9.5x | 2.9x | 35.54% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 22.73% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 31.32% | ★★★★☆☆ |

| Shore Bancshares | 9.9x | 2.6x | -78.51% | ★★★☆☆☆ |

| Auburn National Bancorporation | 13.7x | 2.9x | 22.44% | ★★★☆☆☆ |

| Citizens Community Bancorp | 12.3x | 2.6x | 20.59% | ★★★☆☆☆ |

| Farmland Partners | 6.7x | 8.1x | -39.69% | ★★★☆☆☆ |

| First Northern Community Bancorp | 10.0x | 2.8x | 46.30% | ★★★☆☆☆ |

| Tilray Brands | NA | 2.0x | -29.36% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Burke & Herbert Financial Services (BHRB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services operates primarily in the community banking sector, with a market capitalization of approximately $0.53 billion.

Operations: The company generates its revenue primarily from community banking, with recent figures showing $330.00 million in this segment. Operating expenses have been significant, notably general and administrative expenses which were $139.68 million in the latest period. The net income margin has varied over time, reaching 31.40% recently after fluctuations in previous periods.

PE: 8.7x

Burke & Herbert Financial Services, a smaller financial entity in the U.S., recently reported a significant turnaround with net income of US$29.9 million for Q2 2025, compared to a loss last year. Their earnings per share rose to US$1.98 from a prior loss, indicating improved profitability. Despite no recent insider confidence through share purchases or buybacks, the company declared a US$0.55 dividend per share and is poised for growth with strategic hires enhancing their commercial banking capabilities and expanding into Bethesda, Maryland.

Albany International (AIN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Albany International is a global advanced textiles and materials processing company with operations in machine clothing and engineered composites, boasting a market capitalization of approximately $3.50 billion.

Operations: The company generates revenue primarily from its Machine Clothing and Albany Engineered Composites segments. The gross profit margin experienced fluctuations, reaching 41.72% in early 2021 before declining to 31.75% by mid-2025. Operating expenses include significant allocations to general and administrative costs, which were $214.33 million as of the latest period reported in mid-2025.

PE: 27.5x

Albany International, a small company in the U.S., is navigating financial challenges with strategic moves. Despite a dip in profit margins to 5.3% from last year's 8.8%, earnings are set to grow by 26.67% annually, indicating potential for recovery and growth. Insider confidence is evident through significant share repurchases totaling $106.56 million this year, suggesting belief in future prospects despite reliance on external borrowing for funding. The recent headquarters move to Portsmouth aims at boosting business growth and employee well-being while maintaining strong ties with Rochester operations.

- Dive into the specifics of Albany International here with our thorough valuation report.

Gain insights into Albany International's past trends and performance with our Past report.

Dynex Capital (DX)

Simply Wall St Value Rating: ★★★☆☆☆

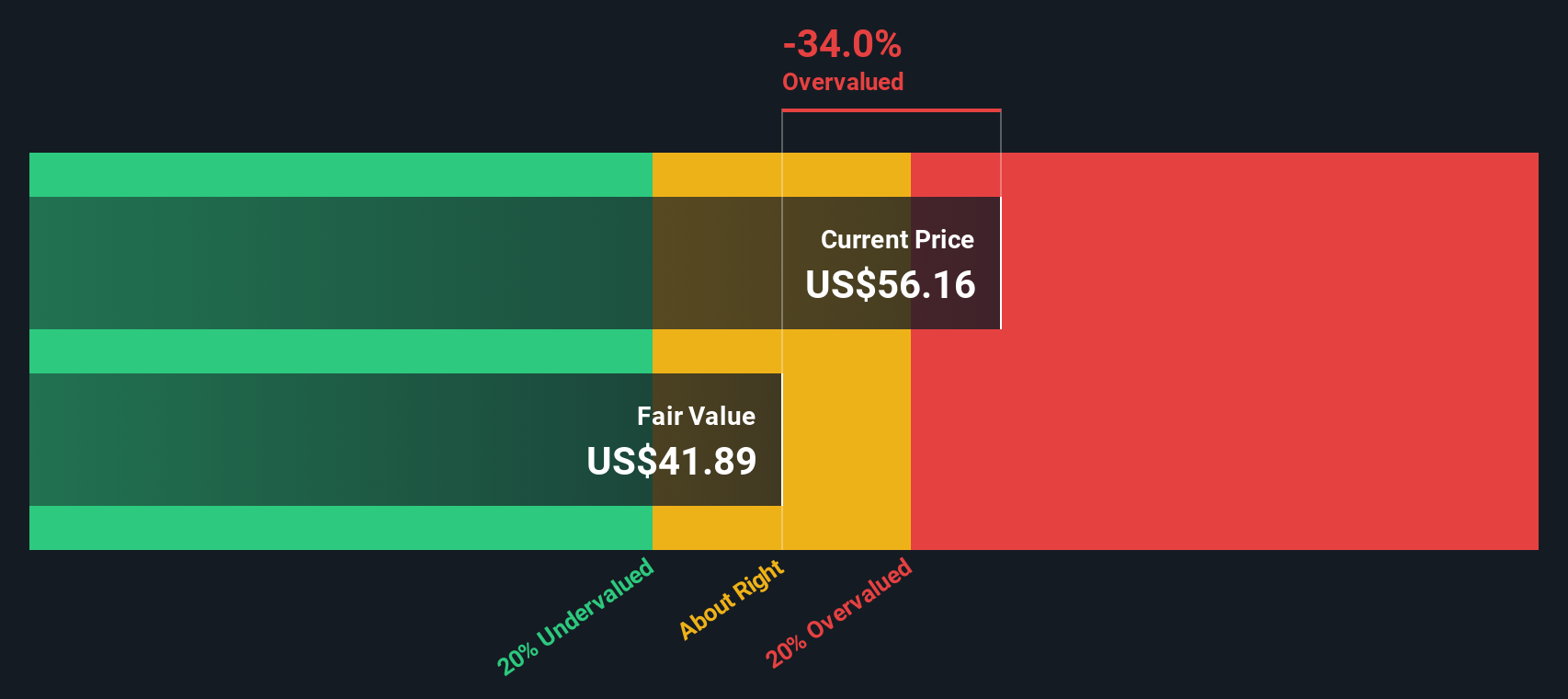

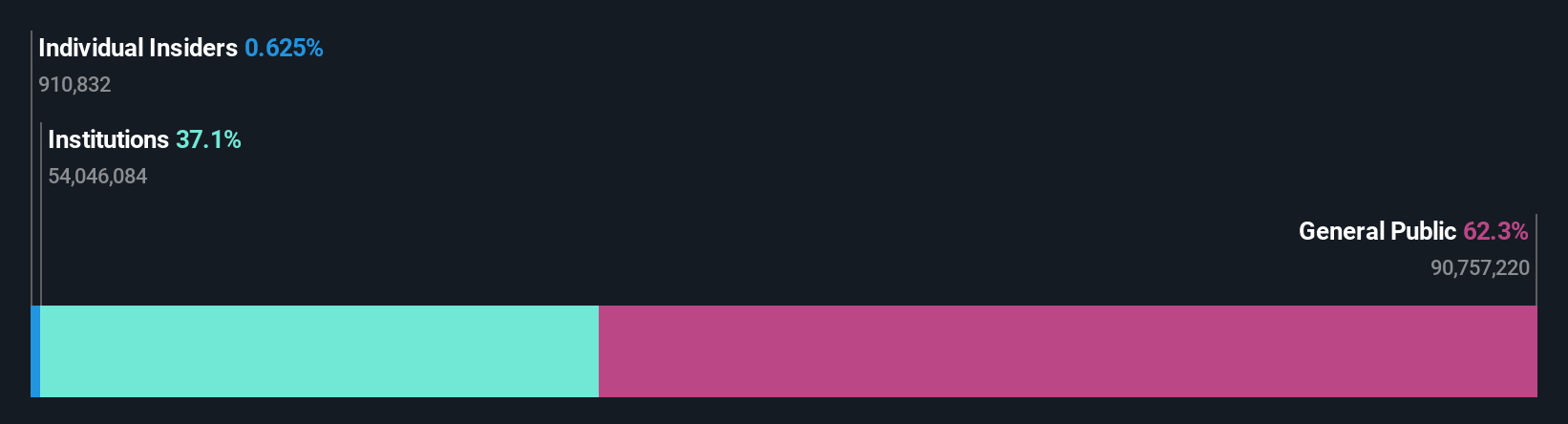

Overview: Dynex Capital is a real estate investment trust (REIT) that primarily invests in mortgage-backed securities with a market capitalization of approximately $0.58 billion.

Operations: Dynex Capital generates revenue with a consistent gross profit margin of 100%, reflecting that its cost of goods sold is negligible or not reported. The company experiences fluctuations in net income, with notable periods of both positive and negative net income margins, indicating variability in profitability. Operating expenses primarily consist of general and administrative costs, which have shown an increasing trend over time.

PE: 11.0x

Dynex Capital, a smaller player in the U.S. market, recently reported a net income of US$150.39 million for Q3 2025, reflecting steady earnings with basic EPS at US$1.09. Despite no share repurchases from April to June 2025, their consistent dividend payouts of US$0.17 per share indicate financial stability and shareholder commitment. The absence of customer deposits highlights reliance on external borrowing for funding, which carries higher risk but is managed effectively given their strong earnings performance and growth prospects projected at over 100% annually.

Where To Now?

- Investigate our full lineup of 74 Undervalued US Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DX

Dynex Capital

A mortgage real estate investment trust, invests in mortgage-backed securities (MBS) in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives