- United States

- /

- Banks

- /

- NasdaqCM:BHRB

Exploring 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

As the U.S. market reaches new highs on optimism surrounding U.S.-China trade talks and potential interest rate cuts, investors are keenly observing the performance of major indices like the S&P 500 and Nasdaq. Amidst this backdrop of record-breaking trends, identifying stocks that offer unique growth opportunities can be particularly rewarding. In this environment, a good stock often possesses strong fundamentals and innovative potential that align well with prevailing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Alliance Entertainment Holding (AENT)

Simply Wall St Value Rating: ★★★★☆☆

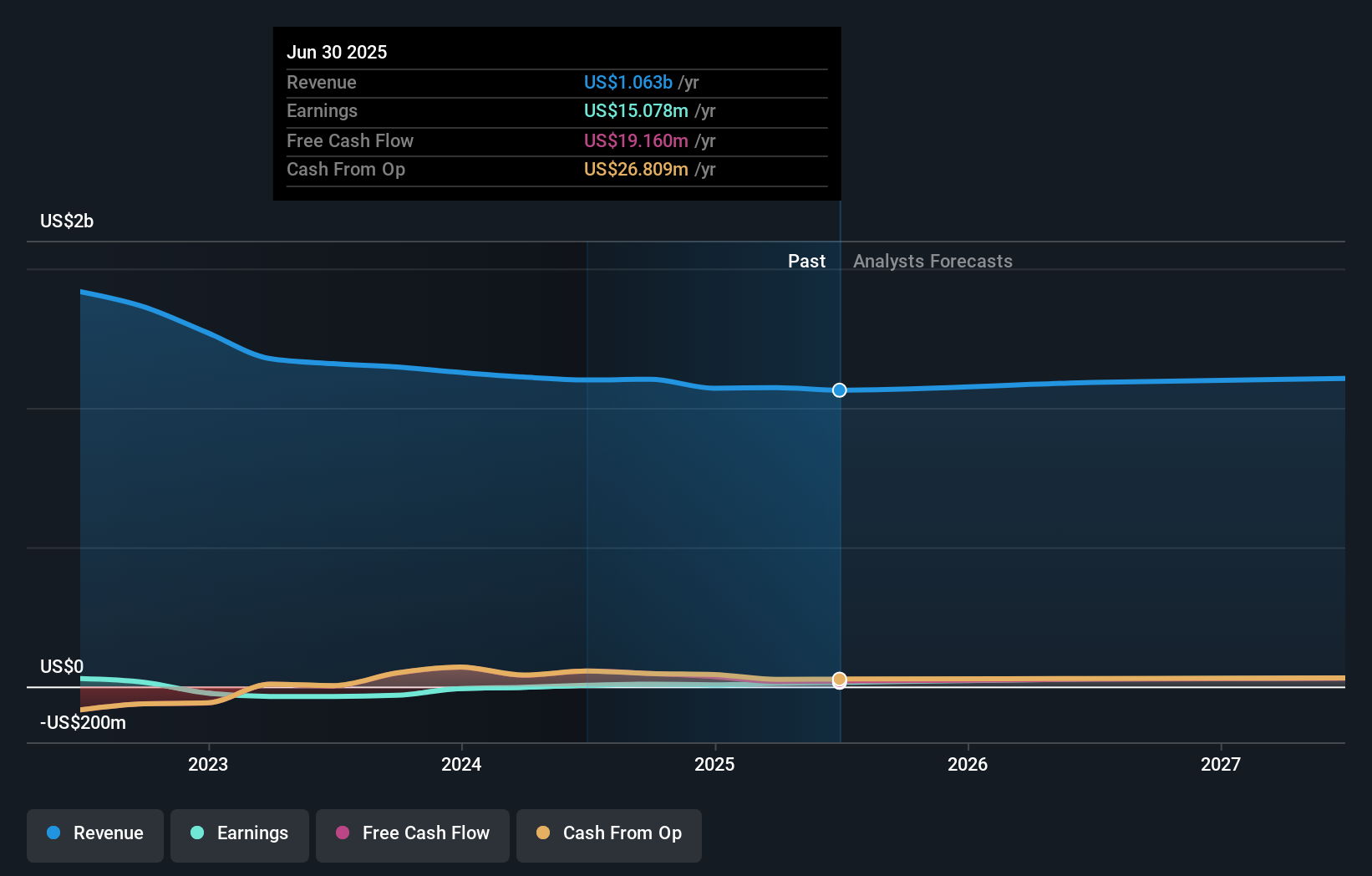

Overview: Alliance Entertainment Holding Corporation operates as a wholesaler and e-commerce provider for the entertainment industry worldwide, with a market cap of $307.27 million.

Operations: The company generates revenue primarily from its wholesale segment, which amounts to $1.06 billion.

Alliance Entertainment Holding, a notable player in the collectibles and distribution industry, has demonstrated significant financial progress. Over the past year, earnings surged by 229%, outpacing the Retail Distributors industry's -11% performance. Despite trading at US$5.90 per share, it remains undervalued by 26.5% compared to its estimated fair value. The company's debt-to-equity ratio improved from 86% to 63% over five years, yet interest coverage is tight at 2.9x EBIT. Recent strategic moves include securing a US$120 million credit facility and expanding its Handmade by Robots brand with new licensing deals and product launches aimed at younger consumers.

Burke & Herbert Financial Services (BHRB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $927.26 million.

Operations: BHRB generates revenue primarily from its community banking segment, amounting to $331.05 million. The company's net profit margin is a key indicator of its financial performance, reflecting the efficiency of its operations and cost management.

Burke & Herbert Financial Services, with total assets of US$7.9 billion and equity of US$822.2 million, stands out in the financial sector for its robust growth and value proposition. The company's earnings surged by 416% over the past year, significantly outperforming the industry average of 16%. Despite a one-off loss impacting recent results, it trades at nearly 55% below its estimated fair value. With deposits totaling US$6.4 billion and loans at US$5.5 billion, it maintains a net interest margin of 3.1%. A low bad loan ratio of 1.6% underscores its prudent risk management strategy amidst primarily low-risk funding sources comprising 91% customer deposits.

Cricut (CRCT)

Simply Wall St Value Rating: ★★★★★★

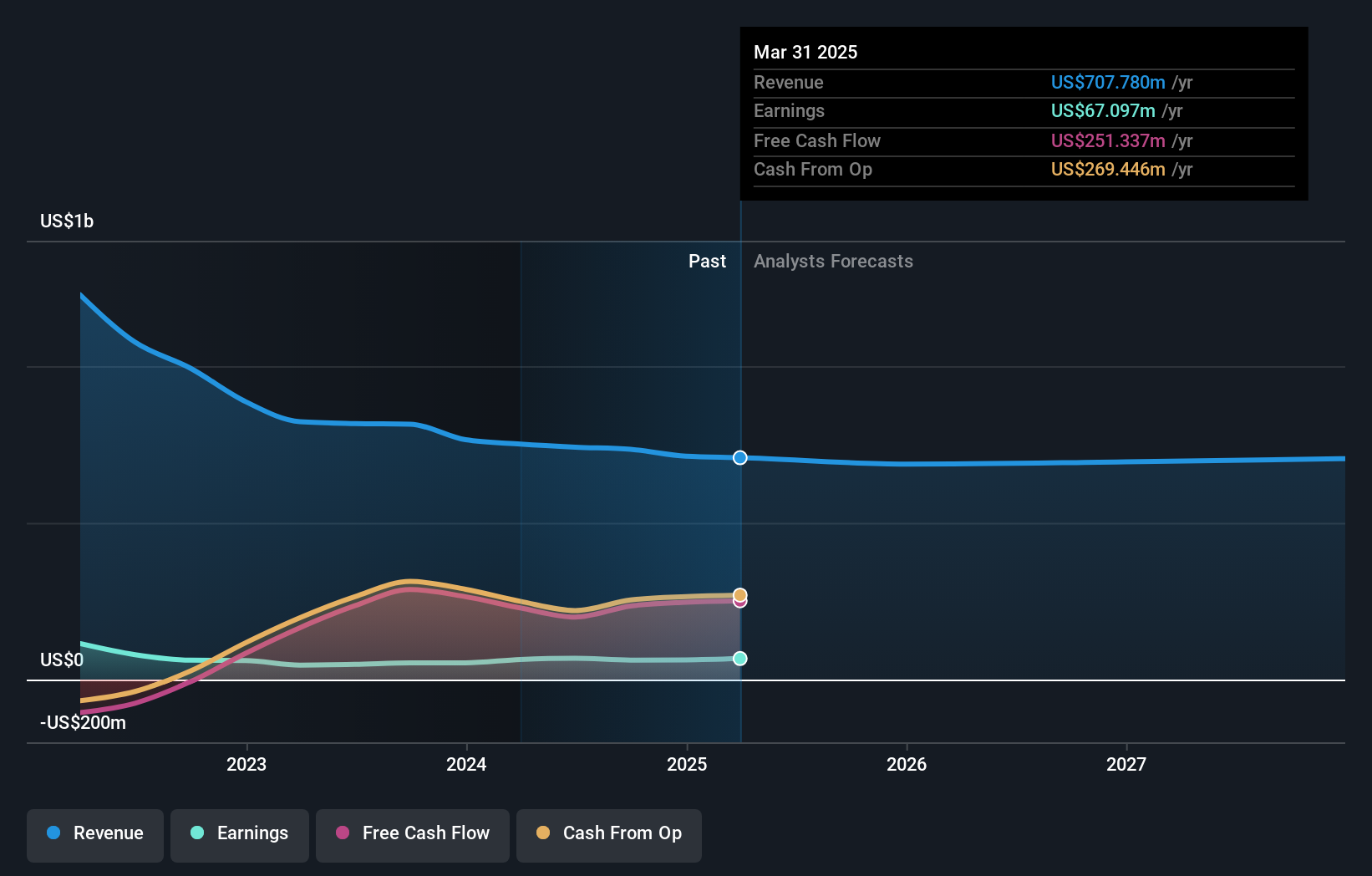

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform for crafting professional-looking handmade goods across various regions including the United States and Europe, with a market cap of $1.11 billion.

Operations: Cricut generates revenue primarily from its platform, amounting to $317.72 million. The company's market cap is approximately $1.11 billion, reflecting its valuation in the industry.

Cricut, a nimble player in the crafting space, has shown a solid performance with earnings rising by 5.7% over the past year, outpacing the Consumer Durables sector's -9.7%. Trading at 77.4% below its estimated fair value suggests potential upside for investors. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 12.4%, reflecting improved financial health. Recent buybacks saw Cricut repurchase over 900,000 shares for US$4.71 million between April and June 2025, indicating confidence in its future prospects despite significant insider selling recently observed.

- Click here and access our complete health analysis report to understand the dynamics of Cricut.

Review our historical performance report to gain insights into Cricut's's past performance.

Make It Happen

- Get an in-depth perspective on all 297 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burke & Herbert Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BHRB

Burke & Herbert Financial Services

Operates as the bank holding company for Burke & Herbert Bank & Trust Company that provides various community banking products and services in Virginia and Maryland.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives