- United States

- /

- Banks

- /

- NasdaqGS:BANF

Is BancFirst's (BANF) Tangible Book Value Growth Shaping a New Investment Narrative?

Reviewed by Sasha Jovanovic

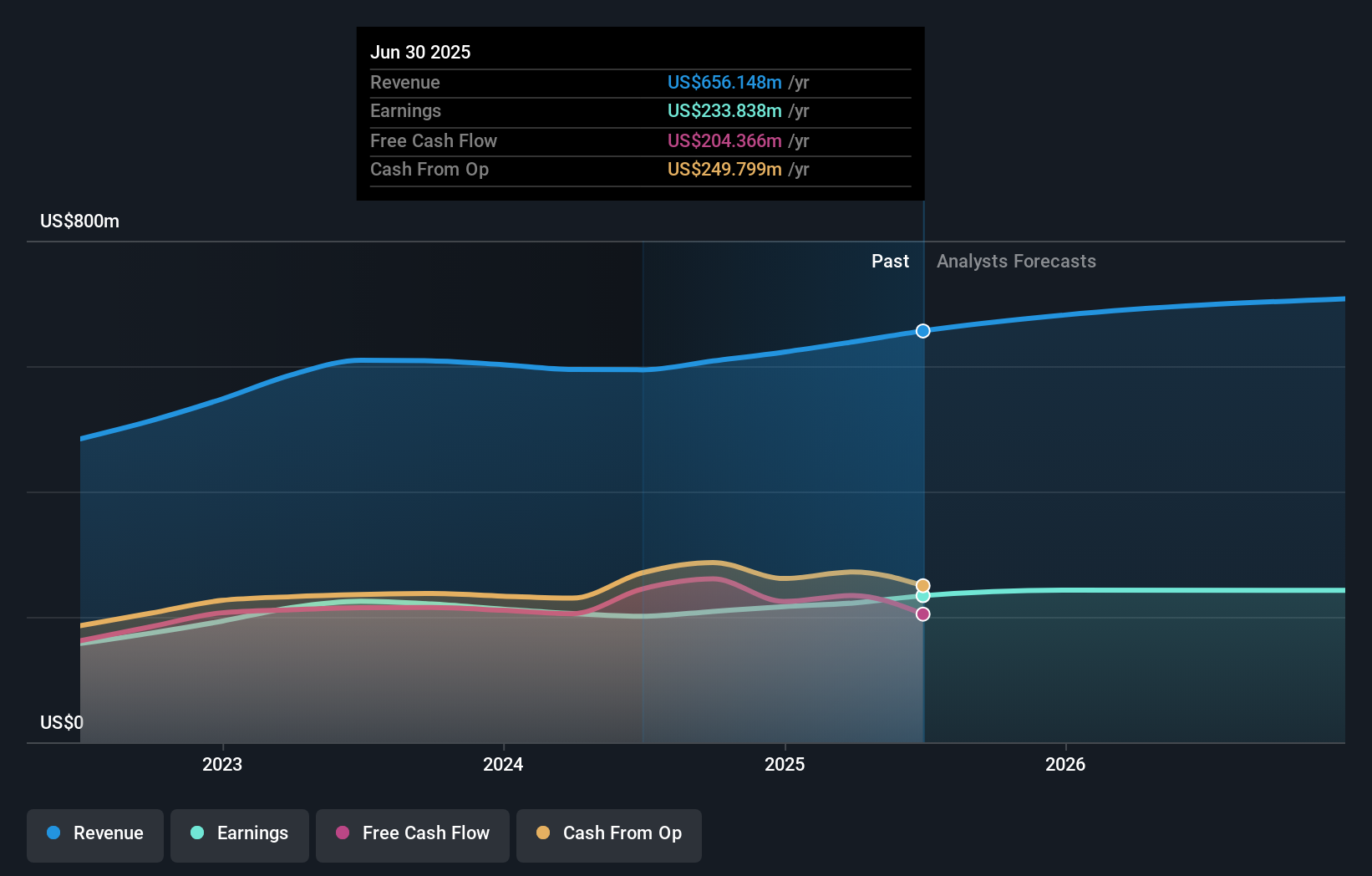

- Recent coverage highlights BancFirst's robust annual revenue and earnings per share growth, alongside a consistent increase in tangible book value per share.

- These positive metrics have contributed to a stronger perception of the company’s fundamentals, leading to heightened interest from the investment community.

- To understand how these strong fundamentals influence BancFirst’s investment narrative, we'll focus on the company's consistent tangible book value per share growth.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is BancFirst's Investment Narrative?

For shareholders in BancFirst, the core belief centers on the bank’s ability to deliver steady growth in earnings and tangible book value per share, reinforced by regular dividend hikes and robust net interest income. With the recent news confirming continued strong annual revenue and EPS growth, the short-term narrative remains focused on operational discipline, capital returns, and tangible book value momentum. Importantly, recent financial updates don’t appear to materially shift the primary near-term catalysts or risks, especially as the price has softened in the past month without clear evidence of deeper operational challenges emerging. However, credit quality remains top-of-mind, as shown by the uptick in real estate charge-offs, and valuation questions linger given BANF’s premium to industry P/E ratios. The most pressing risk still lies in potential credit losses, while slow growth relative to the broader market keeps expectations in check.

Yet, any deterioration in credit quality could quickly reshape the story for BancFirst investors. Despite retreating, BancFirst's shares might still be trading 33% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on BancFirst - why the stock might be worth just $132.67!

Build Your Own BancFirst Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BancFirst research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free BancFirst research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BancFirst's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives