- United States

- /

- Banks

- /

- NasdaqGS:BANF

BancFirst (BANF): Revisiting Valuation After Strong Bank Earnings and Federal Reserve Optimism

Reviewed by Kshitija Bhandaru

BancFirst (BANF) shares attracted attention as investors responded to upbeat third-quarter results from major banks. These results highlighted gains in investment banking and trading. The Federal Reserve’s hint at ending quantitative tightening also boosted market sentiment.

See our latest analysis for BancFirst.

BancFirst’s share price has seen some pullback lately, with a 7.9% drop over the past month despite steady growth in annual revenue and net income. Still, the longer-term story shows impressive momentum. The one-year total shareholder return stands at 11.26%, and has soared over 195% in five years, hinting that investor confidence remains strong even through recent volatility.

If the strength seen in major bank stocks has you thinking bigger, it could be the perfect moment to discover fast growing stocks with high insider ownership.

With BancFirst trading at a discount to analyst targets and notable intrinsic value upside, is the recent pullback an overlooked buying opportunity? Or has the market already priced in the bank’s future growth potential?

Price-to-Earnings of 17.5x: Is it justified?

BancFirst's shares currently trade at a price-to-earnings (P/E) ratio of 17.5x, making them appear more expensive than both industry peers and the bank sector in general. Despite this premium, recent fundamentals and market positioning are key to understanding whether investors are paying a justified markup for growth potential.

The price-to-earnings ratio reflects how much investors are willing to pay today for each dollar of company earnings. For banks like BancFirst, the P/E can signal whether the market expects above-average profit growth, superior efficiency, or other strengths yet to play out in reported numbers.

While solid annual earnings growth has elevated BancFirst’s profile, its current P/E ratio stands higher than both the US Banks industry average (11.7x) and the peer group (12.9x). Compared to a fair P/E estimate of 11.7x, the current valuation may be hard to justify unless profit trends accelerate beyond market forecasts. This gap could narrow if the company outperforms. At present, the market is showing a clear preference for BancFirst’s story.

Explore the SWS fair ratio for BancFirst

Result: Price-to-Earnings of 17.5x (OVERVALUED)

However, slower net income growth and recent share price volatility could signal underlying challenges that may temper BancFirst’s premium valuation and investor enthusiasm.

Find out about the key risks to this BancFirst narrative.

Another View: Are the Numbers Telling a Different Story?

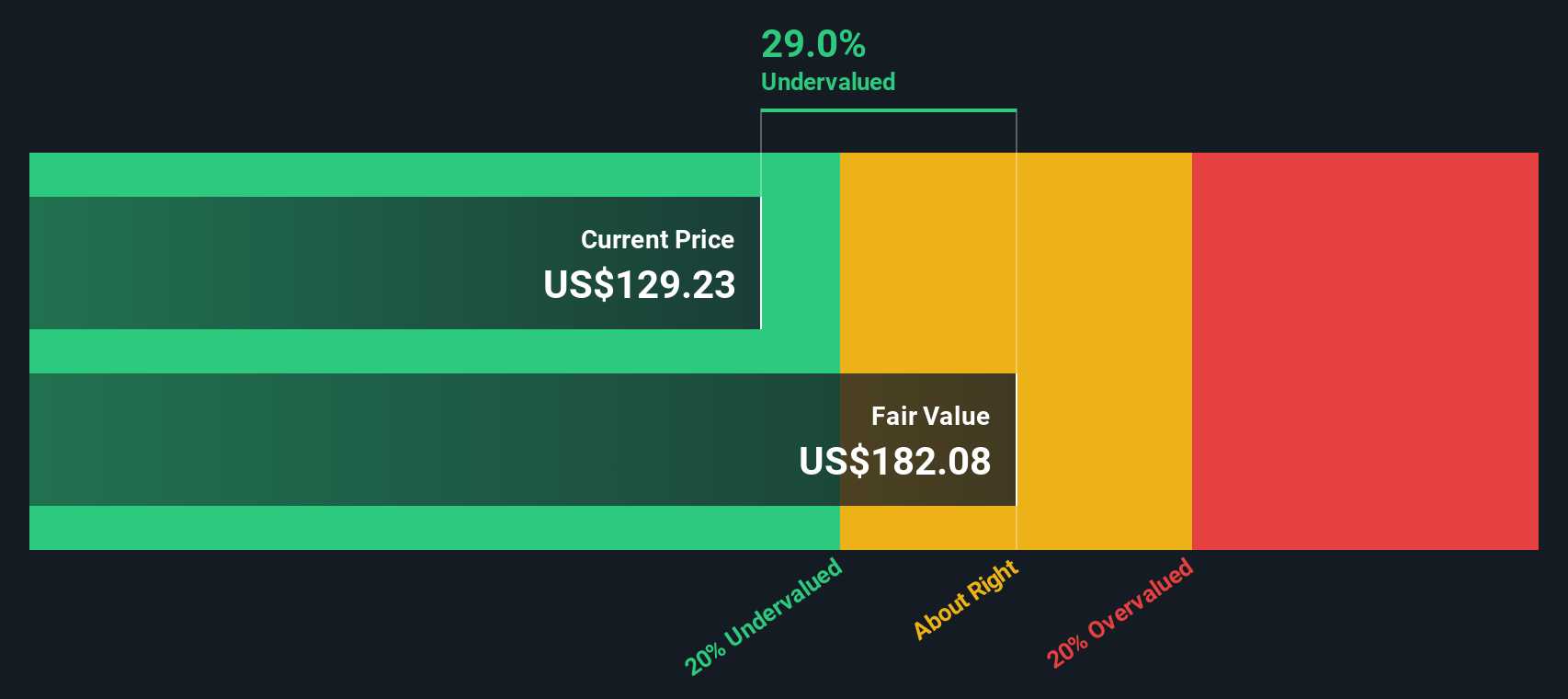

Looking from another angle, our SWS DCF model suggests BancFirst may be undervalued. The current share price is about 32.5% below our estimate of fair value, which indicates that long-term cash flow potential might not be fully reflected in today's trading price. Could market sentiment be overlooking what the future holds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BancFirst for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BancFirst Narrative

Keep in mind, if you have a different perspective or want to dive into the details yourself, you can shape your own conclusions in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BancFirst.

Looking for more investment ideas?

Smart investors know that the best opportunities go to those who look beyond the obvious. Don't leave your next winning stock idea to chance. Use these powerful tools to get ahead:

- Supercharge your search for tomorrow’s industry leaders by jumping into these 24 AI penny stocks, which are redefining how technology shapes our lives and investments.

- Secure steady cash flow and grow your portfolio with these 18 dividend stocks with yields > 3%, which consistently deliver compelling yields above 3%.

- Capitalize on overlooked opportunities by checking out these 873 undervalued stocks based on cash flows and uncovering stocks trading well below their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives