- United States

- /

- Banks

- /

- NasdaqGS:AMNB

How Does American National Bankshares' (NASDAQ:AMNB) CEO Pay Compare With Company Performance?

Jeff Haley has been the CEO of American National Bankshares Inc. (NASDAQ:AMNB) since 2013, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for American National Bankshares

How Does Total Compensation For Jeff Haley Compare With Other Companies In The Industry?

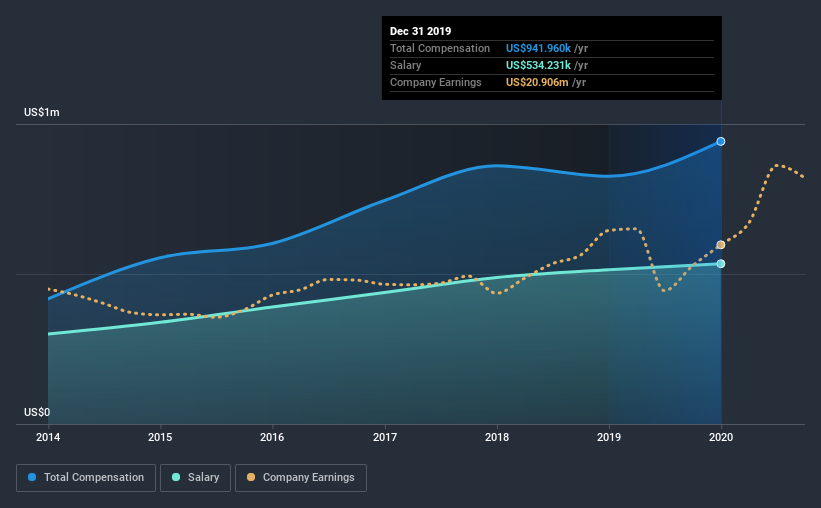

According to our data, American National Bankshares Inc. has a market capitalization of US$288m, and paid its CEO total annual compensation worth US$942k over the year to December 2019. That's a notable increase of 14% on last year. In particular, the salary of US$534.2k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$799k. So it looks like American National Bankshares compensates Jeff Haley in line with the median for the industry. Moreover, Jeff Haley also holds US$1.7m worth of American National Bankshares stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$534k | US$514k | 57% |

| Other | US$408k | US$312k | 43% |

| Total Compensation | US$942k | US$826k | 100% |

On an industry level, around 43% of total compensation represents salary and 57% is other remuneration. American National Bankshares pays out 57% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

American National Bankshares Inc.'s Growth

American National Bankshares Inc. has seen its earnings per share (EPS) increase by 9.2% a year over the past three years. Its revenue is up 4.4% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has American National Bankshares Inc. Been A Good Investment?

Given the total shareholder loss of 23% over three years, many shareholders in American National Bankshares Inc. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we touched on above, American National Bankshares Inc. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But with negative shareholder returns and unimpressive EPS growth, shareholders will surely be disturbed. CEO pay isn't exceptionally high, but considering poor performance, shareholders will likely hold off support for a raise until results improve.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for American National Bankshares (1 is concerning!) that you should be aware of before investing here.

Switching gears from American National Bankshares, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading American National Bankshares or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:AMNB

American National Bankshares

American National Bankshares Inc. operates as the bank holding company for American National Bank and Trust Company that engages in the provision of financial products and services.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives