- United States

- /

- Banks

- /

- NasdaqCM:ACNB

3 Reliable Dividend Stocks With Yields Up To 3.8%

Reviewed by Simply Wall St

In the current U.S. market landscape, where the S&P 500 has recently experienced a streak of gains and investors are navigating through mixed economic signals such as government debt downgrades and fluctuating Treasury yields, dividend stocks continue to offer a stable income stream amidst market volatility. As we explore three reliable dividend stocks with yields up to 3.8%, it's important to consider how these investments can provide consistent returns, particularly when broader market conditions remain uncertain.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.79% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.83% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.40% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.14% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.94% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.72% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.89% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.86% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.85% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 8.79% | ★★★★★☆ |

Click here to see the full list of 140 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ACNB (NasdaqCM:ACNB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ACNB Corporation is a financial holding company providing banking, insurance, and financial services to individual, business, and government customers in the United States with a market cap of $460.84 million.

Operations: ACNB Corporation generates its revenue primarily through its banking segment, which accounts for $104.94 million, complemented by $9.79 million from its insurance services.

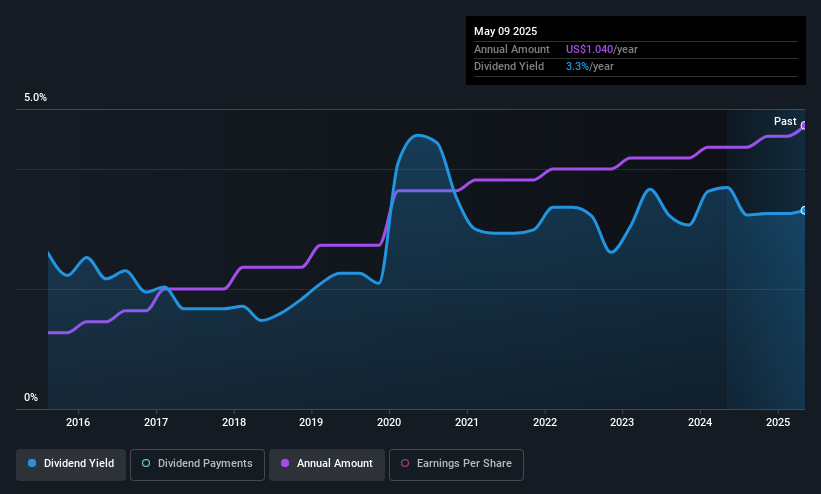

Dividend Yield: 3.1%

ACNB Corporation recently announced a 6.25% increase in its quarterly dividend to $0.34 per share, reflecting stable and growing dividends over the past decade. Despite a recent net loss of $0.272 million for Q1 2025, its dividends remain well-covered by earnings with a payout ratio of 45.6%. The company completed a share buyback program, repurchasing shares worth $5.33 million, potentially enhancing shareholder value amidst diluted ownership over the past year.

- Dive into the specifics of ACNB here with our thorough dividend report.

- According our valuation report, there's an indication that ACNB's share price might be on the cheaper side.

Timberland Bancorp (NasdaqGM:TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $248.81 million.

Operations: Timberland Bancorp, Inc. generates its revenue primarily from community banking services, amounting to $76.81 million.

Dividend Yield: 3.3%

Timberland Bancorp has maintained stable and growing dividends over the past decade, with a current yield of 3.28% and a low payout ratio of 30.1%, suggesting dividends are well-covered by earnings. The recent 4% dividend increase to $0.26 per share underscores its commitment to returning value to shareholders. Additionally, the company completed a significant share buyback, repurchasing shares worth $9.57 million, which may enhance shareholder value despite trading below estimated fair value by 52.1%.

- Click to explore a detailed breakdown of our findings in Timberland Bancorp's dividend report.

- Our valuation report unveils the possibility Timberland Bancorp's shares may be trading at a discount.

Huntington Bancshares (NasdaqGS:HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services across the United States with a market cap of approximately $23.57 billion.

Operations: Huntington Bancshares generates revenue from its Commercial Banking segment at $2.70 billion and its Consumer & Regional Banking segment at $5.09 billion.

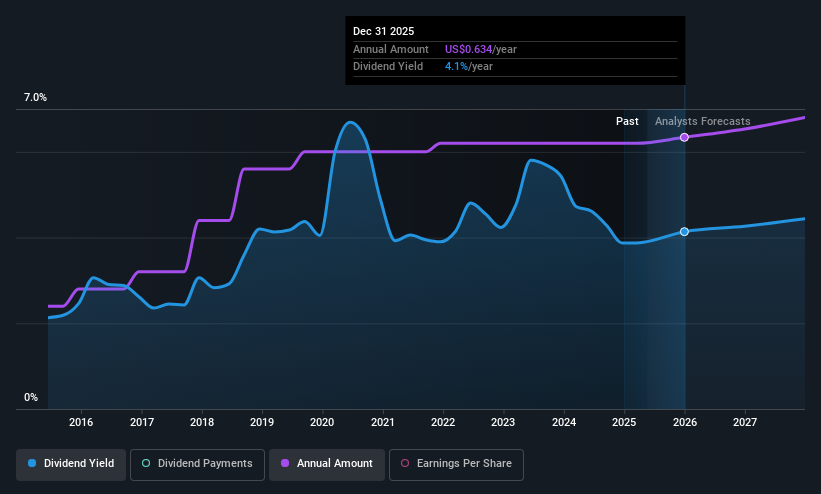

Dividend Yield: 3.8%

Huntington Bancshares offers a stable dividend yield of 3.85%, supported by a payout ratio of 47%, indicating dividends are well-covered by earnings. Despite insider selling, the company maintains dividend reliability over the past decade. Recent financials show net income growth to US$527 million and a share buyback plan worth up to US$1 billion, potentially enhancing shareholder value. The quarterly dividend remains at $0.155 per common share, demonstrating consistency in payouts amidst ongoing earnings growth forecasts.

- Delve into the full analysis dividend report here for a deeper understanding of Huntington Bancshares.

- The analysis detailed in our Huntington Bancshares valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Unlock our comprehensive list of 140 Top US Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACNB

ACNB

A financial holding company, offers banking, insurance, and financial services to individual, business, and government customers in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives