- United States

- /

- Semiconductors

- /

- OTCPK:SCIA

3 US Penny Stocks With At Least $3M Market Cap

Reviewed by Simply Wall St

As the U.S. markets experience a downturn, with major indices like the S&P 500 and Nasdaq Composite extending their slump, investors are keenly observing how different sectors respond to these shifts. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture attention for their potential value despite their vintage-sounding name. These stocks can offer unique opportunities when they possess strong financial foundations, and in this article, we explore three such penny stocks that stand out for their financial resilience and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.54M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86379 | $6.28M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.76 | $392.77M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.47 | $42.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.60 | $82.81M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $47.52M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.00 | $155.17M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.36 | $24.65M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8491 | $77.35M | ★★★★★☆ |

Click here to see the full list of 728 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

IT Tech Packaging (NYSEAM:ITP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IT Tech Packaging, Inc. and its subsidiaries produce and distribute paper products in the People’s Republic of China, with a market cap of $3.52 million.

Operations: The company's revenue is primarily derived from its Dongfang Paper segment, contributing $78.54 million, and a smaller portion from Tengsheng Paper at $0.61 million.

Market Cap: $3.52M

IT Tech Packaging, with a market cap of US$3.52 million, primarily generates revenue from its Dongfang Paper segment (US$78.54 million). Despite being unprofitable, the company benefits from seasoned management and board teams with average tenures of 17.3 and 15.3 years respectively. Short-term assets of US$33 million comfortably cover both short-term liabilities (US$20.8 million) and long-term liabilities (US$4.9 million), while debt has decreased over five years to a satisfactory net debt to equity ratio of 3.3%. However, high volatility in share price and less than one year’s cash runway present challenges for investors considering this penny stock.

- Click here to discover the nuances of IT Tech Packaging with our detailed analytical financial health report.

- Examine IT Tech Packaging's past performance report to understand how it has performed in prior years.

Nu Ride (OTCPK:NRDE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nu Ride Inc. currently lacks significant operations and has a market cap of $19.48 million.

Operations: Nu Ride Inc. has not reported any revenue segments at this time.

Market Cap: $19.48M

Nu Ride Inc., with a market cap of US$19.48 million, is pre-revenue and currently unprofitable, indicating its speculative nature as a penny stock. The company benefits from having no debt and short-term assets of US$58.3 million exceeding liabilities of US$15.2 million, providing some financial stability despite less than a year’s cash runway based on free cash flow. Shareholders have not faced significant dilution recently; however, the board's inexperience and volatile share price add risk factors for potential investors seeking opportunities in this category.

- Unlock comprehensive insights into our analysis of Nu Ride stock in this financial health report.

- Understand Nu Ride's track record by examining our performance history report.

SCI Engineered Materials (OTCPK:SCIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SCI Engineered Materials, Inc. manufactures and supplies materials for physical vapor deposition thin film applications in the United States, with a market cap of $21.97 million.

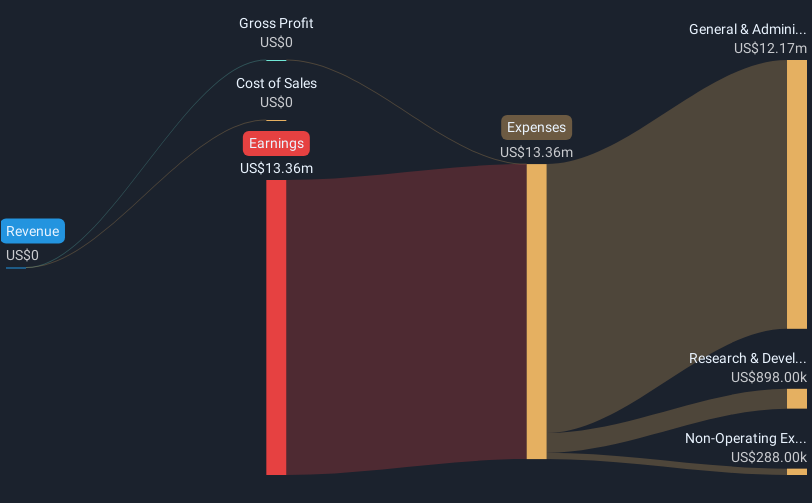

Operations: The company generates $22.87 million in revenue from its role as a global supplier and manufacturer of advanced materials for physical vapor deposition.

Market Cap: $21.97M

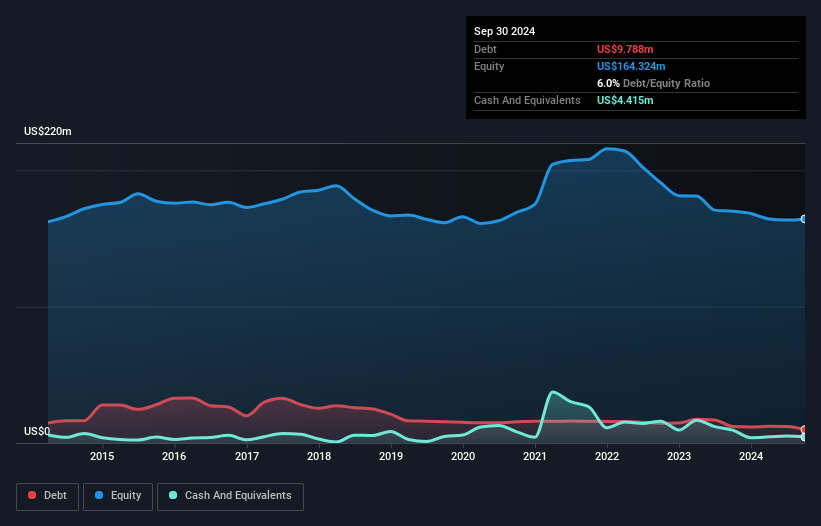

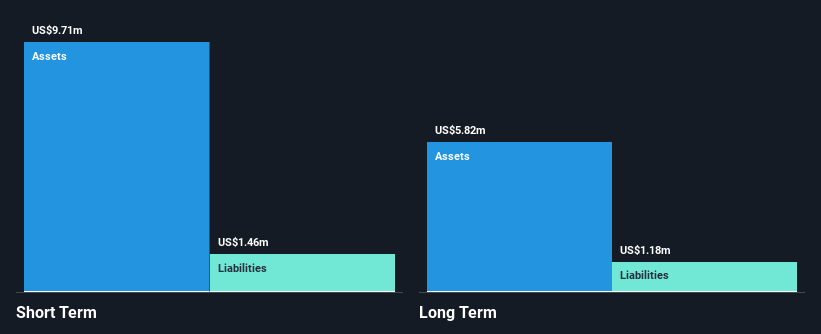

SCI Engineered Materials, with a market cap of US$21.97 million, operates debt-free and maintains financial stability with short-term assets of US$9.7 million surpassing liabilities of US$1.5 million. While its net profit margin improved slightly to 8.1% from 7.8%, the company experienced a decline in earnings growth over the past year, contrasting its significant 5-year profit expansion rate of 21.2% annually. Despite trading below estimated fair value and having an experienced management team, recent earnings showed a decrease in sales and net income compared to the previous year, highlighting potential challenges amid industry volatility.

- Take a closer look at SCI Engineered Materials' potential here in our financial health report.

- Assess SCI Engineered Materials' previous results with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 728 US Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SCIA

SCI Engineered Materials

Manufactures and supplies materials for physical vapor deposition thin film applications in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives