- United States

- /

- Auto

- /

- NYSE:ZK

Assessing Zeekr (NYSE:ZK) Valuation After Strong September 2025 Vehicle Delivery Growth

Reviewed by Kshitija Bhandaru

ZEEKR Intelligent Technology Holding (NYSE:ZK) just reported its September delivery results, with 51,159 vehicles delivered across Zeekr and Lynk & Co. That is an 8% year-over-year increase and a 14% rise from August, giving investors fresh data to consider.

See our latest analysis for ZEEKR Intelligent Technology Holding.

After a solid run of deliveries, ZEEKR Intelligent Technology Holding’s share price has climbed 11.5% year-to-date, signaling momentum is building as investors respond to steady progress and upbeat expectations. Over the past year, total shareholder return stands at 20.2%, outpacing many peers and indicating confidence in the company’s longer-term outlook.

If ZEEKR’s momentum has you thinking bigger, now is the time to see what other auto manufacturers are stirring the market and check out See the full list for free.

With those impressive delivery numbers, the next question for investors is whether ZEEKR Intelligent Technology Holding’s recent gains reflect an undervalued growth story or if the market has already priced in its future potential. Is there still a buying opportunity, or has all the upside been accounted for?

Most Popular Narrative: 19.4% Undervalued

The most widely followed narrative puts ZEEKR Intelligent Technology Holding’s fair value well above its latest closing price, sparking debate about what is driving this bullish consensus and what is already priced in.

The company’s strong innovation pipeline, specifically upcoming launches of premium models such as the Zeekr 9X and 8X with proprietary super electric hybrid technology and 900V fast charging, positions ZEEKR to capture increased demand as consumers globally shift towards high-tech, intelligent electric mobility. This trend may drive revenue growth and improved vehicle margins in the coming quarters.

Want to know the formula behind this soaring projection? The full narrative reveals bold growth bets and a future profit outlook that seasoned market watchers might envy. You will discover why sales targets, margin goals, and a high-stakes profitability timeline continue to influence that fair value. This is the story market insiders are watching. Do not miss the specifics.

Result: Fair Value of $37.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the rapid international expansion and ongoing reliance on Geely's technology mean profitability faces hurdles if market access or innovation slows.

Find out about the key risks to this ZEEKR Intelligent Technology Holding narrative.

Another View: Testing the Numbers with a Different Lens

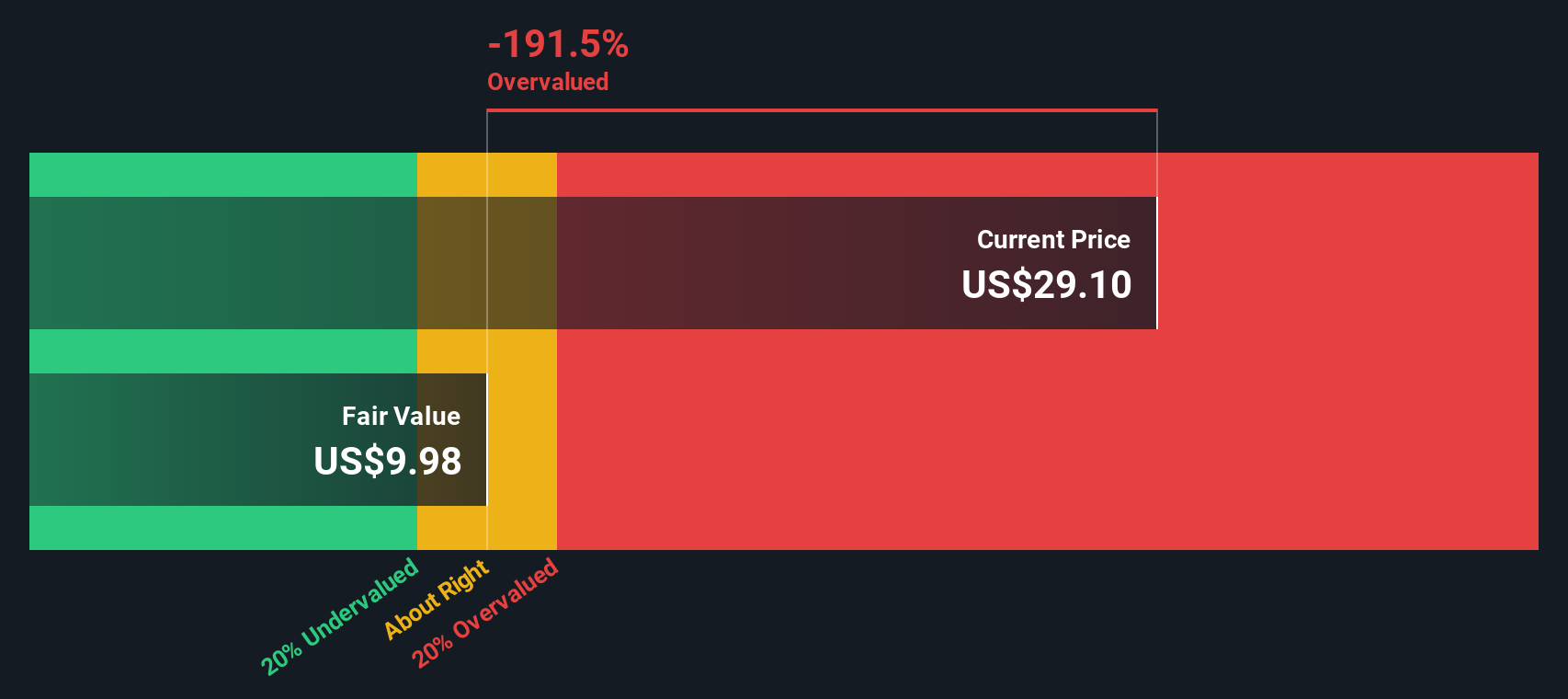

Our DCF model offers a different perspective. Using discounted cash flow, the fair value comes in well below the current market price. This suggests ZEEKR Intelligent Technology Holding may be overvalued by this method. Could growth optimism be running ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ZEEKR Intelligent Technology Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ZEEKR Intelligent Technology Holding Narrative

If you see the figures differently or want to dig into the details yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your ZEEKR Intelligent Technology Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Now is an ideal time to energize your portfolio with fresh, expert-vetted ideas. Don't let the smartest trends pass you by.

- Tap into future tech by checking out these 26 quantum computing stocks, where companies are unlocking transformative breakthroughs in computing power and industry disruption.

- Secure stable returns and potentially boost your income with these 19 dividend stocks with yields > 3%, featuring strong yields above 3% from reliable businesses that reward shareholders.

- Gain early access to companies making big strides in artificial intelligence innovation with these 25 AI penny stocks, helping you position yourself ahead of the curve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZEEKR Intelligent Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZK

ZEEKR Intelligent Technology Holding

An investment holding company, engages in the research and development, production, commercialization, and sale of the electric vehicles and batteries.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives