- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Valuation Check After November Delivery Slowdown and Strong Year‑to‑Date Growth

Reviewed by Simply Wall St

XPeng (XPEV) just posted fresh November delivery numbers, and they are a bit of a mixed bag that still leans encouraging for long term holders watching the company’s execution closely.

See our latest analysis for XPeng.

That mix of softer monthly deliveries but powerful year to date growth seems to mirror the stock action, with a recent 30 day share price return of minus 10.79 percent but a much stronger year to date share price return of 73.16 percent, and a 1 year total shareholder return of 60 percent. This suggests momentum is still broadly building as investors reassess XPeng’s long term growth and risk profile.

If XPeng’s swingy ride has you thinking about what else is out there in EVs, it could be a good moment to explore auto manufacturers for other potential opportunities.

With XPeng shares still more than 40 percent below analyst targets and revenue accelerating, the core question now is whether the market is overlooking its improving fundamentals or already factoring in the next phase of growth.

Most Popular Narrative Narrative: 29.2% Undervalued

With XPeng last closing at $20 against a narrative fair value near the high twenties, the gap hinges on aggressive growth and margin expansion assumptions.

The company's aggressive international expansion now showing triple digit growth in overseas deliveries and entry into local manufacturing in Indonesia positions XPeng to capture EV adoption tailwinds in both developed and emerging markets, diversifying revenue and bolstering medium

to long term top line growth.

Curious how rapid revenue growth, rising margins, and a premium valuation multiple all fit together? Want to see which bold profit forecasts make this upside tick?

Result: Fair Value of $28.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and fierce domestic EV price competition could delay profitability, forcing further dilution and challenging the upbeat international expansion narrative.Find out about the key risks to this XPeng narrative.

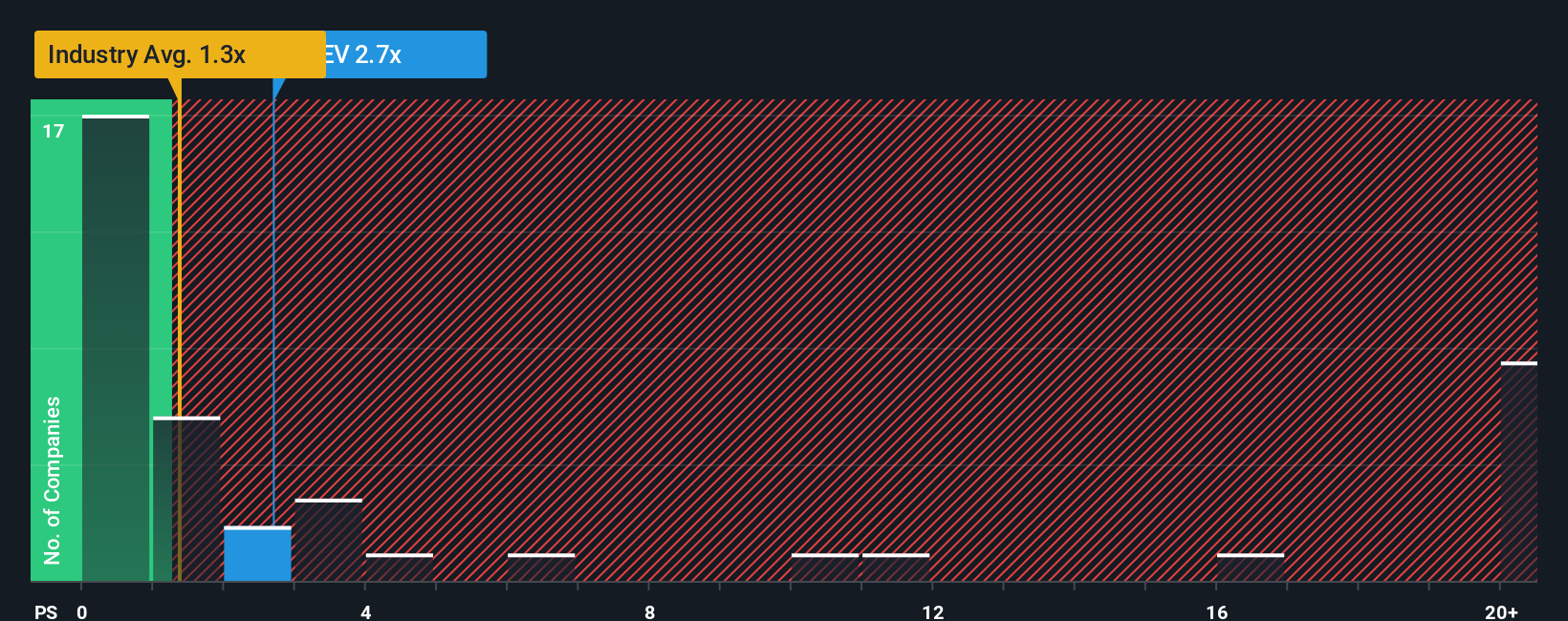

Another View: Market Ratios Flash a Caution Light

While our narrative fair value and DCF style work suggest upside, XPeng’s current price to sales ratio of 1.9 times looks stretched versus US auto peers at 0.9 times and even its own 1.5 times fair ratio. This hints at downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

If you are not fully convinced by this perspective, or simply prefer to dive into the numbers yourself, you can easily build a custom view in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPeng.

Ready for your next investing move?

Put your research momentum to work now. Use the Simply Wall St Screener to spot focused opportunities before the crowd and keep your portfolio one step ahead.

- Target resilient income by reviewing these 15 dividend stocks with yields > 3% that can help anchor your portfolio when growth stocks wobble.

- Capture the next wave of innovation by scanning these 28 quantum computing stocks shaping the frontier of computing and long term disruption.

- Position for structural trends in automation and data by assessing these 26 AI penny stocks that could power the market’s next leadership phase.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026