- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Surges 75% In Last Quarter On Robust Q1 2025 Delivery Forecast

Reviewed by Simply Wall St

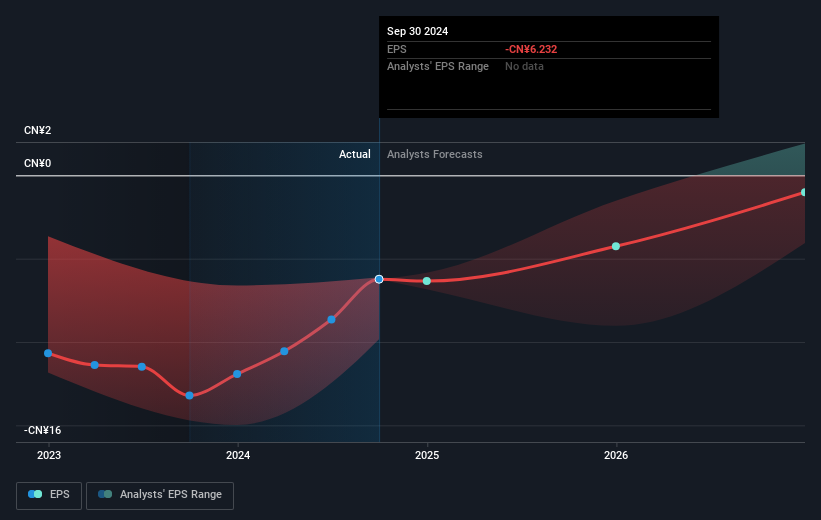

XPeng (NYSE:XPEV) has seen a significant share price increase of 75% over the last quarter, supported by a robust corporate performance and strategic moves. The company's announcement of expected Q1 2025 vehicle deliveries up to 93,000 units, representing an over 300% year-over-year increase, aligns with strong revenue growth guidance, boosting investor confidence. Additionally, XPeng's ongoing expansion into European markets and a successful launch of the XNGP driving technology further strengthens its market position. Meanwhile, the broader market faced mixed signals, maintaining a general upward trend with the S&P 500 trying to break a four-week streak of losses.

Buy, Hold or Sell XPeng? View our complete analysis and fair value estimate and you decide.

Over the last year, XPeng's total shareholder return reached 138.85%, a strong performance that surpassed the US Auto industry's 27.3% return. This outperformance was likely fueled by key developments, including the successful launch of the world's first AI-defined vehicle, the XPENG P7+, announced in November 2024. The collaborative efforts with Volkswagen, established in July 2024, have bolstered XPeng's technological prowess and potential market leverage. Furthermore, the strategic expansion into European markets, with entries into Switzerland, the Czech Republic, Slovakia, and the UK between February and March 2025, marked significant milestones in XPeng's global growth strategy.

Robust vehicle delivery numbers also played a crucial role, with February 2025 deliveries increasing by a very large amount year-on-year. Such substantial growth reflects XPeng's effective adaptation and enhancement of its smart EV offerings, like the global release of XOS 5.4 in January 2025, which amplified intelligent driving features. These advancements solidify XPeng's competitive edge in the EV market and sustain investor enthusiasm.

Click here to discover the nuances of XPeng with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade XPeng, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives