- United States

- /

- Auto

- /

- NYSE:XPEV

How the International Expansion Story Impacts XPeng’s 2025 Valuation After 85% Rally

Reviewed by Bailey Pemberton

- Wondering if XPeng stock is a real bargain or just the latest hype? You're not alone, especially with all the talk surrounding EV stocks right now.

- XPeng’s year-to-date return is a staggering 84.8%, and it’s up 68.2% over the past year, though recent weeks have been choppier with a slight -1.2% dip over 7 days and -9.1% over 30 days.

- Recent headlines have spotlighted XPeng’s ambitious international expansion and new software partnerships, fueling optimism but also raising questions about longer-term profitability. Speculation around shifts in Chinese EV regulations and industry competition has also played into the stock’s volatile swings this month.

- According to our valuation framework, XPeng scores a 1 out of 6 on undervaluation checks (see score). Let's dig into what this really means using different valuation methods. Stay tuned, as we will cover an even smarter way to understand what XPeng might be worth by the end.

- Curious if XPeng is undervalued or if its hype has outpaced reality? You’re in the right place to get the answers that matter.

- The stock has surged an eye-catching 84.8% year-to-date and 68.2% in the past year, but it’s recently pulled back by -9.1% over 30 days and -1.2% over the last week.

- News has highlighted XPeng’s aggressive push into international markets and new tech collaborations, both fueling optimism and intensifying questions about sustainable margins. Shifts in Chinese EV policy and mounting industry competition have only added to the recent volatility in the share price.

- Right now, XPeng earns a 1 out of 6 rating on our undervaluation checks (see score). Let’s break down how this figure is calculated using different valuation methods. There is a smarter, more holistic approach waiting at the end of the article.

XPeng scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: XPeng Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by forecasting its future cash flows, then discounting those future amounts back to their present value. This method gives a foundational sense of what a business could be worth based on how much actual cash it is expected to generate.

For XPeng, the latest twelve-month Free Cash Flow (FCF) stands at approximately negative CN¥5.1 billion, indicating the company is still burning cash as it invests in growth. Analysts expect this to flip substantially, with projections showing annual Free Cash Flow turning positive, reaching an expected CN¥8.2 billion by 2026 and CN¥10.3 billion by 2027. Over a ten-year forecast, extrapolated estimates place annual FCF above CN¥18 billion by 2035 (all in CN¥).

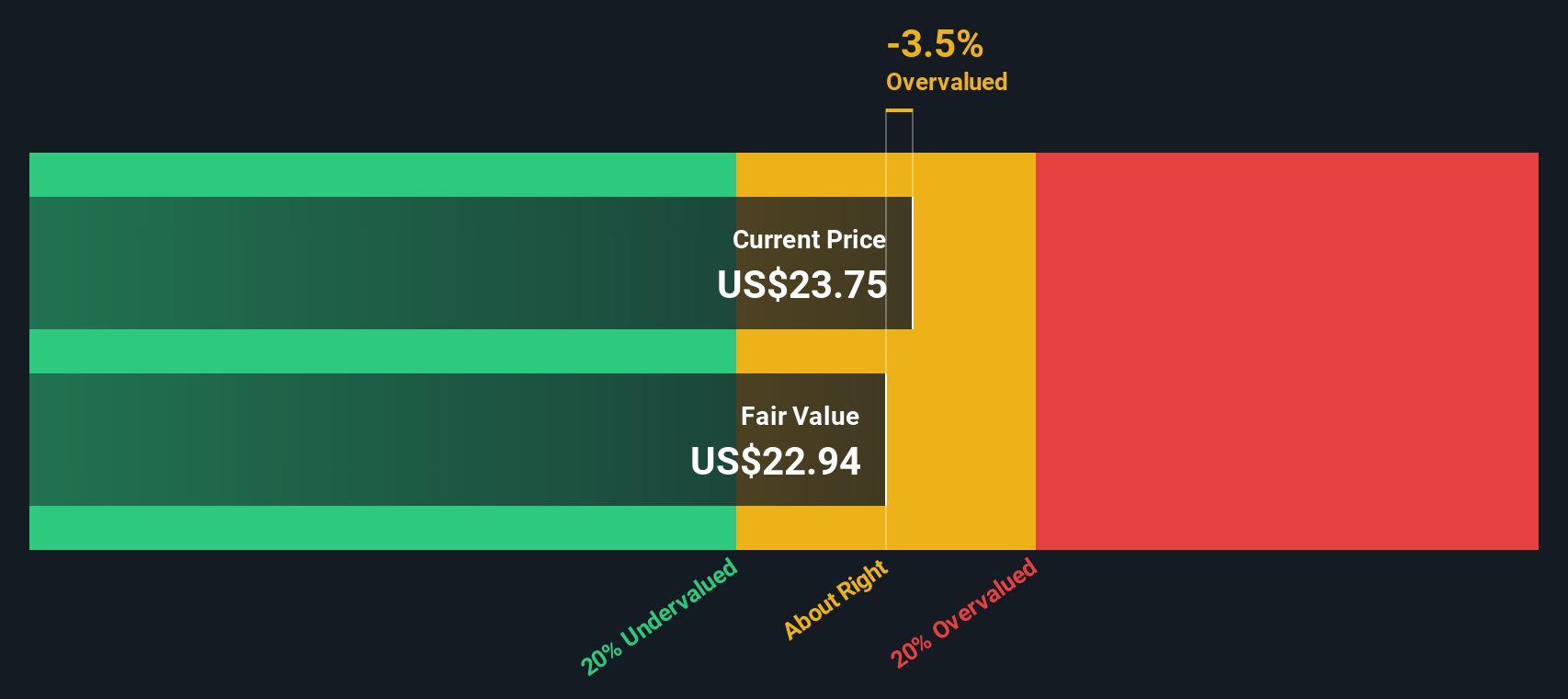

Taking these cash flows and discounting them back to today gives an estimated intrinsic share value of $23.16 (in USD terms). Comparing this result to the current share price, the DCF model suggests XPeng stock is trading at a 7.8% discount to its intrinsic value.

Result: ABOUT RIGHT

XPeng is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: XPeng Price vs Sales

The price-to-sales (P/S) ratio is a widely used valuation metric, especially for companies that are not yet profitable but are seeing rapid revenue growth. This is often the case in the electric vehicle sector. For businesses like XPeng that are still working toward consistent profits, P/S allows investors to compare how much they are paying for each dollar of sales, regardless of near-term earnings volatility.

Growth expectations and risk play a significant role in determining what a fair P/S ratio should be. Higher growth prospects or a unique business model can justify a higher P/S, while more mature or riskier companies typically warrant lower multiples.

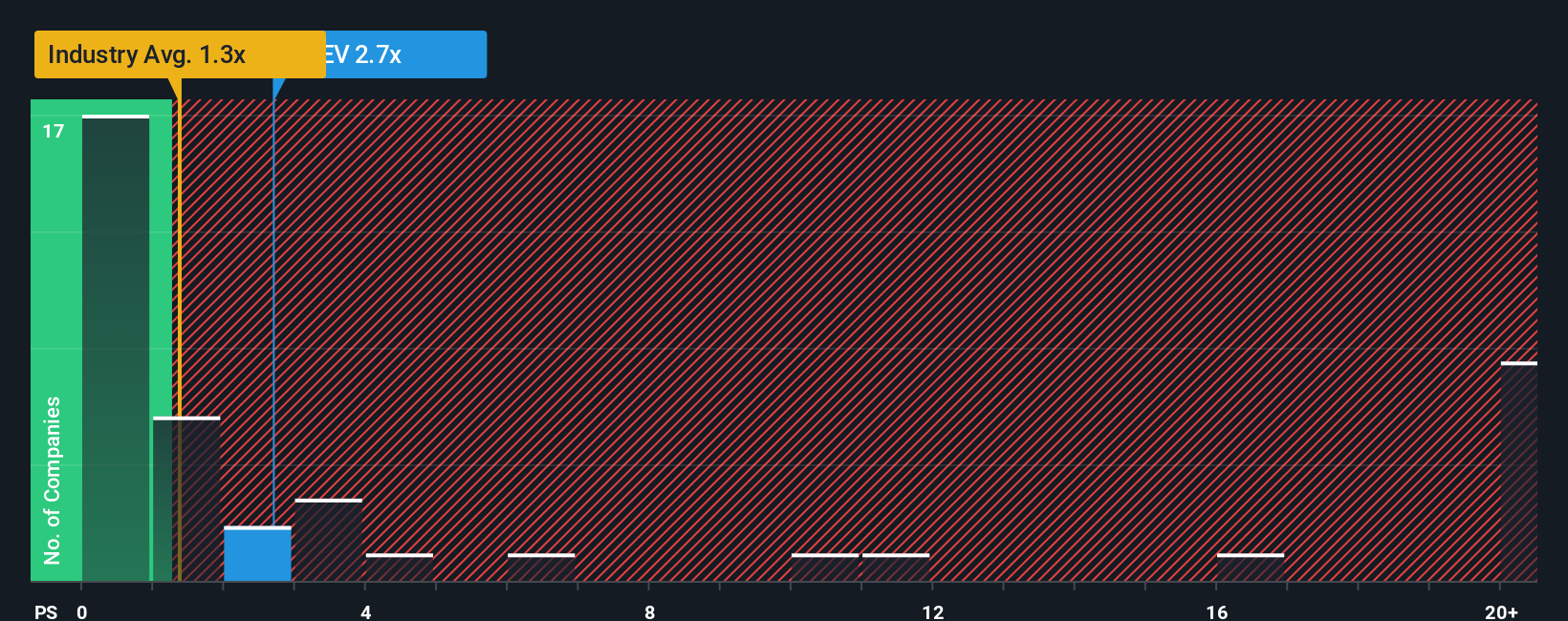

XPeng currently trades at a P/S ratio of 2.04x. For context, this is higher than the auto industry average of 1.06x and above the peer average of 1.59x. However, Simply Wall St’s proprietary “Fair Ratio” for XPeng is 1.55x, which incorporates the company’s expected growth rate, profit margins, industry dynamics, market cap, and business risks. This makes the Fair Ratio a more nuanced benchmark than simple sector or peer comparisons because it is tailored to XPeng’s specific outlook and risk profile.

Comparing XPeng’s P/S ratio of 2.04x to its Fair Ratio of 1.55x suggests the stock is valued a bit above what these fundamentals would imply. The difference is greater than 0.10, indicating that XPeng shares are slightly overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your XPeng Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple but powerful tool that lets you connect your own view of XPeng’s story with real financial forecasts and a fair value estimate, so you can make smarter, more personal investment decisions. On Simply Wall St’s Community page (used by millions of investors), Narratives make it easy for anyone to outline their perspective, from their reasons for revenue and earnings growth to expected profit margins, and see how these assumptions translate to valuation.

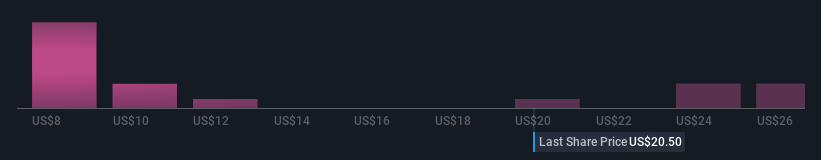

Narratives link the company’s journey and business milestones directly to changing estimates and a dynamic fair value, giving you a living signal for when to buy or sell as new information, news, or earnings are released. For example, on XPeng’s Community page, some investors are bullish and see international expansion boosting its price target as high as $33.26, while others are more cautious, placing fair value closer to $18.27. Narratives put the power and the story directly in your hands, helping you confidently compare your fair value to the current share price and decide what to do next.

Do you think there's more to the story for XPeng? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026