- United States

- /

- Auto

- /

- NYSE:WGO

Winnebago Industries (WGO) Unveils Innovative RV Models at Hershey RV Show

Reviewed by Simply Wall St

Winnebago Industries (WGO) recently announced the introduction of over 120 new RV models at the Hershey RV Show, emphasizing innovation and design enhancements across its brands, which aligns with a general 16% increase in its share price over the last month. This rise might also reflect the company's dividend increase and leadership restructuring earlier in the quarter. These developments coincided with positive broader market trends, as the S&P 500 and Nasdaq reached new highs driven by economic data and tech sector strength, potentially amplifying the impact of Winnebago's strategic initiatives on its stock performance.

Be aware that Winnebago Industries is showing 2 possible red flags in our investment analysis.

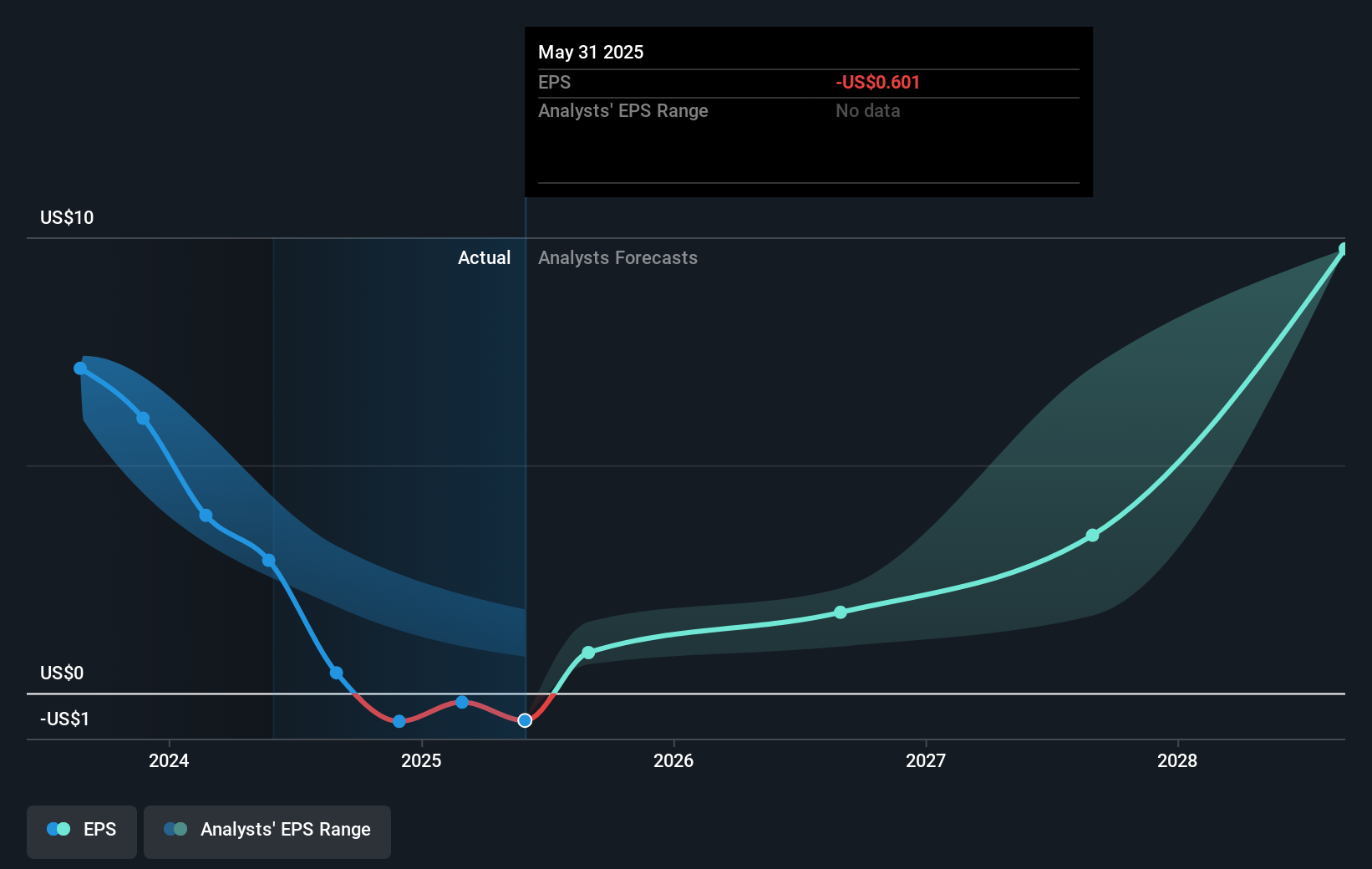

Winnebago Industries' recent introduction of 120 new RV models could significantly influence its market position, aligning with the company's narrative of enhancing market share and revenue growth through product innovation. These launches, coupled with dividend increments and leadership changes, might contribute positively to revenue forecasts, especially if consumer demand aligns with these product strategies. Analysts expect that improvements in margin expansion through a tri-brand strategy and channel enhancements could bolster earnings, although macroeconomic uncertainties and heightened competition remain concerns.

Over the past five years, Winnebago has experienced a total return of 23.16%, indicating a challenging period in contrast to its recent share price uptick. Despite this upward trend, it lags behind the US Auto industry's 51% return over the last year. This discrepancy highlights the company's competitive landscape and emphasizes the need for its innovative strategies to yield tangible financial benefits and reconcile past performance discrepancies.

The current share price of US$35.24 sits modestly below the consensus price target of US$38.08, suggesting that analysts see limited short-term upside potential, with a fair valuation close to its market positioning. Future revenue and earnings forecasts, depending on successful product launches and effective market risk management, could influence whether this price target is achieved. However, potential tariff and inflation pressures might dampen these expectations if not managed effectively.

Understand Winnebago Industries' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Winnebago Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WGO

Winnebago Industries

Manufactures and sells recreation outdoor lifestyle products primarily for use in leisure travel and outdoor recreation activities.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)