- United States

- /

- Auto

- /

- NYSE:THO

A Look at THOR Industries (THO) Valuation Following Strong Q2 Earnings and Lowered Full-Year Outlook

Reviewed by Kshitija Bhandaru

THOR Industries (THO) delivered a strong Q2 revenue result, surprising the market with sales above expectations. However, the company tempered investor enthusiasm by issuing a more cautious full-year outlook given economic headwinds.

See our latest analysis for THOR Industries.

After a strong Q2 surprise, THOR Industries’ share price rallied 13.5% over the last 90 days. However, the 1-year total shareholder return stands at -6.4%. News of a regular quarterly dividend and robust earnings helped fuel recent momentum, but lingering uncertainty around long-term growth is keeping some investors on the sidelines.

If THOR’s mix of surprises and challenges has you rethinking the automotive space, it could be a perfect time to explore See the full list for free.

With shares rebounding after an earnings surprise, but guidance sending mixed signals, the real question is whether THOR Industries is now a bargain in disguise or if the market has already accounted for any future upside.

Price-to-Earnings of 20.6x: Is it justified?

THOR Industries is currently trading at a price-to-earnings (P/E) ratio of 20.6x, which makes it look more expensive than both its immediate peers and the wider auto industry. This premium raises questions about whether the market is expecting outsized growth or if the stock is simply overvalued given its recent performance.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of current earnings, making it a key yardstick for valuing established companies like THOR. A high P/E can signal growth optimism but may also mean the industry or company is being valued for stable returns rather than explosive expansion.

In THOR’s case, the 20.6x P/E is noticeably higher than the peer group average of 14.1x and the global auto industry average of 19x. Even when compared to the estimated fair P/E of 15.4x, the stock stands out as pricey. If the market moves closer to the fair ratio, this premium could narrow, potentially impacting future returns.

Explore the SWS fair ratio for THOR Industries

Result: Price-to-Earnings of 20.6x (OVERVALUED)

However, persistent uncertainty around long-term growth and ongoing economic headwinds could quickly reshape the market’s current outlook for THOR Industries.

Find out about the key risks to this THOR Industries narrative.

Another View: Discounted Cash Flow Perspective

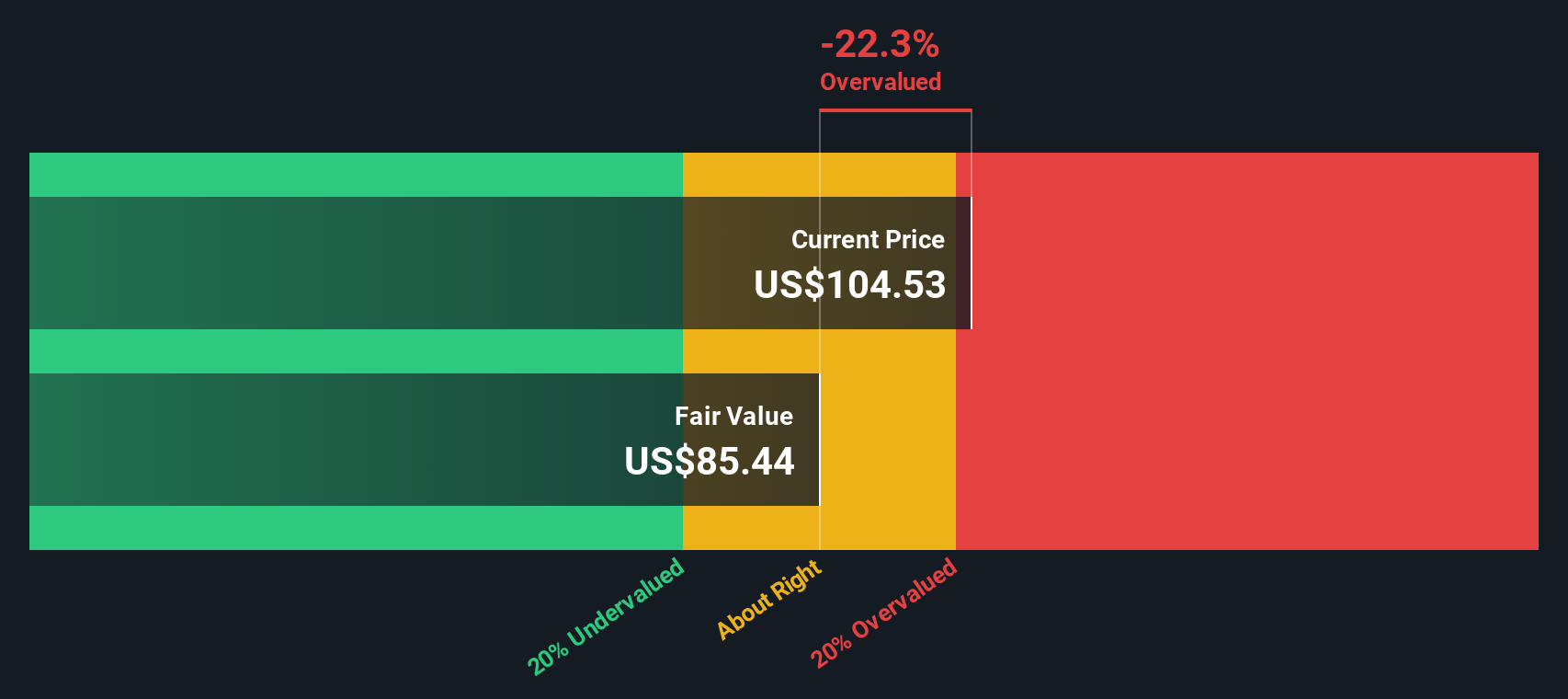

Looking beyond current prices, our SWS DCF model offers a more cautious outlook. THOR Industries is trading above its estimated fair value of $84.99 per share. This suggests the stock may be overvalued according to the underlying cash flow projections. Does this alternative valuation change the equation for potential investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out THOR Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own THOR Industries Narrative

If you want to dig deeper or reach your own conclusions, you can easily craft your personal view of THOR Industries in just a few minutes with our tools. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding THOR Industries.

Looking for more investment ideas?

Make your next move count. The smartest investors do not wait around; they stay ahead using proven strategies and fresh opportunities that are only a click away with Simply Wall Street.

- Unlock fresh dividend income and boost your returns by checking out these 18 dividend stocks with yields > 3%, making waves with payouts above 3%.

- Stay ahead of the curve by targeting next-generation innovators through these 25 AI penny stocks, at the forefront of AI-powered transformation.

- Snag potential bargains others miss by reviewing these 891 undervalued stocks based on cash flows, identified as strong opportunities based on real cash flow data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, rest of Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives