- United States

- /

- Auto

- /

- NYSE:RACE

A Look at Ferrari (NYSE:RACE) Valuation Following Recent Share Price Decline

Reviewed by Kshitija Bhandaru

Ferrari (NYSE:RACE) shares have lagged recently, with the stock down nearly 17% over the past month and off roughly 19% in the past 3 months. Investors may be wondering what is behind the cooling sentiment and whether there is value at current levels.

See our latest analysis for Ferrari.

After surging over the past few years, Ferrari’s momentum has clearly faded. The recent 1-year total shareholder return is down nearly 15%. This comes as the share price has retreated sharply from earlier highs, suggesting investors are reassessing near-term growth prospects and possible risks, even as the company’s long-term performance remains impressive.

If you want to see what other automakers are offering in today's market, now could be a great moment to explore See the full list for free.

With shares now trading well below recent highs and Ferrari’s underlying business still delivering steady growth, investors face a crossroads. Is this a rare buying opportunity, or is the market already anticipating future gains?

Most Popular Narrative: 25% Undervalued

Ferrari’s most-followed narrative pegs its fair value well above the last closing price of $395.72, suggesting a significant gap between market pessimism and projected fundamentals. The bulls see much more left in the tank, which brings us to the key underlying catalyst behind the valuation.

Ferrari's expansion of infrastructure and product offerings, including the new e-building and paint shop for enhanced personalization, is expected to increase production flexibility, supporting revenue growth and improved net margins through operational efficiencies.

Curious what mix of growth, margin expansion, and bold assumptions could justify such a high valuation? There is a key piece of the puzzle hidden here: the narrative hinges on aggressive projections in Ferrari’s operational capabilities and future profitability. Find out what makes this fair value so hard to ignore.

Result: Fair Value of $530.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the possibility that rapid model launches could dilute Ferrari's exclusivity or that supply chain disruptions could put pressure on future margins.

Find out about the key risks to this Ferrari narrative.

Another View: Market Multiples Tell a Cautionary Tale

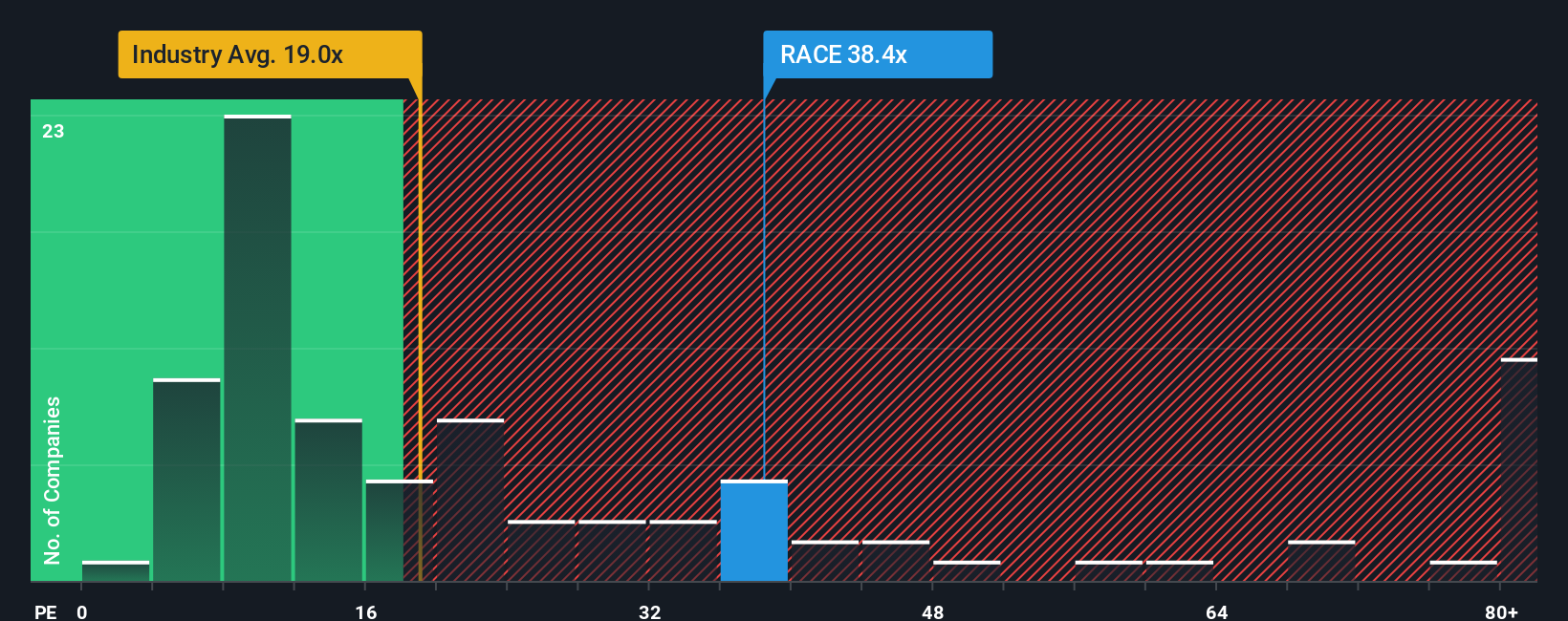

While the main narrative points to Ferrari being undervalued, a look at its price-to-earnings ratio offers a stark contrast. Ferrari trades at 38.4 times earnings, which is double the global auto industry average of 19 and well above its fair ratio of 14.4. This signals that the market currently prices Ferrari far above peers and what valuation models suggest is justified, raising questions about whether future growth prospects truly warrant this premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If the conclusions above don’t reflect your perspective, or you’d rather dive into the data yourself, the tools are available for you to craft your own insights in just a few minutes. Do it your way.

A great starting point for your Ferrari research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t watch opportunity pass you by. Take charge of your investing journey and seize your edge with powerful screeners every smart investor should have bookmarked.

- Get ahead of Wall Street by spotting value with these 892 undervalued stocks based on cash flows that could be trading well below their true worth.

- Power up your portfolio with these 24 AI penny stocks that are at the forefront of AI innovation and transforming entire industries.

- Boost your income stream by locking in returns from these 19 dividend stocks with yields > 3% offering robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives