- United States

- /

- Auto Components

- /

- NYSE:QS

QuantumScape (QS) valuation check as Eagle Line progress and first customer billings signal advancing commercialization potential

Reviewed by Simply Wall St

QuantumScape (QS) just hit an important execution milestone, finishing installation of key equipment for its QSE 5 Eagle Line in San Jose, a step that pushes its solid state battery story closer to real production.

See our latest analysis for QuantumScape.

Despite a sharp pullback recently, with a 30 day share price return of minus 19.4 percent and a 1 day move of minus 7.7 percent to 11.80 dollars, QuantumScape still shows strong underlying momentum. This is reflected in its 90 day share price return of 18.6 percent and a standout 1 year total shareholder return of 141.3 percent as investors respond to milestones like the Eagle Line progress, first customer billings, and its planned shift to Nasdaq.

If QuantumScape’s story has your attention, it may be worth exploring other high potential names in the space through high growth tech and AI stocks for fresh ideas beyond batteries.

After such a powerful 1 year rally, but with no meaningful revenue yet and the stock already trading near fresh analyst targets, are investors still getting in early, or is the market fully pricing in QuantumScape’s next leg of growth?

Most Popular Narrative: 52.8% Undervalued

Compared with QuantumScape’s last close at 11.80 dollars, the narrative fair value of 25 dollars points to a radically different long term upside path.

QuantumScape's technology directly addresses the five key limitations of current EV batteries: range, charging speed, life, safety, and cost10....

Curious how one framework gets from today’s loss making reality to that bold fair value? The narrative leans on aggressive revenue scaling, rising margins, and a premium future earnings multiple. Want to see exactly how those moving parts add up?

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, scaling from lab success to mass production, plus intensifying solid state competition, could challenge QuantumScape’s margins and delay the revenue ramp underpinning that 25 dollar fair value.

Find out about the key risks to this QuantumScape narrative.

Another View: Market Multiples Flash a Warning

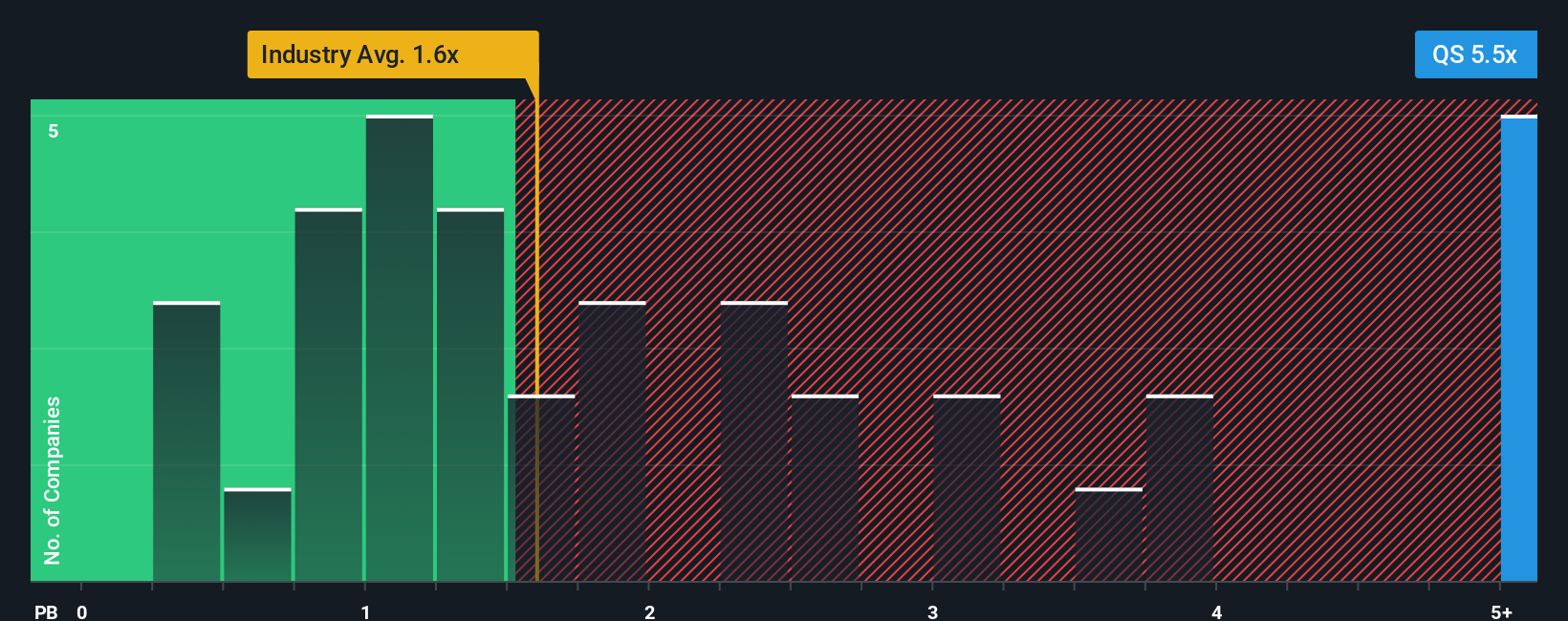

While the narrative model sees big upside, a simple comparison against book value tells a different story. QuantumScape trades at about 5.8 times book value, versus 1.6 times for the US Auto Components industry and 1.8 times for peers, suggesting investors are already paying a heavy premium for future success.

That gap can close either through execution catching up to expectations or the valuation coming down. This leaves investors to ask whether today’s price still offers enough margin of safety.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QuantumScape Narrative

If this storyline does not quite fit your view, or you simply prefer to dig into the numbers yourself, you can build a custom take in under three minutes, Do it your way.

A great starting point for your QuantumScape research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Want to stay ahead of the next wave of winners? Use the Simply Wall St Screener today and lock in a smarter watchlist before markets move.

- Target potential multi baggers early by scanning these 3606 penny stocks with strong financials that already back their small size with solid fundamentals and room to run.

- Capitalize on structural growth by focusing on these 30 healthcare AI stocks blending medical innovation with cutting edge algorithms where real world adoption is accelerating.

- Strengthen your income stream by filtering for these 13 dividend stocks with yields > 3% that combine attractive yields with the financials needed to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)