- United States

- /

- Auto

- /

- NYSE:NIO

Why NIO (NIO) Is Up 9.4% After Record Quarterly Electric Vehicle Deliveries and New Model Rollouts

Reviewed by Sasha Jovanovic

- NIO Inc. reported record-breaking monthly and quarterly electric vehicle deliveries, handing over 34,749 units in September 2025 and 87,071 for the third quarter, driven by strong demand for its NIO, ONVO, and FIREFLY brands and the successful rollout of new models like the ES8 and ET9 Horizon Edition.

- This surge not only highlights the company's diversified brand strategy but also demonstrates its ability to scale production and meet robust consumer demand amidst an evolving electric vehicle market.

- We'll examine how NIO's record vehicle deliveries and new model launches may reshape its investment narrative and future growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

NIO Investment Narrative Recap

At its core, being a NIO shareholder means believing in the company's ability to scale delivery growth and carve out market share in a fiercely competitive electric vehicle sector. The record-breaking September and third-quarter deliveries are significant, as they reinforce confidence in NIO’s multi-brand rollout and alleviate production execution concerns, both key drivers for short-term sentiment. However, these results do not fundamentally shift the near-term risk of persistent net losses and the challenge of reaching sustained profitability.

Among recent announcements, NIO’s successful US$1.81 billion follow-on equity offering stands out. This capital injection helps address ongoing investment needs for new products and technology platforms, which are critical given the company’s ambitious delivery targets and the intensity of competition. Whether this additional funding will meaningfully accelerate progress toward profitability remains to be seen, as operating costs continue to challenge the bottom line.

On the other hand, investors should be aware that despite the surge in deliveries, NIO’s ability to break the cycle of ongoing losses may remain elusive if …

Read the full narrative on NIO (it's free!)

NIO's outlook anticipates CN¥148.4 billion in revenue and CN¥7.5 billion in earnings by 2028. This projection relies on an annual revenue growth rate of 28.8% and an earnings increase of CN¥31.8 billion from the current level of CN¥-24.3 billion.

Uncover how NIO's forecasts yield a $6.58 fair value, a 15% downside to its current price.

Exploring Other Perspectives

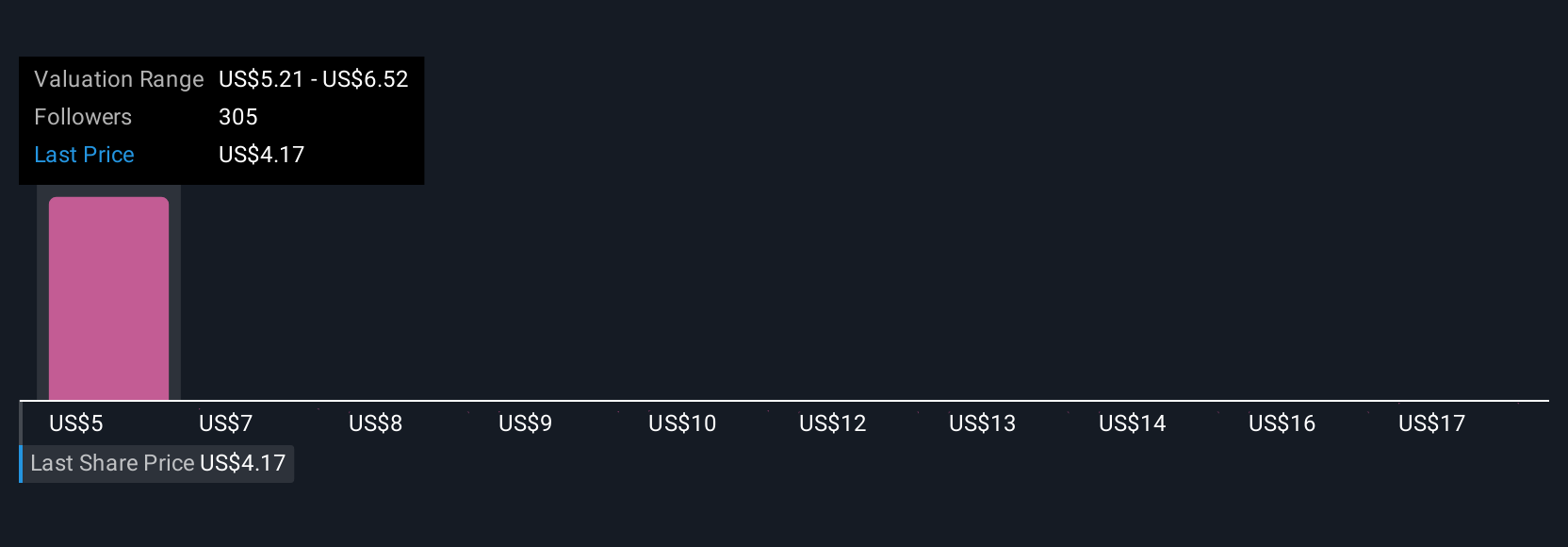

Nineteen members of the Simply Wall St Community estimate NIO’s fair value between US$4.41 and US$18.27, highlighting wide-ranging confidence and caution. With competition rapidly intensifying in the EV market, the variety of views shows how perspectives can differ and why it pays to weigh the full spectrum of opinions.

Explore 19 other fair value estimates on NIO - why the stock might be worth 43% less than the current price!

Build Your Own NIO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIO research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free NIO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIO's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives