- United States

- /

- Auto

- /

- NYSE:NIO

Why NIO (NIO) Is Up 14.4% After Strong June Deliveries and Onvo L90 SUV Launch – And What's Next

Reviewed by Simply Wall St

- NIO Inc. recently reported June deliveries of 24,925 vehicles, with strong contributions from its NIO, ONVO, and FIREFLY brands, while launching pre-sales of the new Onvo L90 flagship electric SUV at a US$39,000 starting price point.

- This rapid expansion of product offerings and the Onvo L90’s push into the family electric SUV segment have attracted positive analyst attention, highlighting NIO’s bid to strengthen its position against domestic competitors.

- We'll assess how the Onvo L90 launch and robust June deliveries are reshaping NIO’s investment narrative and future outlook.

NIO Investment Narrative Recap

To be a NIO shareholder right now, you need to believe that strong growth in electric vehicle deliveries and new model launches, like the Onvo L90, can outweigh ongoing financial losses and intense domestic competition. The recent June delivery surge is a clear catalyst for near-term sentiment, but the biggest risk remains continued pressure on margins from costly expansion and high operating expenses, which this news doesn’t materially change.

Among recent announcements, the company’s Q2 delivery results, up 25.6% year-over-year, stand out. This achievement supports the view that NIO's multi-brand strategy is beginning to gain traction and could be a critical factor in hitting revenue targets, especially with new models broadening the customer base and offering differentiation in a crowded market.

However, despite encouraging sales numbers, investors should be aware that continued high SG and A costs could...

Read the full narrative on NIO (it's free!)

NIO's narrative projects CN¥134.6 billion in revenue and CN¥5.7 billion in earnings by 2028. This requires 27.0% yearly revenue growth and an earnings increase of CN¥28.4 billion from current earnings of CN¥-22.7 billion.

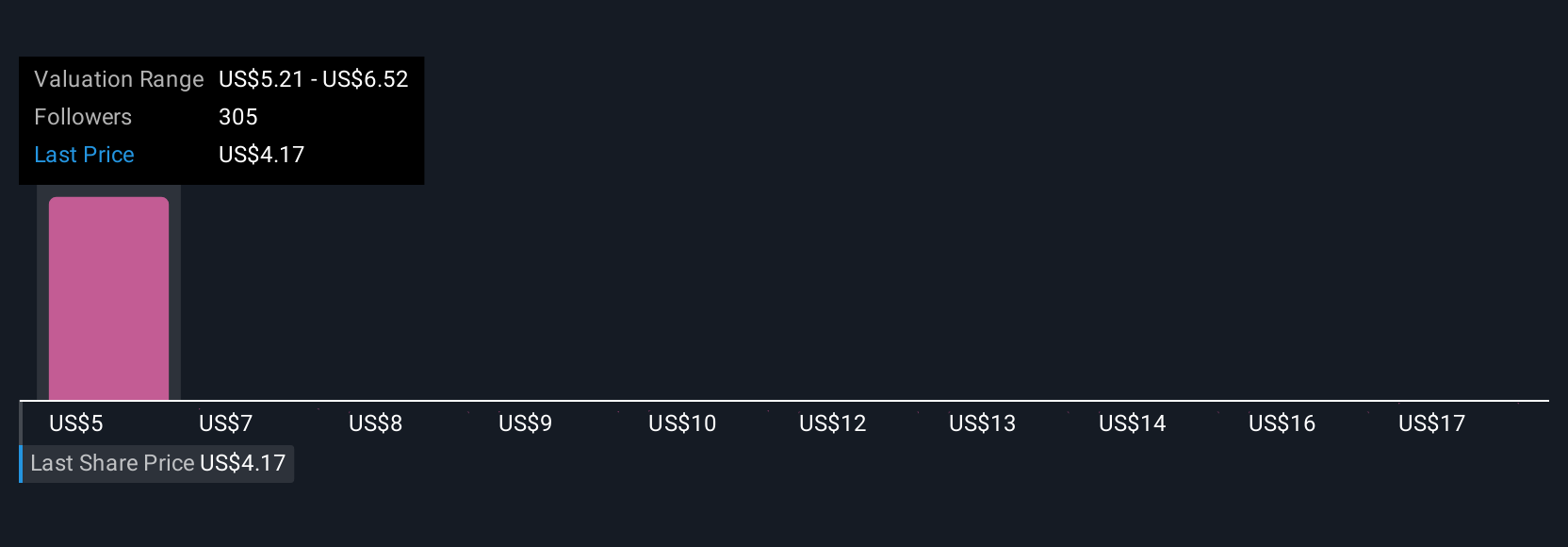

Uncover how NIO's forecasts yield a $5.21 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Twelve members of the Simply Wall St Community estimate NIO's fair value from US$5.21 to US$18.27 per share. While some focus on the launch-driven revenue opportunities, others point to challenges managing SG and A expenses affecting long-term sustainability, consider these different views before deciding where you stand.

Build Your Own NIO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NIO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIO's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives