- United States

- /

- Auto

- /

- NYSE:NIO

Nio (NYSE:NIO): Rethinking Valuation After Second-Best Delivery Month and 76% Year-Over-Year Surge

Reviewed by Simply Wall St

NIO (NYSE:NIO) just logged its second best delivery month ever, shipping 36,275 vehicles in November, up 76% year over year. This puts the company within sight of one million cumulative deliveries.

See our latest analysis for NIO.

Even with this operational momentum, NIO’s share price at $5.01 reflects a mixed picture, with a 30 day share price return of minus 30.03% but a positive year to date share price return of 10.11%. The five year total shareholder return of minus 88.92% shows how long term holders are still deep underwater, suggesting sentiment is improving from a low base rather than fully turning bullish.

If NIO’s latest delivery surge has you rethinking the whole EV space, it could be worth comparing it with other auto names using our auto manufacturers.

With revenues growing more than 20% annually and losses narrowing sharply, yet the stock still trading nearly 27% below estimated intrinsic value, is NIO a mispriced turnaround story, or has the market already discounted its next growth leg?

Most Popular Narrative Narrative: 26.6% Undervalued

With the most followed narrative putting NIO's fair value at $6.83 against a $5.01 share price, the story hinges on aggressive growth turning into future profitability.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥148.4 billion, earnings will come to CN¥7.5 billion, and it would be trading on a PE ratio of 22.7x, assuming you use a discount rate of 13.6%.

Curious how a loss making EV maker earns a premium style multiple that is usually reserved for market darlings? The answer hides in its revenue surge and margin makeover.

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained losses and intensifying EV competition could quickly undermine margin progress and challenge the idea that NIO deserves a premium-style valuation.

Find out about the key risks to this NIO narrative.

Another View: Market Ratios Flash A Different Signal

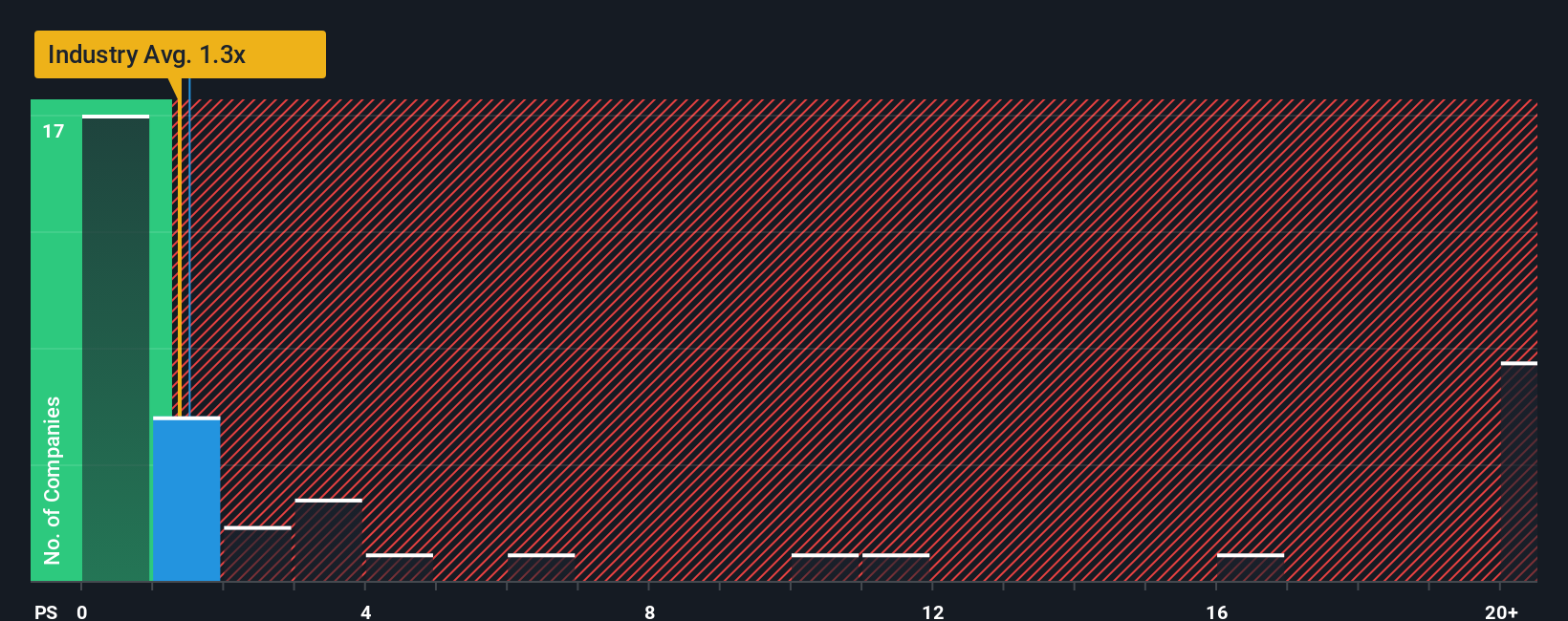

Market ratios tell a more cautious story. NIO trades on a price to sales of 1.2x, richer than the US Auto industry at 0.9x and slightly above its 1.1x fair ratio, even if it still looks cheaper than peers at 1.8x. Is that a margin of safety or a value trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NIO Narrative

If this framing does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom take in under three minutes, starting with Do it your way.

A great starting point for your NIO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, set yourself up for the next opportunity by scanning fresh ideas that could balance NIO risk and sharpen your overall portfolio strategy.

- Capture potential multi baggers early by reviewing these 3575 penny stocks with strong financials that pair tiny market caps with surprisingly resilient fundamentals.

- Target megatrend tailwinds by focusing on these 26 AI penny stocks positioned at the intersection of automation, data, and exponential software demand.

- Lock in quality at sensible prices by hunting through these 908 undervalued stocks based on cash flows that look cheap relative to the cash they generate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026