- United States

- /

- Auto

- /

- NYSE:NIO

NIO (NYSE:NIO): Evaluating Valuation After ES8 Launch, ONVO Momentum, and Major Investor Moves

Reviewed by Simply Wall St

NIO (NYSE:NIO) has given investors plenty to talk about this week, as the Chinese electric vehicle maker’s new ES8 SUV rolled into the spotlight and drove shares up by double digits. The launch is not just another product drop; it signals a realignment of NIO’s strategy with advanced autonomous technology, a family-friendly three-row design, and aggressive pricing positioning it directly in the path of a fast-growing EV market. Add in promotional incentives and a fresh round of operational updates, and investor interest is being rekindled at a pace rarely seen since the stock’s earliest rallies.

Taking a broader view, the story becomes even more interesting. NIO’s shares are now up around 55% in the past year and have gained nearly 31% over the past three months, reversing a long slide from its peak above $60. The stock’s recent climb has come alongside upbeat news from its ONVO L90 launch, reported sales momentum, and heavyweight investors like BlackRock increasing their stakes. With the company reporting stronger sales and aiming for breakeven later this year, market sentiment appears to be improving, though with continued attention to risk and ongoing competition in China’s EV sector.

This leads to a key question: After this latest surge, is NIO trading at a discount to its true value, or are markets simply adjusting to the company’s potential by factoring in future growth now?

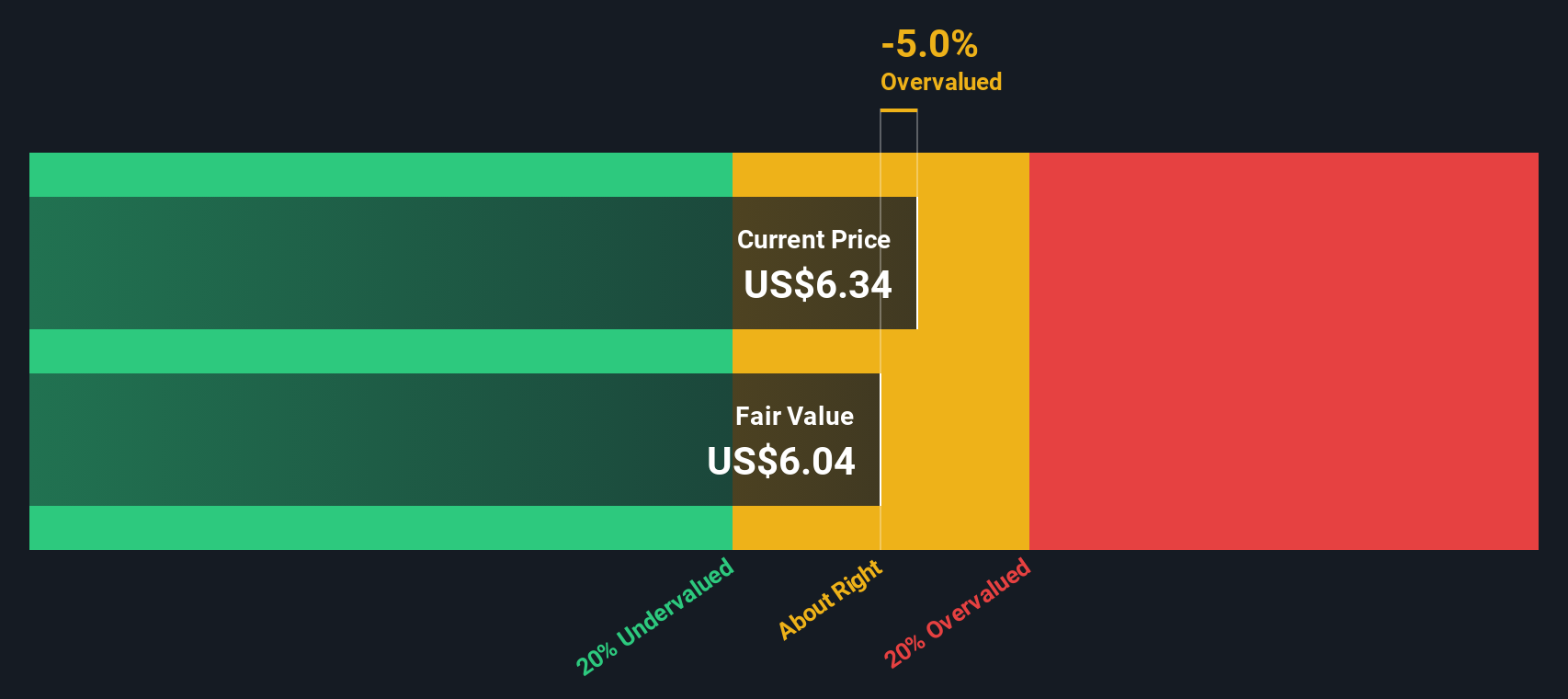

Most Popular Narrative: 1.6% Overvalued

According to the narrative by KGarner789, NIO is currently seen as slightly overvalued relative to its calculated fair value, with an implied discount to fair value of -1.6%. This assessment is based on an analysis of its rapid expansion, battery innovations, and its position in the evolving EV market.

"If NIO can execute its expansion plans while managing costs, it could see significant upside. Current price levels may reflect an opportunity if the company meets or exceeds its targets."

Curious about what fuels this bold valuation call? The explanation centers on assumptions about fast-tracked revenue growth, breakthrough battery swaps, and premium brand momentum. These factors could have a significant impact on NIO’s market value. The full narrative provides details on the financial drivers and expansion strategies influencing this figure.

Result: Fair Value of $6.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing profitability pressures and fierce competition in the EV space could quickly undermine even the most optimistic outlook for NIO’s future.

Find out about the key risks to this NIO narrative.Another View: The SWS DCF Model

Looking from a different angle, the SWS DCF model takes a deeper dive into NIO’s fundamentals. This method also concludes NIO is priced above its fair value, which challenges any pure optimism. Could this signal an inflection point, or is it simply a sign of cautious consensus among models?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NIO Narrative

If you see the story differently or want to test your own perspective, you can craft a personal narrative based on your research in just a few minutes. do it your way.

A great starting point for your NIO research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for just one opportunity when a world of smart investing options awaits you. Seize the chance to uncover compelling stocks tailored to your goals, guided by expert analysis and the latest financial trends. Give yourself an edge and stay ahead of the pack with these timely ideas:

- Unlock powerful yield potential and secure regular returns by checking out dividend stocks with yields > 3% for income-generating opportunities above 3%.

- Supercharge your portfolio with tomorrow’s technology by seeking out AI penny stocks that are fueling innovation in artificial intelligence.

- Target robust fundamentals while keeping risk in check through penny stocks with strong financials with standout financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives