- United States

- /

- Auto Components

- /

- NYSE:LEA

Does Recent Insider Selling at Lear (LEA) Hint at Management Uncertainty or a Strategic Shift?

Reviewed by Sasha Jovanovic

- In recent days, Lear Corporation's CEO and CFO executed significant, non-pre-scheduled insider sales while the company faces ongoing business stagnation and technical weakness in its stock.

- This combination has heightened investor caution as it raises questions about management's confidence and comes during a period when revenue and margins remain stable but unimproved.

- We'll now examine how concerns about insider selling may impact Lear's longer-term investment narrative and outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Lear Investment Narrative Recap

Owning shares in Lear Corporation rests on the view that stable global auto demand and advancing vehicle technologies will drive steady sales, margin improvements, and long-term value creation. However, the recent, unscheduled insider stock sales by both the CEO and CFO may not materially change the company’s largest near-term catalyst, expansion into high-value EV seating and wiring programs with major automakers, but do increase awareness of ongoing margin and volume risks if auto production falters or pricing pressures intensify.

Separately, Lear’s recent extension of its technology partnership with Palantir underscores its cost-efficiency efforts, with $30 million in operational savings reported in the first half of 2025. This announcement aligns closely with the company’s efficiency-driven strategy, which remains a core catalyst for supporting margins during periods of flat or uncertain industry demand.

By contrast, investors should pay close attention to how ongoing pricing pressure and shifting OEM sourcing strategies could challenge...

Read the full narrative on Lear (it's free!)

Lear's outlook anticipates $24.7 billion in revenue and $1.0 billion in earnings by 2028. This scenario relies on an annual revenue growth rate of 2.5% and a $530 million increase in earnings from the current $469.8 million.

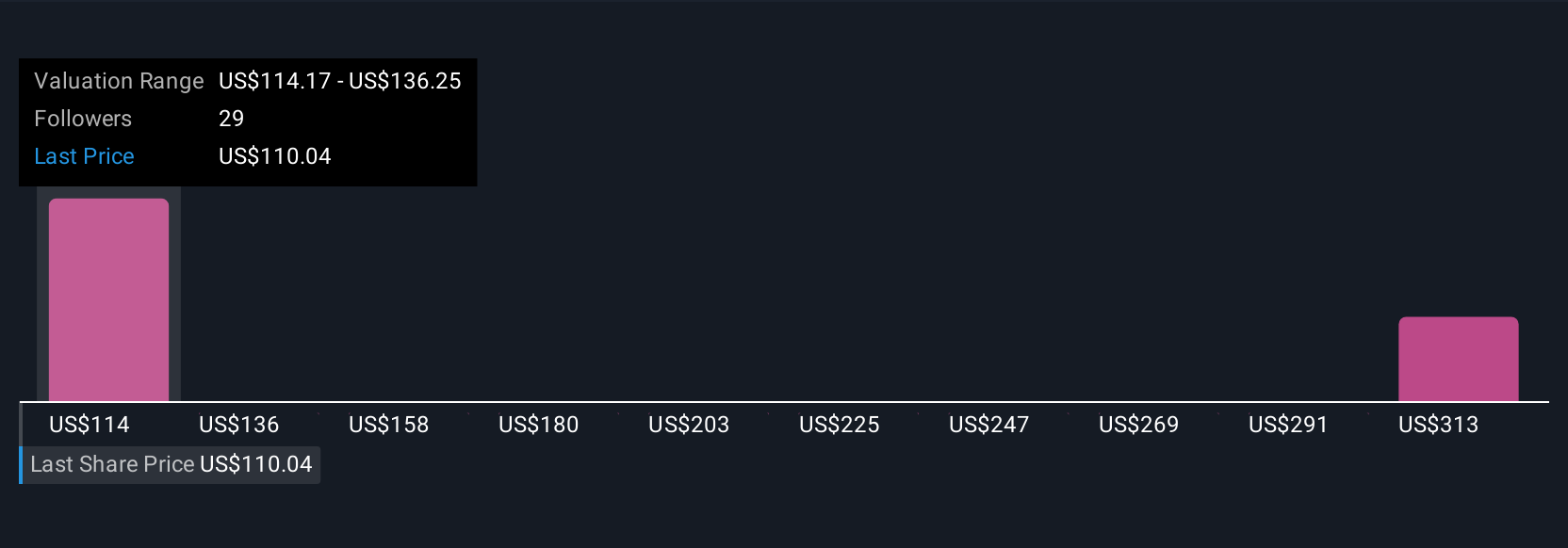

Uncover how Lear's forecasts yield a $114.17 fair value, a 18% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 2 fair value estimates for Lear ranging from US$114 to a high of US$329 per share. While opinions differ widely, many are closely watching potential risks from lost program volumes and ongoing automaker contract negotiations as these developments could drive meaningful changes to expectations for Lear’s future growth.

Explore 2 other fair value estimates on Lear - why the stock might be worth over 3x more than the current price!

Build Your Own Lear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lear research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lear's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEA

Lear

Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives